North Sea rig pool declining following fiscal disincentive

Offshore staff

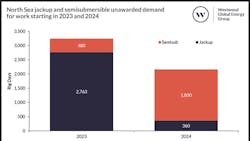

LONDON — Westwood’s RigLogix service estimates current demand in UK waters for jackups and semisubmersibles at a tender/pretender/enquiry stage at 5,403 days, or 14.8 rig years.

This covers assignments due to start in 2023 or 2024 and already in the tender or pre-tender/enquiry stage. The figures relate to new greenfield projects, brownfield and P&A work with both short-term and multi-year durations.

However, several of the planned projects could be jeopardized by the UK government’s decision late last year to impose a further 10% rise in the Energy Profits Levy (EPL) that it introduced last spring, taking the headline tax rate for UK oil and gas producers to 75%.

According to Teresa Wilkie, research director at RigLogix, the outlook could worsen considerably if UK offshore operators decide their projects are no longer feasible in the current financial climate.

TotalEnergies, Equinor, Shell and EnQuest plan to reduce their UK offshore expenditure this year, and FID for planned greenfield projects, such as Ithaca Energy’s West of Shetland Cambo oil development, may also be at risk due to the EPL.

Apache recently announced an early contract termination for Diamond Offshore's Ocean Patriot semisub, which should now become available in July, more than 400 days earlier than planned. Apache said the cancellation followed the changes to the EPL.

Wilkie added that a letter of intent (LOI) awarded to a sixth-generation semi by a UK operator has been cancelled after the company overhauled its UK drilling plans. The rig could have been contracted until 2030 if all options had been taken up but will now be available on completion of its current UK drilling campaign in mid-2024.

The International Association of Drilling Contractors’ North Sea Chapter recently sent a letter to all 650 UK MPs and 129 MSPs warning that further harsh-environment rigs could be “lost for good” to the UK due to the windfall tax changes.

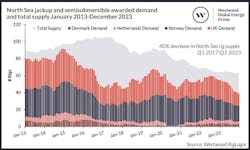

North Sea rig supply is now 40% below what it was in March 2017, RigLogix has calculated, with 13 rigs departing the region in the past two years either for work elsewhere or retirement. Two more will relocate later this year to eastern Canada and Namibia (the semis Hercules and Deepsea Mira).

A Westwood Insight published last November found that despite improving North Sea rig conditions, assignments elsewhere commanded longer durations and higher day rates.

Even in Norway, an uptick in development drilling in light of the country’s tax incentives appears unlikely to materialize until mid-2024.

RigLogix counts four cold-stacked rigs at present in the North Sea, comprising three semis and one jackup, and nine warm-stacked rigs (five semis and four jackups). Only three of the latter have work lined up, in two cases outside of the region.

And 15 further rigs could come off contract before the end of this year if follow-on work is not secure or options not declared.

A high-spec, harsh-environment semi currently in the North Sea could relocate later this year to drill in the eastern Mediterranean.

As for jackups, Valaris reportedly plans to preservation stack the Valaris Viking as a cost-reducing measure as it does not foresee sufficient work in the region to keep all three of its harsh-environment rigs operating due to weaker North Sea demand related to the fiscal changes.

And once rigs exit the region, they may not return, Wilkie claimed, due to a combination of high mobilization costs and more attractive contract terms and day rates in the Golden Triangle region, the Middle East and Australasia.

This would lead to a smaller pool of rigs within the North Sea region, with less choice and higher day rates for operators planning fresh campaigns in the years ahead.

03.23.2023