Steady growth in exploration, field life extension across the North Sea

Jeremy Beckman, Editor-Europe

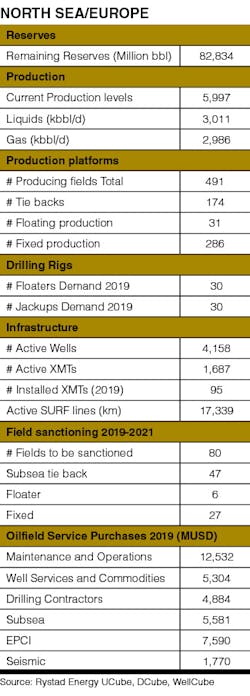

Regulatory authorities in Norway and the UK are pushing E&P companies to step up development and exploration, mindful of the prospect of a steady production decline through the 2020s unless more projects go forward. The various initiatives they have promoted such as frontier offshore licensing rounds have had a positive impact, helped by the industry’s continued commitment to drive down costs.

As the oil price recovered and then stabilized, Norway was the first to experience a resurgence of exploration drilling, particularly in the newly opened areas of the Barents Sea. Results over the past year, however, have been disappointing, with no oil finds in the far north apart from Equinor’s Skruis, close to the Johan Castberg field, and Vår Energi’s Goliat West. Most of the real action has been farther south – Equinor’s Cape Vulture (oil) and OMV’s Hades/Iris gas-condensate discoveries, both in the Norwegian Sea, and Aker BP’s ongoing campaign in the Alvheim area of the North Sea, which earlier delivered an estimated 60-130 MMboe from a well on the Froskelår Main prospect.

In the UK sector, the exploration well count slipped to single figures last year, the lowest since the mid-1960s, although a revival is at last under way. This may be because the few wells drilled have delivered strong results, led in recent months by Nexen’s Glengorm in the HP/HT corridor of the central North Sea, and Total’s Glendronach west of Shetland. Both are thought to hold around 250 MMboe recoverable. Oil & Gas UK expects up to 15 exploratory wells to spud in UK waters this year, some in the high-impact category. One, to be drilled by new partners Hurricane Energy and Spirit Energy, will attempt to prove oil in the fractured basement Warwick prospect west of Shetland.

Earlier this year, Equinor secured approvals from the Norwegian Authorities for long-term life extensions of platforms at five of its main field centers in the North Sea: Gullfaks, Oseberg, Snorre, Norne, and Åsgard. The longest, through end-2040, relates to the two Snorre field platforms in the North Sea, where a program started last summer to expand production through 24 new subsea wells, to be connected to Snorre A, and to import injection gas in order to increase oil recovery.Equinor and its partners in Snorre and Gullfaks are also considering constructing the Tampen Hywind wind farm to provide a renewable power source for the fields’ platforms, instead of the fuel gas currently burned. Assuming a positive investment decision later this year, the wind farm could begin operating in 2023. The company has submitted applications for further operation of the Tordis, Vigdis, and Veslefrikk facilities and will seek extensions later this year for Troll B and Heidrun Subsea.

Toward the end of 2019, Equinor expects to start oil production from the giant Johan Sverdrup field in the Utsira High region of the North Sea. Allseas’ Pioneering Spirit installed the last two topsides earlier this year for the processing and utilities/living quarter platforms. Construction is now under way on the Phase 2 platform which will be connected via a bridge to the existing complex. Two other major projects could go forward in the Norwegian North Sea later this year. One is Balder X, operated by Vår Energi, which was formed last year through the merger of Eni Norge and Point Resources. This will entail modifications to extend the lives of the Jotun and Balder production vessels to respectively 2045 and 2030; drilling 26 new production wells on the Balder and Ringhorne fields; and exploratory drilling in 2020 to prove up fresh resources in the Balder/Ringhorne area. The other big scheme is Aker BP’s proposed NOAKA hub, designed to mop up numerous stranded fields with potential combined resources of over 500 MMboe.

In the UK North Sea, the main project set to come onstream this year is Equinor’s Mariner in the East Shetland basin, which is initially targeting 250 MMbbl of oil in the Heimdal reservoir. Equinor could also open development of a deeper-water play west of Shetland if it succeeds in devising a commercial scenario for the Rosebank oilfield, after acquiring operatorship from Chevron last year. Another major player helping to sustain the sector’s future is Shell, through its redevelopment of the Penguins oilfield in the UK northern North Sea; conversion of its Shearwater gas platform in the central sector to host the Arran, Columbus, and Fram subsea tiebacks; and its new E&P co-operation with Siccar Point Energy in oilfield plays west of Shetland.

Independents continue to bring fresh thinking on previously neglected discoveries. London-based i3 Energy recently contracted the semisub Borgland Dolphin for a 94-day appraisal/exploratory drilling program this summer on the Liberator and Serenity prospects in the UK central North Sea. If successful, the company believes it could produce over 200 MMbbl from the surrounding licenses under a phased development, possibly bringing in an FPSO for Phase 2. Other independents such as Siccar Point Energy and Chrysaor have formed innovative engineering alliances for their development projects with contractors such as BHGE in order to contain costs.

Earlier this year RockRose Energy acquired Marathon Oil’s operated interests in the Brae area of the UK central North Sea. But the pool of private equity finance has been drying up of late, frustrating other small companies looking to complete field transactions. One reason is thought to be general nervousness over a global economic downturn. The uncertainty may also explain which Chevron and ConocoPhillips have been struggling to attract buyers for their mature producing UK North Sea interests. •