Expansion prospects for Kudu gas project offshore Namibia

Offshore staff

OSLO, Norway — BW Energy is assessing potential for further exploration on its Kudu license offshore Namibia, following two recent large oil and gas discoveries in the deepwater Orange Basin to the south.

BW Energy completed acquisition of the rig during the first quarter for $14 million.

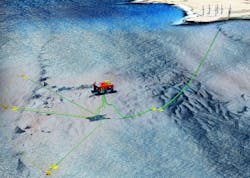

The company has recently acquired additional 2D seismic data over areas updip of Kudu and is reviewing all geophysical and well data from previous exploration activities to further develop the Kudu reservoir model and identify other exploration targets.

In addition, it is evaluating exploration upside along the Kudu North Ridge (a 10 to 30-km/6.2 to 18.6-mile step-out) with multi-Tcf gas potential.

Its current development plan calls for three subsea wells producing from the proven gas reservoir. Other planned facilities include a nearshore jackup barge with a 420-MW power plant, and an onshore substation and transmission system tie-in to the Namibian power grid.

Gas would be exported through a new 195-km (121-mile), 12-inch subsea pipeline from the converted FPU to Elizabeth Bay. Under the initial development phase, the facility would handle 65 MMcf/d, but it will be designed for 130 MMcf/d to accommodate upside.

In the Dussafu license offshore Gabon, production from the BW Energy-operated Tortue Field averaged about 11,600 boe/d in the first quarter.

A shortage of gas-lift capacity at the FPSO BW Adolo will continue to impact operations until a new compressor is installed, probably toward the end of the year.

COVID-19 and the war in Ukraine are affecting the supply chain, with a knock-on impact on all project execution, the company said, including FPSO operation and offshore modification work.

Its focus remains on managing the industrywide supply chain disruptions and related inflationary pressure on services and materials.

For the Hibiscus/Ruche offshore development in the same license, conversion of the jackup rig to the offshore production platform Hibiscus Alpha is progressing at Lamprell’s yard in the UAE, with sailaway scheduled for August.

Production from the Hibiscus and Ruche fields is estimated to add about 30,000 bbl/d of oil production. The initial drilling campaign included four Hibiscus Gamba and two Ruche Gamba wells.

TechnipFMC will lay a 20-km pipeline from Hibiscus Alpha to BW Adolo. A rig has been contracted for four firm and two optional wells, and it is due to mobilize in the fourth quarter.

First oil should flow at year-end 2022 with gross capex projected at about $425 million

05.27.2022