Renewabl CEO talks offshore wind economics in the era of hourly procurement

Key Highlights

- Hourly procurement provides clearer price signals and more stable revenues by aligning contracts with actual energy output, reducing risks and encouraging investment.

- Granular data enables better storage coordination, reduces curtailment and enhances the accuracy of renewable energy claims, especially as new standards like the GHG Protocol evolve.

- Operational challenges in offshore wind include transmission risks, project delivery uncertainties and grid congestion, which can be mitigated through detailed hourly data analysis.

As corporate buyers push toward 24/7 carbon-free energy, offshore wind developers face a new challenge of proving clean power delivery hour by hour.

In this exclusive Q&A interview, Renewabl CEO and Co-founder Juan Pablo (JP) Cerda explains why granular data and hourly procurement models are reshaping project economics, risk profiles and the future of offshore wind.

Founded in 2023, the London-based renewable energy technology startup enables corporate buyers to track, procure and report on hourly matched clean energy.

The company also recently announced that it is partnering with S&P Global on the development of an "Hourly EAC Index," which will provide a fair-value reference point for the certificates tied to scarce-generation hours for offshore wind developers.

Cerda has more than 20 years of experience in the energy sector, from trading to technology, having previously served in various roles with bp, Shell, Schneider Electric and Zeigo. Below, he discusses the operational and market challenges offshore wind developers face when implementing hourly procurement models.

Offshore: You’ve said hourly procurement provides clearer price signals and more stable revenue. Can you elaborate on how this model accelerates investment and benefits both developers and corporate buyers?

Cerda: Hourly procurement gives a clearer signal of when renewable power has real value. Energy buyers align their demand to the actual output of the assets they procure from, hour by hour, not on an annual average. This removes the data gap that often leads to odd claims, like showing solar coverage in the middle of the night.

In this new paradigm, developers can see when their power is needed and price their contracts with far more stability. It reduces the risk of negative price events and forced shutdowns, which improves financing and helps new wind and hybrid projects move forward.

For buyers, hourly procurement gives a clearer picture of what they are actually covering. You see the clean hours you secure and the gaps that still sit in your load, which makes the whole strategy more honest and more useful. That view helps you shape better PPAs [power purchase agreements], spot where hybrid structures add value and understand how each contract behaves across the day. It also prepares you for the shift in the GHG [greenhouse gas] Protocol toward hourly and local matching, which is now the direction of travel.

And when buyers and developers work from the same hourly data—load, generation and grid carbon intensity—the process becomes far easier to manage, because everyone can see the same problem and the same solution in front of them.

Lessons from European offshore wind for the shift to hourly procurement

Contributed by Renewabl

Hourly accounting is changing how offshore wind fits into corporate renewable energy strategies. Instead of proving annual coverage, companies now need to show that their electricity use is matched by carbon-free generation in the same hour and region. This shift from “how much” to “when and where” is reshaping procurement, and it is particularly relevant for offshore wind because of its strong evening, overnight and winter output (i.e., the hours where solar dips and demand tends to rise).

Operational challenges highlighted in European markets include:

1. Transmission-related risk

2. Delivery and availability uncertainty

3. Balancing generation and demand

Based on Renewabl's work in Europe, the most consistent challenge for buyers looking at offshore PPAs is the interplay between transmission-related risk and project delivery risk. Offshore wind farms connect into the transmission system, which exposes buyers to curtailment, congestion and pricing differentials that are far more pronounced than for onshore assets.

At the same time, offshore construction and grid-connection processes are longer and more complex, making it difficult to pin down precise delivery dates, availability levels and early-stage performance. These factors make offshore PPAs more demanding to evaluate and negotiate, and they require a much more detailed and data-driven approach when assessing long-term value.

Hourly data helps address several of these issues. When operators and buyers can see the generation profile hour by hour, they can assess how well the shape fits actual demand and where curtailment risk is most likely to emerge.

Granular data is also essential for accurate forecasting and settlement, particularly as storage, hybrid portfolios and flexibility markets play a growing role in shifting offshore output into the hours that matter most.

Offshore: How does hourly accounting influence decisions around storage coordination and future flexibility markets? What role do these elements play in reducing curtailment?

Cerda: Hourly accounting shows the hours when clean power isn’t there, and that changes how you think about storage. A battery can take the excess from a windy hour and shift it into a tighter part of the day, so the project isn’t forced to push power into a crowded grid. This becomes even more relevant as AI and data centers scale, because their flat overnight demand depends on carbon-free power in the hours when storage can make the biggest difference. That shift has a clear link to curtailment: when the offtake matches the hours that matter, and storage moves clean power into those same hours, the system faces fewer forced cuts.

One extra point is the tracking challenge. When a grid-connected battery charges from a renewable asset, today’s GO [guarantee of origin] systems don’t follow that MWh through charge and discharge. So the system treats that stored energy as generic grid electricity, and buyers can’t claim to be running on clean energy. At Renewabl, we see this gap often, so building technology for clearer tracking is a big focus for us.

Offshore: How do you see hourly procurement shaping the economics and risk profile of global offshore wind projects over the next decade?

Cerda: When I started working on PPAs over 13 years ago, almost no corporates—aside from big tech—wanted to take on such complex structures. Today the landscape looks completely different, and PPAs are now standard practice.

I think 24/7 carbon-free energy is following the same pattern: early interest led by Google and a few other front-runners, strengthened by voluntary initiatives like EnergyTag, Eurelectric’s Next-Level CFE Hub, and the Climate Group’s 24/7 Carbon-Free Coalition. The GHG Protocol is now reviewing its Scope 2 rules, with public consultation underway and a final standard expected in 2027. So the renewable reporting and procurement focus is definitely changing from “how much” to “when and where.”

For offshore wind, this shift is positive. Offshore wind has one of the strongest and most stable profiles among variable renewables, with heavy production in the evenings, overnight and in winter—the exact hours where solar dips and demand tends to rise. As corporates move toward hourly matching, this profile fills the temporal gaps left in solar-heavy portfolios and becomes a core piece of 24/7 clean coverage.

GHG Protocol update and 2027 standard

The Greenhouse-gas (GHG) Protocol sets global standards for corporate emissions reporting, and its Scope 2 guidance (covering purchased electricity) is currently being reviewed.

Current rules allow annual matching, but the proposed update will likely require hourly and locational matching for renewable claims.

Public consultation is underway, and a final standard is expected in 2027.

For offshore wind developers, this will result in a demand surge, as companies will need assets that deliver clean power during high-carbon hours, and PPAs will evolve to include hourly performance guarantees and granular data sharing. In addition, there will likely be an increase in technology investment as developers adopt advanced metering, SCADA integration and digital platforms for real-time tracking.

Offshore: Offshore operators increasingly rely on real-time data. How critical is transparency in hourly generation data for optimizing operations and meeting corporate sustainability goals?

Cerda: Hourly data is the foundation. Offshore operators can see what the asset delivers hour by hour, and that makes it simpler to line up with what corporates want for their 24/7 goals. When the data is clear, the decisions are clear—and the whole process runs with far less friction.

Key takeaway

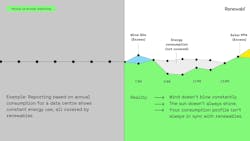

Traditional renewable energy procurement models rely on annual matching, where companies purchase enough renewable energy certificates (e.g., GOs) to cover their yearly electricity consumption. While this satisfies current reporting standards, it creates a temporal mismatch, because a company can claim 100% renewable coverage even if its actual consumption occurs when renewable generation is low (e.g., solar at night).

Hourly procurement changes that, because it requires matching electricity consumption with carbon-free generation in the same hour and region, creating a more accurate and transparent accounting system.

About the Author

Ariana Hurtado

Editor-in-Chief

With more than a decade of copy editing, project management and journalism experience, Ariana Hurtado is a seasoned managing editor born and raised in the energy capital of the world—Houston, Texas. She currently serves as editor-in-chief of Offshore, overseeing the editorial team, its content and the brand's growth from a digital perspective.

Utilizing her editorial expertise, she manages digital media for the Offshore team. She also helps create and oversee new special industry reports and revolutionizes existing supplements, while also contributing content to Offshore's magazine, newsletters and website as a copy editor and writer.

Prior to her current role, she served as Offshore's editor and director of special reports from April 2022 to December 2024. Before joining Offshore, she served as senior managing editor of publications with Hart Energy. Prior to her nearly nine years with Hart, she worked on the copy desk as a news editor at the Houston Chronicle.

She graduated magna cum laude with a bachelor's degree in journalism from the University of Houston.