Analysis: US retreat on offshore wind opens door to Chinese domination of market

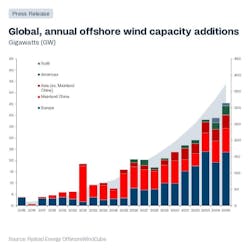

Despite an increasingly unfavorable US market, a recent analysis offered by Rystad Energy shows that new global offshore wind capacity will reach 16 gigawatts (GW) by the end of 2025. This is due to projects already underway, with two thirds of these being developed in China.

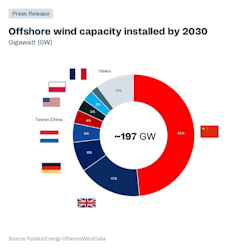

By 2030, Rystad Energy forecasts that China’s offshore wind projects will claim 45% of the world’s cumulative capacity, making it difficult for the US market to compete in the long term, regardless of potential policy reversals.

Alexander Fløtre, senior vice president and head of offshore wind research, Rystad Energy, said: “It is now clear that the energy policy shift in the US not only halts or slows progress on offshore wind projects that were previously greenlit[,] but pushes European wind developers away from US investment. The US-China supply chain may be decoupled, but China’s position as a global renewables leader may have only been strengthened because of it.”

Some clear effects are already emerging, according to Rystad. US renewable energy investments have plunged 36% year-on-year so far in 2025, whereas European investments are rising as companies redirect capital away from the United States. Stop work orders were issued for both Orsted’s Rhode Island offshore wind development and Equinor’s New York project, with the latter reaching a deal that lifted the administration’s ban. A federal judge has reversed the order on Orsted’s Revolution project, with the question of a continued legal battle waiting to be answered. To remain attractive to investors, Orsted and companies like it must evaluate all options for offshore wind developments and their overall US presence.

On the flipside, China-based CNOOC stated that it is staging its offshore wind portfolio expansion, with a key project in the 1.5 GW Hainan CZ7 aimed to be commissioned before 2030. The project is approved and is to be the first utility-scale project for CNOOC. For European energy companies with less US exposure, their reliance on China and other nations will only be enhanced, Rystad says.

Andrea Scassola, vice president of supply chain research at Rystad Energy, said: “Europe’s wind industry has taken notice, and policymakers are mobilizing to help reduce the reliance on Chinese imports and beef up the domestic wind energy supply chain. Officials hope such measures will encourage manufacturing buildouts while keeping costs in check.”