Excess supply still overhangs offshore rig construction market

Key Highlights

- The offshore rig market has seen a slowdown since late 2024, with rig attrition rising and new orders decreasing, signaling a cautious industry outlook.

- Most rigs under construction are speculative, with many delayed or unlikely to be delivered as planned, reflecting market uncertainties and financial constraints.

- High costs and supply chain disruptions have limited newbuild activity, prompting contractors to prioritize upgrading existing rigs for efficiency and emissions reduction.

Angel Gutierrez, S&P Global

Despite experiencing robust demand in the years following the COVID-19 pandemic, the offshore rig market is currently facing a notable softness, characterized by a slowdown in contracting that began in late 2024. Although there have been two new orders and the count for offshore rigs under construction has decreased by four since August 2024, this market dynamic has created an environment where there is no immediate pressure to build new rigs.

As we look ahead, forecasts suggest a pipeline of opportunities that may signal a rebound in demand, projected to gain momentum from late 2026 into 2027. This cyclical nature of the market underscores the importance of strategic planning and adaptability in navigating the evolving landscape.

In addition to a market softening driven by project delays—largely attributed to restricted access to capital and escalating costs—rig attrition has risen by 12 units since December 2024. Additionally, five more floaters are intended to be disposed of, either through sale for recycling or for alternative use. Furthermore, contract suspensions and even terminations for jackups have persisted in both the Middle East and Mexico, while an uptick in rig sales has emerged. Collectively, these market dynamics have unfolded over the past 12 months.

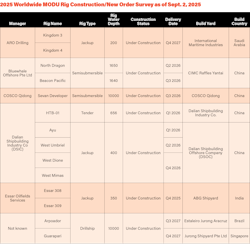

As a result of the agreement between ARO Drilling and Saudi Aramco, and the subsequent partnership with IMI (a joint venture including Lamprell), two new jackup rigs have been ordered within the last year. However, these orders were planned years before they took effect. Kingdom 3 was ordered in the fourth quarter of 2024 and steel was cut in Saudi Arabia earlier in January 2025. Kingdom 4 was understood to be ordered later into 2025. The joint venture has two newbuild jackups already delivered. Kingdom 1 and Kingdom 2 were delivered in the fourth quarter of 2023 and the third quarter of 2024, respectively. These rigs are part of a larger plan to build 20 jackup units over ten years and feature high-specification offshore drilling technology. These orders reflect a commitment to fulfilling specific contractual obligations rather than a direct response to anticipated future demand.

The ongoing slowdown in the offshore rig market is anticipated to exert additional pressure on utilization rates and day rates for the remainder of the year and into 2026. This trend is primarily attributed to the impending expiration of contracts for several rigs, which are unlikely to secure immediate follow-on work. While there may be limited 'spot' opportunities to bridge the gap until the next wave of contracts begins, drilling contractors are expected to maintain discipline by stacking available units, retiring less favorable rigs, and focusing on further cost reductions. This context suggests that new orders for rig construction will remain elusive.

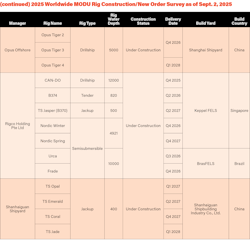

Currently, there are 28 rigs under construction, comprising six drillships, 13 jackups, seven semisubmersibles, and two tenders. Over the past 12 months, the industry has seen the delivery of two drillships and two jackups. This year, three additional rigs are slated for delivery, followed by 14 more in 2026, nine scheduled for 2027, and the final two anticipated for 2028. However, it is important to note that most of these rigs will not be delivered as planned, and are likely to remain undelivered altogether.

Out of these 28 rigs, only seven were ordered with contracts in hand or by operator themselves, but four of those rigs are part of Sete Brasil and those original charters were cancelled years ago and there is no sign they will ever be re-awarded. The future of the four units remains unclear, as market sources suggest that the rigs may either be converted, sold, or scrapped. Sete Brasil drillships Arpoador and Guarapari were relocated to Singapore from Brazil in 2023, while semisubmersibles Urca and Frade remain stranded in Brazil.

Chinese shipyards are outpacing their global counterparts in rig construction, currently undertaking the building of 15 rigs. This includes eight high-spec jackups, three deepwater drillships, one tender rig, and three semisubmersibles. In comparison, Singaporean shipyards are engaged in the construction of six rigs, which consist of one high-spec jackup, three ultra-deepwater drillships, one tender rig, and two high-spec semisubmersibles designed for harsh environments. There are currently no rigs under construction in South Korea. Two uncompleted F&G JU-2000A jackups remain in India. Essar Oilfield Services previously suggested it planned on reviving the construction of the unfinished rigs, which were originally ordered in 2009 by Essar with ABG Shipyard.

Virtually all of the rigs under construction were commissioned on a speculative basis, and as of now, none have secured contracts that would lead to their completion and subsequent entry into the market. The CSSC Offshore Tiger Series drillships, ordered in 2012 by the now-defunct Opus Offshore, consist of three units known as Opus Tiger 2 to Opus Tiger 4. Currently, only the three rigs are available in the near term. The first two units could become operational within six months, while the third unit is over 50% complete and will require at least a year for delivery. These drillships are designed for operations in Southeast Asia and the Mediterranean.

As semisubmersibles approach the completion of their construction, the harsh-environment units, Beacon Pacific and North Dragon, are now 99% complete and hold renewed Certificates of Compliance (CoC) at CIMC Raffles shipyard in China. Bluewhale Offshore is actively exploring work opportunities for these rigs. If acquired or chartered, they will only require modifications as specified by clients and subsequent sea trials to ensure readiness.

A semisubmersible unit with an interesting story is the ultra-deepwater Sevan Developer. Although it is technically a new unit under construction, the rig's building began in 2011. In December 2020, Sevan Developer was contracted for a three-year charter with Petrobras offshore Brazil. However, the Brazilian national oil company terminated the charter in June 2022. It is understood that the Sevan Developer is essentially complete and has been on standby, awaiting delivery at the Cosco Shipyard in China since 2014. Sources indicate that the rig was offered in a competitive tender for deepwater floaters this year.

Over the last decade, the average slippage in delivered rigs has been approximately 3.6 years, with the longest delay recorded at 13 years and the shortest at just 9 days. However, this average has significantly increased in recent years. For rigs delivered in 2024, the average slippage rose to 8 years.

In terms of recent deliveries, last year saw the completion of four drillships and eight jackups. Currently, only two units remain uncommitted and available since leaving the shipyards. As of 2025, only one rig has been delivered so far this year: the Hanwha Drilling drillship Tidal Action, which is set to commence its first long-term assignment soon.

Following the increase in fixtures after the COVID-19 pandemic, contractors had shifted their focus to reactivating stranded or cold-stacked units. These units became more appealing due to their lower costs compared to newbuilds and their quicker availability in the market. The regions of the Middle East, Southeast Asia, and West Africa have experienced the highest number of reactivations over the past five years.

However, with the current softening of the offshore rig market, the expenses associated with reactivating cold-stacked units, and the costs of maintaining stacked rigs, drilling companies have been proactive this year in disposing of and retiring less competitive units from their fleets.

Reactivating cold-stacked floaters typically incurs costs ranging from $70 million to $125 million and can take up to 18 months to complete. In contrast, jackups are generally more economical to reactivate, with costs averaging between $5 million and $15 million, though they can occasionally reach up to $40 million. Currently, there are 71 jackups, 15 drillships, and 11 semis cold-stacked; however, many of these units are older and in suboptimal condition. Furthermore, the average idle cost for floaters currently stands at approximately $30,000 to $35,000 per day.

Rather than focusing on newbuilds or reactivating stacked units, the industry may pivot towards upgrading active rigs to improve efficiency and minimize emissions. A recent fixture in the US Gulf, involving two rigs contracted for long-term work with upgrades and services incorporated into their day rates, exemplifies the industry's shift towards prioritizing rig upgrades. Notable upgrades include implementing offline capabilities for jackups and integrating advanced drilling systems for floaters, such as managed pressure drilling and backup blowout preventer (BOP) systems. The introduction of the 20,000-psi BOP stack exemplifies the latest advancements in drilling technology, providing new opportunities in challenging environments, though it requires a substantial investment and lead time comparable to that of newbuilds.

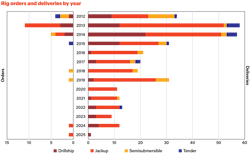

Looking at rig orders and deliveries since 2015, ordering of new rigs has been minimal with only four orders made in the last seven years, while rig deliveries have averaged around 9.5 units per year since 2020. Any future rig orders will only take place on the back of a substantial long-term contract at an extremely attractive rate. But given the number of units already in the market and that high cost, such a scenario looks unlikely in the short term.

In conclusion, while the offshore rig market currently faces significant challenges, including a slowdown in contracting and increased rig attrition, the potential for future recovery remains. Strategic planning and adaptability will be crucial as companies navigate this cyclical market. As the industry shifts focus towards upgrading active rigs and enhancing operational efficiency, stakeholders must remain vigilant and responsive to emerging opportunities. The next few years will be critical in determining the trajectory of rig construction and utilization, and industry participants must be prepared to adapt to the evolving landscape.

About the Author

Angel Gutierrez

Angel Gutierrez joined Petrodata in 2014, initially focusing on the offshore supply vessel market in the Americas until 2021. He then transitioned to Petrodata’s international team, specializing in the offshore rig market. Currently, Angel oversees North America reporting and leads the team analyzing the rig market across the Americas. He actively contributes to the market intelligence tool Petrodata Rigs by S&P Global, including the World Rig Forecast: Short Term Trends. Angel holds a Bachelor of Science degree in Hospitality from the University of Houston.