Quantifying logistics emissions in offshore wind provides a case for smarter supply chains

Key Highlights

- Transport logistics, including manufacturing location and vessel choice, are key levers for reducing offshore wind emissions.

- Long-distance supply chains, especially from China, can increase emissions by up to 11 times compared to regional European routes.

- Switching to low-emission fuels, port infrastructure upgrades and smart logistics planning can significantly cut the carbon footprint of offshore wind projects.

By Eloïse Ducreux, Spinergie

By providing a low-carbon alternative to fossil fuels, offshore wind is a key pillar in the energy transition. However, its life-cycle emissions are not negligible. While the most significant contributor to wind farm life-cycle emissions is component manufacturing, supply chain transport choices also play a major role.

The carbon impact of transporting wind farm components can vary significantly depending on logistical decisions. Therefore, optimizing transport scenarios is critical to reducing the environmental footprint of offshore wind. In large-scale offshore wind farms, each transport decision contributes a significant carbon cost as hundreds of turbines and components must be delivered. This means that by choosing a higher-emission scenario for each major component, developers can significantly inflate a wind farm’s total carbon footprint, even before energy is generated.

Even though the offshore industry is moving toward greater standardization—with initiatives like the Carbon Trust’s Product Carbon Footprint standards—there remains a lack of data collection and robust studies on the emissions of maritime logistics. This article quantifies the impact of transport decisions on emissions, showing why logistics must be better integrated into decarbonization strategies.

Logistics as a carbon lever in offshore wind

Supply chain choices are some of the most important decisions to be made as they impact cost and schedule as well as emissions. A key decision lies in where components are manufactured and how they are transported.

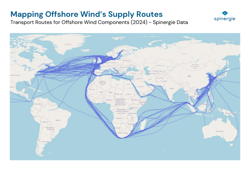

Two hubs dominate the offshore wind supply chain:

- Northern Europe, with players like Sif and Navantia; and

- China, with companies like Daijin Heavy Industry and ZPMC.

Because production is concentrated, developers often rely on long transport routes for monopiles, blades and other components. This cross-continental transport has a carbon cost that is often overlooked.

Regionalizing production can reduce transport needs, especially when the manufacturing hub is close to the installation site. However, this must be balanced with available capacity, cost structures and local content requirements, which are increasingly present in tenders.

Beyond manufacturing location, transport choices like vessel type, routing strategy, port infrastructure and fuel type also shape the final carbon impact.

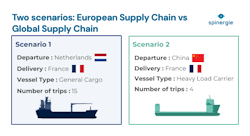

Case study: Two transport scenarios for monopiles

To assess the impact of logistics decisions, Spinergie's team analyzed two scenarios for transporting 60 monopiles to a marshalling port in France. Both scenarios represent realistic supply chain strategies used in current offshore wind projects. The data is taken from Spinergie’s Supply Chain Module, which allows for comparative analysis of supply chain scenarios, quantifying differences in duration, routing, vessel use and number of trips across offshore wind campaigns.

Scenario 1: Regional (European) Supply Chain

- Origin: Netherlands

- Vessel: General cargo vessel carrying four monopiles

- Trips: 15 round trips

Scenario 2: Global Supply Chain

- Origin: China

- Vessel: Heavy load carrier with capacity of 10 to 20 monopiles

- Trips: Four round trips

Although the heavy load carrier offers greater efficiency per trip, the emissions modeling shows that the much longer distance from China leads to significantly higher overall emissions.

Modeling the impact of offshore emissions

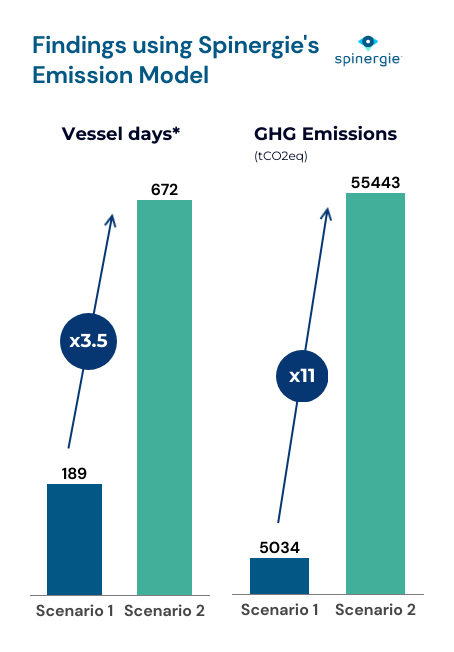

Spinergie’s Offshore Emissions Model (SOEM) quantified the greenhouse gas (GHG) emissions impact. By combining vessel technical data with operational parameters, analysts accessed detailed trip-by-trip emission estimates.

The key result was that transporting monopiles from China led to GHG emissions 11 times higher than using a European supply chain.

This difference was mainly due to the longer transit route, despite the heavy load carrier's higher per-trip efficiency. Such emissions can reduce or cancel out the cost savings from lower component prices, especially as carbon pricing expands.

This analysis, though focused on monopiles, applies more broadly to other large components such as towers, transition pieces, nacelles or cables. These components often follow similar transport patterns, and their carbon impact increases significantly when supply routes are global and fragmented. Furthermore, weather delays or port bottlenecks can extend voyage durations, leading to additional fuel consumption and emissions.

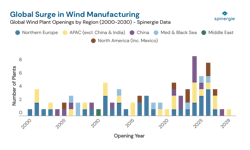

Factoring in these operational risks strengthens the case for short, robust and regional logistics chains, especially as developers seek predictability in both carbon and cost performance. Figure 5 highlights the increased reach of offshore wind manufacturing. This presents both more options for developers but also more pressure to make the right decisions for their projects.

Beyond distance: key transport levers for emissions reduction

The above case study illustrates how route and distance dominate the emissions outcome, but developers can take other factors into account:

1. Vessel choice

Vessel type is a key driver of emissions, with heavy transport vessels such as heavy load carriers or semisubmersibles showing high fuel consumption due to their size and power requirements. Where available, using hybrid or battery-assisted vessels can help reduce emissions during transit and port operations.

2. Fuel type

Most offshore transport still uses marine gas oil, a high-emission fuel. Switching to advanced biofuels or methanol can cut well-to-wake emissions by up to 70% but requires early planning and access to infrastructure.

3. Shore power and port choices

Ports with shore power capability reduce emissions during idle times. Choosing ports closer to wind farm zones also helps reduce vessel travel time and associated fuel use.

4. Smart logistics planning

Combining cargo, avoiding empty return trips and optimizing load factors can significantly improve the carbon efficiency of a logistics campaign.

5. Long-term O&M logistics

Once the farm is installed, operations and maintenance (O&M) become the main source of vessel activity. Strategic siting of O&M bases and use of low-emission vessels (e.g., CTVs or SOVs with alternative fuels) is a long-term emissions lever.

Implications for procurement and regulation

As the EU Emissions Trading System (ETS) expands, it now covers both international shipping (as of January 2024) and offshore operations (phased in from 2027). This means that emissions from transporting components over long distances, as well as from offshore installation and O&M vessels, will carry a direct financial cost. In parallel, the FuelEU Maritime regulation will gradually constrain the carbon intensity of marine fuels, further raising the cost of high-emission transport. These regulatory changes create a stronger incentive for developers to integrate carbon performance into procurement and logistics strategies.

Regulators and developers should:

- Require emissions disclosure and modeling in bids;

- Evaluate life-cycle GHG impact alongside cost and local content;

- Support the deployment of low-carbon vessels through demand aggregation and targeted subsidies; and

- Encourage transparency and comparability through standard emissions methodologies.

Action items for industry leaders

Reducing emissions from offshore wind logistics will require structural shifts across both industry and policy.

There are some clear steps to take for each industry player:

- Vessel owners: Invest in cleaner propulsion technologies like hybrid, electric, methanol or hydrogen-ready supported by clearer signals from developers and financiers. These investments should be derisked through stable project pipelines and regulatory visibility, especially in emerging markets.

- Ports: Upgrade infrastructure to provide shore power and alternative fuel bunkering. On the demand side, developers and EPCs must integrate emissions performance into tender criteria not only for manufacturing, but throughout all logistics. Regulation can reinforce this by expanding carbon reporting and enabling joint planning of low-carbon transport corridors.

Collaboration is key. Shipowners, OEMs, ports and developers must share data, anticipate constraints and align on logistics strategies that support long-term sustainability goals.

Conclusion: logistics as a climate decision

Offshore wind is rightly seen as a low-carbon technology. But this status depends on the entire value chain, not just electricity generation. Transport decisions, often made on purely economic or timing grounds, have a structural influence on project emissions.

The example of monopile transport shows how emissions can vary by a factor of 10 based on transport scenarios. Optimizing vessel types, routes and port selection, combined with clean fuel adoption, is essential for offshore wind to fully deliver on its climate promise.

By factoring in emissions early in supply chain planning, developers can align cost, compliance and climate performance in a single procurement strategy. Doing so will not only reduce emissions but also improve supply chain resilience and support the offshore sector’s long-term license to operate.

Editor's note: This article is an updated and extended version of the Spinergie analysis article that published in March 2025, titled "How do supply chain choices impact offshore wind emissions?"

About the Author

Eloïse Ducreux

Eloïse Ducreux is an offshore sustainability analyst with Spinergie, a maritime technology company. She first joined Spinergie as a Stagiaire data analyst intern in April 2023 and was then hired in December 2023 for her current role.

She has also been a workshop facilitator with 2tonnes since May 2021, focusing on actions that will bring about a direct change in greenhouse-gas emissions.