GLOBAL DATA

Latin America >>>>>>>>>>>

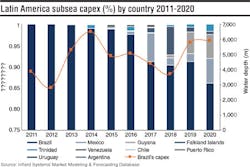

This month Infield takes a look at the effects of Latin America’s current turmoil on the subsea capex market up to 2020, with particular focus on Brazil and Mexico.

Brazil will remain the key driver of subsea demand globally, accounting for almost one-quarter of the global subsea investments over the next five years. However, Brazil’s subsea market faces falling demand over the next couple of years with Infield forecasting a -13% drop in demand between 2016 and 2017 and a further -16% reduction between 2017 and 2018. The reduced demand could be seen as a temporary cyclical downturn with an inevitable rebound by 2019 driven by the Buzios oil field development.

Mexico could see a significant increase in subsea market share demand over the next five years, driven entirely by state- owned PEMEX. Although due to recent changes in legislation, demand could be supported by private international companies. Increasing demand in Mexico is driven by PEMEX’s drive to tap into deepwater oil fields in order to help reduce the country’s production decline. A noteworthy project driving demand in 2017 includes PEMEX’s Lakach oil field. Lakach could potentially become Mexico’s first deepwater producing field, located in water depths of around 988 m (3,241 ft) and could account for 34% of the country’s subsea investment over the next five years. However, PEMEX has had to defer work on the deepwater development as it cuts costs and seeks international investment.

- Neda Djahansouzi, Research, Infield Systems

Iran oilfield >>>>>>>>>>>>>>

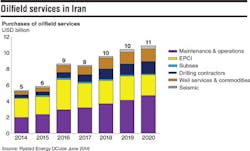

From 2016 to 2020, a total of about $50 billion of oilfield service purchases in Iran will be directed toward the offshore market, which is expected to be at $9 billion this year and increase to $11 billion by 2020.

The majority of the market consists of EPCI contracts. Five new platforms will be commissioned in 2017 at South Pars phases 20 and 21 and more platforms are to follow at the $4-billion South Pars Phase 11 as well as Farzad B that was discovered by an Indian consortium. The increased number of active platforms combined with aging facilities which have been underinvested during the sanctions, will force a rise in the maintenance and operations purchases. The demand for drilling contractors as well as well service and commodities picks up in the coming years as many of the offshore projects under development will go into pre-drilling. Roughly 25% of investments are well-related costs; with 22 wells to be drilled over the next 30 months at South Pars Phase 14 and additional infill drilling to commence at the producing field, these services will rise going forward.