Longboat lauds Norway’s petroleum tax revisions

Offshore staff

STAVANGER, Norway — The Norwegian parliament (Storting) has approved Norway’s new Petroleum Tax system.

According to Longboat Energy, the new system is positive for the company as it seeks to expand its sources of finance for its offshore exploration and development projects.

The main elements are:

- Unchanged marginal rate (78%);

- Move to immediate expensing of investments (71.8% repayment of all losses in following year); and

- Corporate tax (6.2%) carried forward until profitable.

Longboat already held discussions with banks concerning restructured credit facilities to meet its working capital requirement for future development expenditure.

CEO Helge Hammer said, “The new tax system gives us an additional option for realizing the value of exploration success by carrying discoveries through to development as we look at all available options to progress to a full-cycle E&P company.”

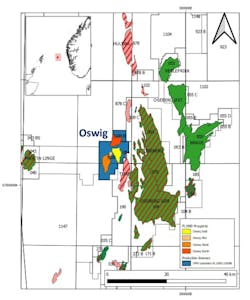

Oswig is close to the producing Tune and Oseberg fields operated by Equinor. The well will target two separate intervals estimated to hold combined resources of 93 MMboe, the key risks being reservoir quality and fault seal.

Other fault blocks on the two licenses could contain a further 80 MMboe, which would be de-risked by an Oswig discovery.

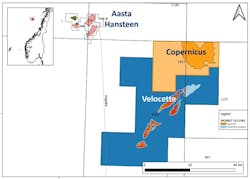

By the end of September, the Deepsea Yantai semisubmersible should spud a well on the 254-MMboe Copernicus prospect in PL 1017 in the Vøring Basin region of the Norwegian Sea.

Main risks are reservoir presence/quality and trap.

06.16.2022