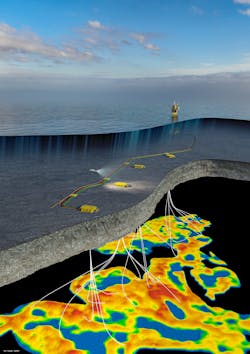

Subsea tiebacks continue to lead development options in the US Gulf of Mexico, and the number of tieback projects is growing in North Sea and other offshore regions as well.

The attractiveness of tiebacks as a development option resides in their lower capex requirements and short cycle times, key virtues in a time of low or falling oil prices and economic uncertainty.

In addition to these factors, in the US GoM, the growing trend of infrastructure-led exploration has further affirmed the value of subsea tiebacks. There is spare capacity on existing deep, and midwater host facilities, and an established pipeline infrastructure to tie into.

When infrastructure-led exploration is combined with new seismic imaging techniques and the latest tieback systems, developers can bring on new fields in less than a year. In some cases, time to first oil has been lowered to just six months.

Gulf of Mexico

In the US Gulf, this model is being used by Kosmos Energy, Murphy Oil, LLOG Exploration, Talos Energy and Fieldwood Energy, as well as majors like BP, Chevron and Shell, all of whom either recently completed tiebacks in the US GoM or are planning to do in the near future.

Shell is expected to move forward this year with its PowerNap project, which will tie back three subsea wells to the Olympus production hub. The PowerNap field is located in the south-central Mississippi Canyon area approximately 240 km (150 mi) from New Orleans in about 1,280 m (4,200 ft) of water. TechnipFMC has received an integrated engineering, procurement, construction, and installation contract for PowerNap. TechnipFMC will design, manufacture, and install subsea hardware, including subsea tree systems, subsea distribution controls, topside controls, flying leads, and connectors for three wells, in addition to the supply of 20 miles of production umbilical and flowlines. The project is expected to start production in late 2021 and produce up to 35,000 boe/d at peak rates. It is anticipated to have a forward-looking break-even price of less than $35/bbl and is currently estimated to contain more than 85 MMboe recoverable resources.

Murphy Oil Corp. is moving forward with its Khaleesi/Mormont, and Samurai field developments in the deepwater Gulf, both of which will be tied back to its King’s Quay FPS. The Khaleesi/Mormont field development includes seven subsea wells a subsea tieback to King’s Quay. Khaleesi is in Green Canyon block 390 and Mormont is in Green Canyon block 478. The Samurai field in Green Canyon block 476 will be developed as a four-subsea well tieback to King’s Quay. The King’s Quay FPS facility is expected to be in service in mid-2022, when initial production from the two new fields is expected to exceed 30,000 boe/d. Wood Mackenzie has estimated that each project has a development-cycle breakeven less than $35/bbl.

Subsea 7 has been selected to provide subsea installation services for the Samurai and Khaleesi/Mormont developments. The contract calls for the tieback of seven subsea wells to the King’s Quay FPS. The project scope includes engineering, procurement, construction, installation, and commissioning of all subsea equipment including PLETs, PLEMs, umbilicals and distribution hardware, production and export flowlines and jumpers, as well as the wet tow in the Gulf of Mexico to the fields and mooring system installation of the semisubmersible FPS.

Project management and engineering will start immediately at its offices in Houston. Offshore operations are expected to begin this year.

Meanwhile, LLOG is pursuing development of at least two tiebacks in the deepwater and shallow-water Gulf. The company recently reported continued successful drilling results at its Spruance discovery and finalization of development plans for the field. Spruance is in Ewing Bank blocks 877/921 and was initially discovered by LLOG and its partners in mid-2019 via a subsalt exploratory well in 1,600 ft (488 m) of water. The EW 877 #1 well and the EW 921 #1 well are scheduled for completion in 2021, with first oil sales scheduled for early 2022.

LLOG and its partners have signed a production handling agreement for the processing of Spruance reserves via a 14-mi (23-km) subsea tieback to the EnVen-operated Lobster platform in Ewing Bank block 873. The Lobster platform is located 130 mi (209 km) south of New Orleans in 775 ft (236 m) of water.

LLOG also reports that it is advancing a subsea tieback related to its Taggart discovery in the deepwater Gulf. The company says it has sanctioned the development and signed a production handling agreement for development via tieback to the Williams-owned Devils Tower spar in Mississippi Canyon block 773 in the Gulf of Mexico. The Taggart discovery is in Mississippi Canyon block 816 in about 5,650 ft (1,722 m) of water. Initial development plans include the completion and tieback of two wells with first production expected in 2022.

Chevron says it is assessing development alternatives for its Ballymore discovery in the US Gulf of Mexico. The company said during its 2020 Analyst meeting event that a subsea tieback is a possible option for the field, but an FID is not expected until 2023/2024. The Ballymore discovery is 4.8 km from the Chevron-operated Blind Faith semisubmersible, so a subsea tieback instead of a semi could be used to develop the field. The field sits in Mississippi Canyon Block 607 in a water depth of 2,006 m (6,581 ft).

North Sea

Several tieback projects are being planned in the North Sea. Last fall, Equinor and its partners have committed to develop the Breidablikk field in the Norwegian North Sea via a subsea tieback to the Grane platform. The plan for development and operation involves drilling 23 oil producing wells from four six-slot subsea templates, controlled from Grane. Breidablikk’s oil will be exported to the platform for processing and then sent through the Grane oil pipeline to the Sture terminal for storage and shipping. Breidablikk is northeast of Grane field in 127 m (416 ft) of water, and 185 km (115 mi) west of Haugesund. First oil should flow during the first half of 2024.

Elsewhere, the Oil and Gas Authority has approved Tailwind Energy’s field development plan for the Evelyn field in the UK central North Sea, and the company has taken a final investment decision. Evelyn will initially be developed as a one-well subsea tieback to the Triton FPSO with provision for future additional wells. The first Evelyn well is expected to be drilled in H2 2021 with the subsea tieback completed in summer 2022. First production is expected in 4Q 2022. The Evelyn oil and gas discovery is in block 21/30f about 6 km (4 mi) south of the Triton FPSO.

In addition, Neptune Energy has reported plans to build a subsea tieback from its Fenja field to Equinor’s Njord A platform in the Norwegian Sea. The project is currently on track for start-up in June 2022, pending progress on the Njord Future redevelopment project.

Meanwhile, Anasuria Hibiscus UK (AHUK) is studying the possibility of building a subsea tieback related to the Eagle discovery in the UK central North Sea. Eagle is in production license 238, block 21/19a, 6.4 km (3.9 mi) from the Cook field and up to 15 km (9.3 mi) from various facilities connected to AHUK’s Anasuria FPSO.

Mediterranean

Energean has committed to the NEA/NI subsea tieback gas project in the West Nile Delta offshore Egypt. Estimated capex is around $235 million, most of which is set to be incurred in 2022, with start-up anticipated in the second half of that year. Energean has appointed TechnipFMC as the EPC contractor. The facilities will develop 49 MMboe, with peak production close to 90 MMcf/d, plus 1,000 b/d of condensates.

Challenges and solutions

For all its positive attributes, the tieback strategy is not without challenges. Developing many of these fields could require high-cost subsea pumping equipment and other enhanced flow assurance technologies. To enhance the feasibility of tieback projects, several operators have been studying ways of reducing capex through the use of new and existing technologies, and new (and simpler) field architecture designs. Proposals include:

- Switching from electrically-heated pipe-in-pipe systems to single line pipe with wet insulation made of polymer materials and electrical trace heating modules, a move that reduces pipe procurement costs;

- Switching from an electro-hydraulic system to an all-electric subsea system to control the wells, a move that removes the hydraulic pump units from the topsides and reduces the size and amount of umbilicals needed;

- Deploying a local water treatment and injection system to the subsea surface, a move that enables removes this equipment from the topsides and eliminates the need for a water injection riser and flowline;

- Deploying a local chemical injection and storage system to the subsea surface, thereby removing that equipment from the topsides and reducing or removing some umbilicals;

- Using an anti-agglomerate hydrate inhibitor, thereby removing the trace heating element from the flowline.

Early estimates suggest that by implementing some or all of these concepts, developers can reduce the capex on subsea tieback projects by 7 to 34%.

About the Author

Bruce Beaubouef

Managing Editor

Bruce Beaubouef is Managing Editor for Offshore magazine. In that capacity, he plans and oversees content for the magazine; writes features on technologies and trends for the magazine; writes news updates for the website; creates and moderates topical webinars; and creates videos that focus on offshore oil and gas and renewable energies. Beaubouef has been in the oil and gas trade media for 25 years, starting out as Editor of Hart’s Pipeline Digest in 1998. From there, he went on to serve as Associate Editor for Pipe Line and Gas Industry for Gulf Publishing for four years before rejoining Hart Publications as Editor of PipeLine and Gas Technology in 2003. He joined Offshore magazine as Managing Editor in 2010, at that time owned by PennWell Corp. Beaubouef earned his Ph.D. at the University of Houston in 1997, and his dissertation was published in book form by Texas A&M University Press in September 2007 as The Strategic Petroleum Reserve: U.S. Energy Security and Oil Politics, 1975-2005.