SUBSEA TECHNOLOGY: Canyon Express tiebacks model for future deepwater marginal development

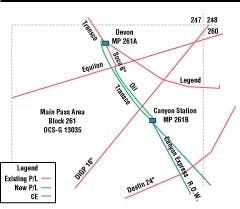

While the change in product transport destination has slightly delayed the Canyon Express subsea tieback project, the US Gulf of Mexico development could become a blue-print for marginal deepwater field production in the future. The complex seafloor development becomes the first to surpass 7,000 ft water depths, although others on the drawing board may go onto production before Canyon Express is ready.

As the Gulf of Mexico OCS, and other deepwater basins around the world begin to mature, fewer giant fields will be discovered. Attention will then turn to smaller fields. Subsea tiebacks eliminate the need for surface piercing structures and substantially lower the cost of deepwater developments, making smaller finds more economical. In some cases, such as Canyon Express, combining several smaller fields into one tieback could further enhance the economics.

The technology used on Canyon Express is unique, and at water depths greater than 7,250 ft, the fields will form the deepest subsea tieback in the world. The development will tie back gas production a near record 55 miles at a production rate of 500 MMcf/d. There are other technological feats, but the commercial situation may also be unique. Canyon Express ties back three fields owned by three different operators to a single flowline.

The deal evolves

Elf Exploration, Inc. (now TotalFinaElf E&P USA, Inc.), as operator of the Aconcagua field, initiated studies with Marathon (operator of Camden Hills) in April 1999 on the potential development of their two fields. Elf Exploration and BP-Amoco also held talks concerning BP-Amoco's Kings Peak field.

In December 1999, seven working interest owners in these three marginal deepwater fields met in Houston to discuss the possibility of working together. These early meetings outlined the design and commercial aspects of such a project. Following this initial meeting, the operators continued to meet to discuss technical, commercial, and operational aspects of shared infrastructure. In parallel with the technical team, a commercial team formed by the operators began meeting every two weeks to work out ownership and operating principles for Canyon Express.

The ensuing discussions between the parties were initially difficult. Added to the difficulty were the mergers and acquisitions going on among those represented at the table. What started as seven companies - Marathon, Pioneer Natural Resources, Baker Hughes, BP-Amoco, Mariner Energy, TEP USA, and Elf Exploration - has been reduced to BP, TotalFinaElf, Marathon, Pioneer, and Mariner, through buyouts, mergers, and other changes.

In parallel with the "commercial" meetings, the technical work continued. In December 1999, Intec Engineering was contracted to perform the technical evaluation of the subsea systems, and Paragon Engineering for evaluation of the host platform system requirements.

Sharing critical

Frederik Rijkens, Canyon Express Project Manager (TotalFinaElf), who was there from initiation, said the critical components of the deal's success were outlined early on. There was an attitude of sharing information, expertise, and experience, with the goal of making the project profitable. A project team was formed with 12 representatives each from BP and Marathon, nine from TotalFinaElf, the operator, and the balance coming from major contractors such as Intec. The fields being tied back on Canyon Express are:

- Aconcagua, operated by TotalFinaElf in Mississippi Canyon Block 305, which will feature three to four wells

- King's Peak, operated by BP in Mississippi Canyon 173 and 217 and Desoto Canyon 177 and 133, which will have four producing wells

- Camden Hills, the deepest of the three, operated by Marathon in Mississippi Canyon 348, which has two wells.

The three field operators - Marathon, BP, and TotalFinaElf - would share their reservoir data to optimize production from the three assets. There were technical components to the design that also drew from the experience of different participating companies. This project fits in with the approach TotalFinaElf is applying in the deep offshore domain, which is a strategic area of the company's current growth, Rijkens said.

There were technical challenges to working at this water depth. Installation techniques were discussed as well as the reliability of subsea components. On top of this, efficient implementation was key to keeping costs down. Multiphase subsea-flow metering, pioneered by TotalFinaElf, and in-line pipeline sleds, also used by BP in the nearby King field, are examples of innovation that allowed the project to save on the order of $20 million per field. Rijkens said the agreement reached by the field owners was without a doubt the first major challenge of the project, but once this was accomplished there remained the challenges of installation and completion, as well as reliability and intervention.

New destination

Originally, production from the three fields was headed for the Virgo platform, with DIGP acting as host. Due to difficulties in negotiating the terms, a decision was made in September 2000 to look for a new host. Based upon an aggressive timetable, a call for tender was performed over a two-month period, with Williams being awarded the host contract.

Being able to agree upon a PHA (production handling agreement) in such a short time demonstrates the cooperative team spirit that permeated the Canyon Express working interest owners and their commitment to proceed with the project, said Marcus Allen of Marathon.

Rather than tie back to an existing facility, Williams said the decision was made to install a new platform called Canyon Station. Originally, a new platform was not considered as an option, but Williams made a good proposal for this, which persuaded the operators that it would be the best solution. "Williams made an impression on the Canyon Express team," Rijkens said.

When asked how Williams could afford to put in a new platform just for Canyon Express, Rijkens said he believes the platform will make good economic sense for Williams and can also be used for future fields, possibly through the Canyon Express system. "They have been clear. For them, this is a long-term commitment," he said.

Other discoveries

The Canyon Express production profile stretches out about eight years, Rijkens said. In addition to the wells currently proposed, Rijkens said other discoveries are expected in the area. "There are potentially other fields out there," he said.

These new fields could be tied into the Canyon Express system down the road, making further use of this costly infrastructure. At the very end of the Canyon Express system, there are two 12-in. jumpers where another field could tie in. The dual jumpers would make this portion pigable.

In addition, Rijkens said, there are 11 pipeline sleds at different points in the system equipped with 5-in. connectors. Future fields could tie into these. Rijkens said Canyon Express may later serve as a subsea hub for other marginal field developments. If so, this would mean more prod-uction for the Canyon Station.

Multi-phase metering

While additional tie-ins to the Canyon Express line would further complicate the individual metering of the gas from different fields, Rijkens said the US Minerals Management Service is supporting their efforts in the interest of developing smaller subsea fields, thereby helping ensure a continued domestic energy supply that might otherwise be wasted. "The three fields we are talking about are not very big fields. The only way they can be developed is to link them together into one system," he said.

Subsea multiphase flow meters will be installed at each of the Canyon Express wells. Flow from each well is thus measured individually before production is comingled in the 12-in. flowlines.

TotalFinaElf was initially involved in a joint industry project to research the accuracy and reliability of multiphase meters and has now signed an agreement with Southwest Research Institute (SWRI) to install one of the meters on a test loop. This will help calibrate the individual flow meter to the specific flow mixture of a particular well.

While all the flow meters used on Canyon Express are identical in design, the pressure range in which the system will operate is the pressure range at which the meters are to be calibrated by SWRI. The combination of condensate, methanol, and formation water the meters are exposed to is designed to mirror what is found in each well. This should ensure the meters on different wells properly measure each phase of flow accurately.

Water production

Some of the Canyon Express reservoirs are expected to produce water early. A volume of 1,800 b/d of methanol will be injected into the system to prevent the development of hydrates from the projected 1,200 b/d of produced water expected at peak water cut. Without the methanol to ensure flow, these wells would have to be shut in. Rijkens said this could kill reserves recovery. "In order to recover those reserves efficiently, you have to be able to handle a fair amount of water," he said.

To assist in the area of flow assurance, the system will receive about 1.5 bbl of methanol for every 1.0 bbl of water produced. To offset the cost of the methanol and to protect the environment, there will be equipment installed on the Canyon Station platform to recycle the methanol and re-inject it into the system.

Using existing technology, Rijkens said Canyon Express will recover about 80% of the methanol from the produced water. The 20% that is not recovered stays in the production stream and is introduced into the export line. The water itself will be cleaned and discharged. While the system is designed to handle peak water prod-uction at around 1,200 b/d, the average should be much lower, Rijkens said.

When Canyon Express comes onstream, it will include a total of ten or more wells producing. There are two existing wells in Aconcagua, and two in Camden Hills that will be used in production. The drilling schedule shows four wells in King's Peak, two in Aconcagua, and a sidetrack in Camden Hills.

There are optional wells that could be added at a later date. Rijkens said the system is designed with spare connector hubs to handle up to two more wells per field without the addition of splitters. Once the existing spare hubs are used, they can be split to add further wells.

The Canyon Express system is being built with the long-term goal of bringing new fields into the system without disturbing the production from existing wells. Canyon Express team member Bryan Wallace (Marathon) and Intec Engineering have performed comprehensive flow assurance modeling studies for this project. In addition to dynamic and steady-state behavior, this includes the calculation of pressure and capacity profiles over time that form the basis of the capacity sharing agreement in the Canyon Express system.

Later in field life, if this capacity is not used, it may be possible to farm other fields into the system, or move the remaining production into one line only and isolate the second flow line. In this configuration, the second line could be dedicated to a high-pressure application from a new field, yet to be identified. This isolation capability is built into the system to provide further flexibility.

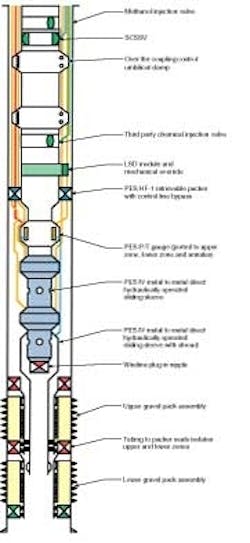

Flexible completions

One of the keys to making this a successful project, recognized early on by the operators, was installing Intelligent Well Completion System (IWCS) completion equipment on the King's Peak wells. For those wells that are dual zone completions, in this case all but one, IWCS technology helps avoid intervention later in the well's life. Avoiding intervention is a key economic parameter of subsea tiebacks. In cases where intervention is required, it generally reduces the savings a subsea tieback represents.

If these wells were conventional, dual-zone completions, it would be necessary to produce one zone, and then when it plays out, return to shift the production sleeve to access the other zone. With a subsea tieback, this is cost prohibitive. Instead, IWCS technology allows zones to be switched by remote control. Installing two valves and a packer downhole, along with pressure and temperature gauges, allows the operator the option of producing either zone, both zones, or shutting in all production to build up downhole pressure.

Amoco, later BP, worked with PES to evolve the IWCS system to a direct hydraulic three-line, two-valve system. While not equipped with all the features of the original design, the simplified design was deemed more robust and fit for purpose. Once it was decided to combine King's Peak with two other fields to form Canyon Express, the IWCS completion portion of the project was expanded. King's Peak will use Schlumberger's Quartz-dyne downhole gauges, with PES valves and packers, while the other fields will use PES Quartzdyne gauges, valves, and packers.

Once the wells on all three fields are completed, this will be the largest collection of IWCS direct hydraulic completions in the world: three of the four King's Peak wells, two wells on Camden Hills, and another four on Aconcagua. Each of these wells is a multiple-zone completion and thus requires advanced downhole technology to avoid future intervention work.

IWCS components

There are basically two components to these IWCS systems, gauges and the packer valve assembly. There are three electronic gauges in each well, Vicky Jackson, SmartWell Project Engineer for PES/Halliburton, said. One gauge reads the annular pressure outside the gauge in the upper zone completion, which is also the tubing pressure. Another reads the pressure in the lower zone, and the third reads the tubing pressure.

Using these real-time readings, it is possible to manipulate the valves to optimize production between the two zones. While the MMS does not generally allow the comingling of production in the Gulf of Mexico, Jackson said the readings from these gauges might offer data showing comingling is necessary to optimize depletion of the fields.

While the gauges in these wells are conventional, a fiber optic connection through the umbilical will link the King's Peak field. This allows high bandwidth data transmission to and from the field for both operating equipment and retrieving real-time reservoir information. The power transmission for all fields is electrical, and the data transmission for Aconcagua and Camden Hill is electric.

Joe Eck, Business Development Manager for Schlumberger's WellWatcher Monitoring System said he can use the broadband capability of the King's Peak fiber optic line to deliver real time data at critical times in the well's life. Schlumberger also was working with Amoco from the beginning when King's Peak was to be developed as part of the King Complex. He said the gauges to be used in King's Peak are designed to measure pressure and temperature at two critical points: the lower production zone and upper production zone. A third gauge measures the tubing pressure/temperature and is essentially a back up.

Data retrieved by this equipment is key to understanding the dynamics of the reservoir. Because many critical readings come during a very narrow space in time, the reservoir engineers on King's Peak insisted on high bandwidth data transmission.

Eck cites well shut-in as an example. When a well is shut in, there is critical "early-time data" that must be collected in the first few seconds. If this data is missed, it affects the engineer's ability to analyze what is happening in the reservoir. While all systems for the Canyon Express fields collect this data, the fiber optic system returns such data in real time, instead of storing it and sending it in a batch hours later.

Eck said Schlumberger is focusing on reliability in the design and installation of this equipment. There are two facets to this, Eck said. First, the gauges must function and return data to the surface, and second, the data that is returned must be accurate. If the gauges fail in either of these areas, then the system is not dependable. To date, Schlumberger has installed more than 60 of these systems in the Gulf of Mexico, with one reported failure.

Carrying this data, as well as electrical and hydraulic power and injection fluids, is the main umbilical for Canyon Express. This component will be manufactured by Kværner Oilfield Products (KOP) in Moss, Norway. The subsea production control system and the workover control system will be manufactured by KOP in Houston. KOP Houston also will build the master control system and hydraulic power unit that will be installed on the Canyon Station topsides.

The umbilical will transmit three-phase electric power over the 55-plus miles of umbilical. In addition to copper wire for data transmission to and from Camden Hill and Aconcagua, there will be an optical production control system connected to the King's Peak wells. The fiber optic line will communicate between the topsides and the control pod, but from there, the tree mounted sensors, chemical injection metering valves, and multiphase flow meters are electric.

This is the first application of a fiber optic production control system in deepwater after BP's Nile and King subsea tiebacks. The direct hydraulics that control the SmartWells will be activated by a multiplex (MUX) system. The control pod has the ability to accumulate pressure data on its own to improve the response time of downhole equipment.

The patented KOP stainless steel tube umbilical design separates each of the elements - steel tubes, electric cables, and fiber optics - with PVC conduits, allowing them to move independently. Each element is self supported, allowing the umbilical to have a greater overall bend radius compared to a conventional umbilical. A conventional umbilical has a bend radius equal to the bend radius of the largest pipe. This design has a bend radius equal to the larger bend radius of the overall umbilical. This design is more akin to pipeline technology than conventional cable technology.

The umbilical actually will be installed in three main lengths. The first will run from Canyon Station to King's Peak where it will make a stab and hingeover connection. This section will be the longest electrohydraulic umbilical ever manufactured in a continuous length. Another stab and hinge over will attach a second length of umbilical to Aconcagua in the same manner. A third length will then connect Camden Hills. This Kværner steel tube umbilical will be the deepest installed umbilical in the world.

Christopher Lindsey-Curran, Engineering Manager with KOP Controls in Houston, said the change in product transport destination from Virgo to Canyon Station did not alter the design of the umbilical, in terms of control functions, since the contractor had already been asked to consider adding up to eight miles to its design. This addition in length did not alter the overall design.

Hardware

For the Aconcagua and Camden Hills wells, the operators set up a Well Integrated Project Team (WIPT) to develop common procedures and equipment for the completions in these fields. This adds another area of unconventional operation.

This WIPT team includes two completion engineers, Greg Stimatz of Marathon and Jose Piedras (TFE). To complete the well with IWCS technology, José Piedras, Senior Completion Engineer for TotalFinaElf, explained that the lower completion will be set at the true depth of the well to complete each zone of both reservoirs. For that, the well is perforated and the sand control equipment is run by stage.

Each piece of equipment has a specific device to avoid the well control issues and the losses created by the well fracturing system (frac pack) in this type of high permeability zone. Then the frac pack is made. Each zone is completed following this diagram. The last piece of equipment comprises a long seal bore receptacle where the upper completion will be linked. This upper completion consists of the IWCS assembly (gauges, valves, packer), the injections mandrels, the tubing retrievable safety valve, and the tubing.

The link between the upper and the lower completion is made by a seal assembly. A shroud is used in the lower IWCS valve to divert the production and provide the selectivity. The upper completion string is run, linking with the lower completion. The production packer (IWCS equipment) is set.

Once all tests are complete, using internal tubing pressure, all the fluid loss devices are opened by pumping through each IWCS valve. While the downhole sensors are electric, all IWCS valves are actuated using direct hydraulic pressure from the subsea control pod. Downhole isolation and running procedures are critical in these wells, according to Piedras, because of the complexity of the numerous types of material and control lines.

To insure reliability, Piedras said, these wells will have direct hydraulic communication with the subsea pod. Electronics are not required for valve manipulation, only hydraulics. Piedras said direct communication from the pod can reduce the possibility of equipment failure although the fact that the hydraulic lines are paired with each downhole valve eliminates the possibility of full redundancy. In addition, the "fail current" nature of the valve relies more heavily on the piston seals than does the PES electrohydraulic actuation system because a leak in a piston seal can result in valve motion.

With all of these systems coming together under a management philosophy of openness and cooperation, Canyon Express may not only indicate the technological future of deepwater marginal fields, but also a new approach of teamwork among operators. The fields should come on stream in the summer of 2002.