Maersk Drilling, Seadrill seeing positive signs in rig markets

Offshore staff

LYNGBY, Denmark – Market prospects continue to improve for Maersk Drilling’s rig fleet, according to the company’s latest results statement.

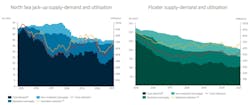

During 1Q 2021, there was increased activity in the North Sea jackup sector, with average demand for 23 rigs, up from 20 in 4Q 2020. The average marketed supply remained unchanged at 37 rigs.

At the end of 1Q, the one-year forward contract coverage for North Sea jackups had risen to 43%, up from 34% in 4Q 2020, suggesting that an increasing share of the available jackup capacity in the North Sea is contracted for the next 12 months.

In the Norwegian sub-segment, however, demand looks set to remain relatively flat in 2021, with few tendered opportunities for commencement in 2022. But the long-term outlook for the Norwegian jackup market remains stable with a substantial pipeline of subsea development projects in prospect in shallow waters.

As for the global floating rig market, average demand rose in 1Q to 105 rigs, while the average marketed supply fell slightly to 166 rigs, an average marketed utilization of 63%.

Demand for floaters should rise further toward 2022, but still with excess capacity holding back the pace of the recovery. And although some floaters were scrapped in 1Q 2021, more rationalizations will be needed to achieve a more favorable market balance, the company concluded.

Seadrill also issued an update on the status of its global rig fleet.

The drillship West Tellus is contracted for two wells, intervention work plus two optional wells with Shell Brazil in direct continuation of the rig’s contract with Petrobras.

In Norway, Equinor exercised options for the semisubmersible West Hercules, and the same company awarded the drillship West Saturn a four-year firm contract, with four one-year options, for a program off Brazil that is due to start in April 2022.

The drillship West Neptune has started a one-well contract with Talos, and the same rig will then transfer to Kosmos Energy for another well.

Seadrill claims that its total backlog of work, at $2.1 billion, is one of the highest in the drilling market, with rigs contracted to work across all the world’s major oil and gas basins, and 13 rigs in operation globally, including in the Middle East, Americas, and Norway.

05/20/2021