Noble/Diamond merger could strengthen mid-term rig rates

Offshore staff

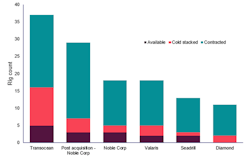

LONDON — Noble Corp.’s acquisition of Diamond Offshore means that four drilling contractors will account for more than 60% of the world’s total floater backlog, according to consultants Wood Mackenzie.

“We have been predicting offshore rig market consolidation for some time,” said Leslie Cook, principal analyst of upstream supply chain for Wood Mackenzie, “and with little appetite from owners to add new rigs as rig demand is flattening out, we believed growth would be inorganic."

Cook added, “Noble has grabbed first mover advantage and solidified its status in the top two offshore rig contractors.”

While the dominance of the top four in the floating market will have little impact on day rates in the shorter term, Cook added, “we do believe that the consolidation of the market will afford rig contractors more control in the medium and long term.

“With day rates currently reaching $500,000/d, this will be an ongoing concern for operators adhering to capital discipline and planning for long-term drilling programs.”

Other advantages to Noble from this deal are said to include a broader client footprint, with greater access to the UK and Australia, and a strengthened position in the US Gulf of Mexico.

If the expected synergies and costs are delivered, this should make Noble’s fleet more competitive, the consultants claimed.

06.14.2024