WELL INTERVENTION: Platform wells produce 25% better than subsea because of routine interventions

The rapid growth in the number of subsea production and injection wells in the North Sea is creating a substantial market for subsea well intervention services. According to estimates, there could be 1,600 subsea wells in the North Sea by 2003. The majority of these wells are in the UK and Norwegian sectors.

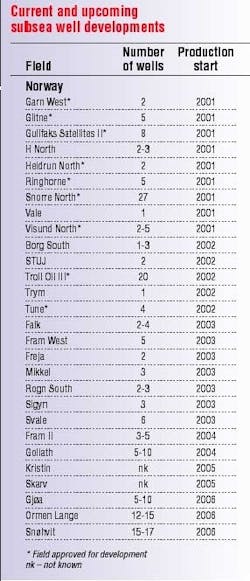

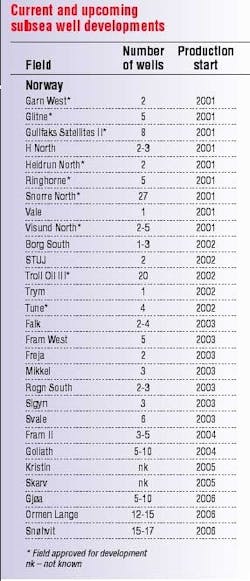

In Norway, the number of subsea wells in current and upcoming developments, whether tied back to floating or fixed production facilities is greater than the number of platform wells. The number in the accompanying table exceeds 150. Already 60% of the country's production comes from subsea wells, and that proportion will grow in coming years. Norway is the land of massive subsea developments:

- Troll Oil, third stage development will take the total past 100

- Åsgard, with 51 wells

- Gullfaks Satellites, with around 30

- Snorre North, with 27.

Norwegian concentration

Future large developments are likely to be concentrated in the Norwegian Sea, where discoveries such as Kristin and the other Halten Bank South fields will be developed with subsea wells. It is likely that this will be the case with other significant finds made in this area.

In the more mature North Sea, there is no shortage of current subsea and floating developments like Glitne and candidates for the future such as Sigyn and Freja, though these will call for smaller numbers of wells. Development is also looming in the Barents Sea, where both Sn hvit and Goliath will, if developed, use subsea wells.

What the UK lacks in large fields, it makes up in numbers of fields. The current and prospective developments listed in the table could call for around 100 subsea wells. There are also 570 wells on fields already in production. The profile of the market in the UK sector differs from the Norwegian.

Not a few subsea wells date back to the mid 1980s. For example, more than 30 wells have been drilled at Hutton, the world's first tension leg platform development.

But the wells from this era were vertical or slightly deviated and do not present the same problems of access as more modern wells with long horizontal sections. Fields developed in the 1990s with large numbers of subsea wells include Scott (33), Schiehallion (28), and Foinaven (23).

Repressed demand

Although only a small amount of intervention work is currently carried out on subsea wells in the North Sea, there is repressed demand. According to calculations made in Norway, close to one workover per well per year is carried out on platform wells, while the figure for subsea wells is currently only 0.2.

This helps to explain the fact that the performance of platform wells is 25% better than subsea wells drilled in the same geological environment. The bulk of work required falls into the light category - subsea wireline work - which is very price sensitive. If the price were right, more work would already be being performed on subsea wells. Hence the need for a competitive supply of equipment serving this sector of the market.

Eighteen companies in Norway have now joined forces in a Statoil-initiated collaboration called the Efficient Well Intervention project aimed at finding solutions for these problems.