Report: Offshore drilling market has entered ‘multi-year upcycle’

Offshore staff

NEW YORK CITY – A new report by Evercore ISI finds that the offshore drilling market has entered “a new multi-year upcycle.”

The report comments that “dayrates have rebounded sharply for select rig classes, with incremental demand from key geographies pulling idle assets from markets that have been slower to recover.”

These lagging markets “will soon find themselves short of rigs as contract terms have lengthened and rigs are being contracted up to a year in advance.”

In addition to an overall increase in contracting activity and higher dayrates, the report notes that “supply chain and labor tightness are driving longer lead times for upgrades, reactivations, and contract prep, as well as higher costs.”

As for new contracts, Petrobras is expected to award seven floaters new multi-year contracts “imminently, setting the stage for its rig count to rebound from 28 to 40.”

Meanwhile, the report noted that Saudi Aramco is also executing on its rig count growth plans, and Saudi Arabia is expected to have 30 jackups “mobilizing in country shortly.”

The consulting firm reports that the newbuild order book has fallen to 19 available jackups, down from 28 at the start of the year, while available newbuild floaters are unchanged at 21. “Despite rising rig rates and tightness in the market, we do not expect global rig contractors to order newbuilds in the foreseeable future as they are in cash harvesting mode,” the report noted.

The report also noted that floating rig dayrates have increased “substantially over the past year,” rising by an average of 63% and 55% for ultra-deepwater (>7,500’) drillships and semisubmersibles respectively.

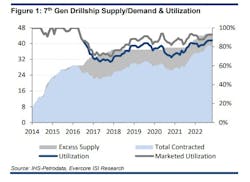

Evercore says that the marketed supply of seventh-generation drillships increased by four units this year, and the marketed utilization continues to hover in the high 80% to low 90% range. Dayrates are firmly in the low-to-mid $400,000/day range “and could move higher from here when incorporating reactivation and mobilization costs or for unique circumstances.”

11.10.2022