OTC 2024: US faces 'learning curve' with offshore wind, says Atlantic Shores exec

Editor's note: This article originally published May 9, 2024, and it was later featured in the 2024 Offshore Wind Special Report and the July/August issue of Offshore magazine.

By Ariana Hurtado, Editor and Director of Special Reports

HOUSTON — Rain Byars, technical and delivery director with Atlantic Shores Offshore Wind, provided a developer's perspective on US offshore wind during her keynote session on May 7 at the Offshore Technology Conference (OTC). The dedicated offshore wind thread was a first at OTC this year.

Byars has 14 years of experience in offshore wind, and prior to that she worked in the onshore wind sector for about 12 years.

"There's so many avenues and so many technologies that that will come together to make this energy transition, and we need them all," she said. "I see offshore wind as a really critical part. It's not 100% of the solution, but I do think it has an important role to play, especially in places like the Northeast where our projects are, where some of the other technologies won't work as well."

Atlantic Shores Offshore Wind is a 50:50 partnership between Shell New Energies and EDF Renewables, and its customers are primarily the states of New Jersey and New York. Byars said those states are seeking 100% electrification and 100% clean energy by 2050.

"Offshore wind has been is a big part of that [goal]," she added. "So we have the appetite from our customers; that's a really important part of it. That's what they're asking for and what we want to deliver."

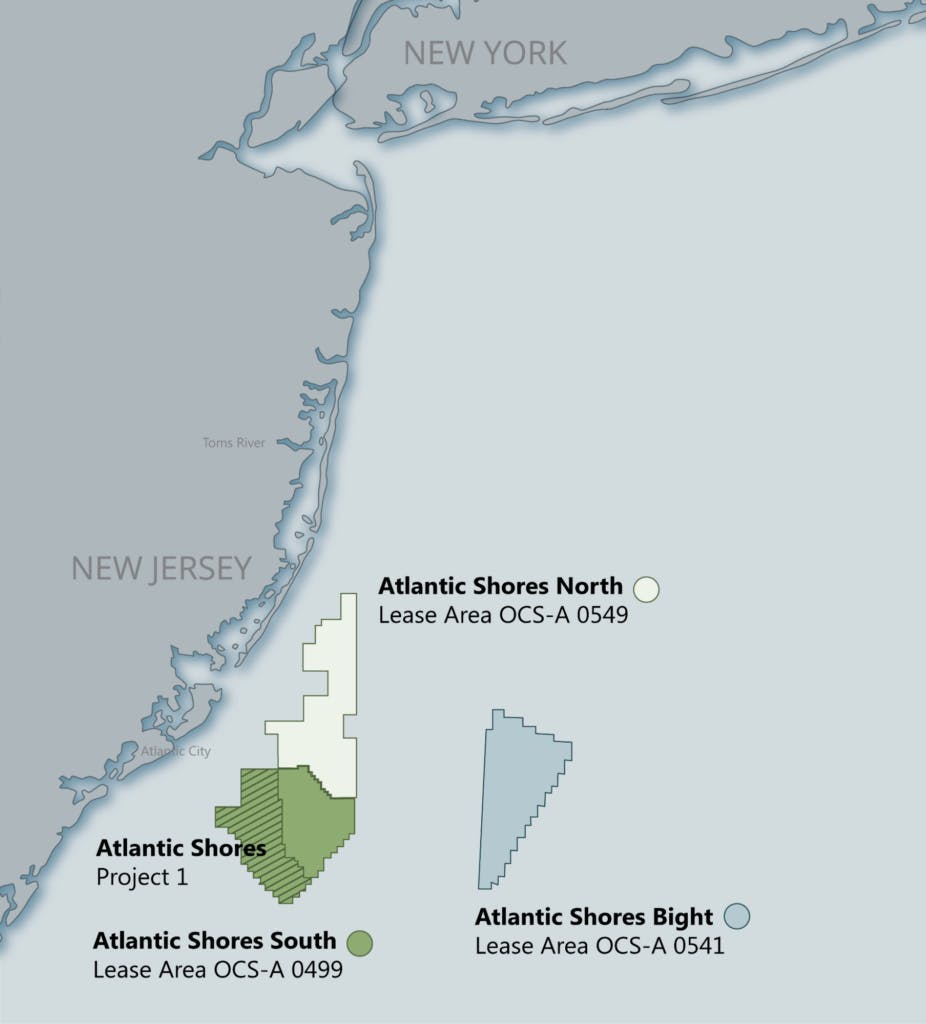

Atlantic Shores has three northeastern US lease areas totaling more than 400 sq miles under active development. Two of the lease areas are about 10-20 miles offshore New Jersey, and a third lease area is in an area of the Atlantic Ocean known as the Bight.

The company said its Atlantic Shores Project 1 is the largest clean energy project in New Jersey and the third largest awarded offshore wind project in the US.

Challenges

Byars stressed that a key challenge developers, OEMs, utilities and transmission system operators, and states are all trying to solve revolves around interconnection.

"So right now, it's a bit of a mix, where a lot of the projects have their own radio connections, meaning you run your own line from your offshore lease area to shore and then run the onshore export cable through city streets to a substation, that's usually 10 or more miles inshore," she said. "And often you're building a substation there and connecting into the existing grid. You also have to cooperate with the utilities that are operating there, because they often have to do upgrades on their side in order to take in the power."

What many states are trying to do now is a coordinated transit transmission upgrade, she continued. They want to bring in multiple projects in the range of 9-11 GW and are seeking how to upgrade their coal grid in a coordinated way, while working with utility owners and the transmision system operators instead of the offshore wind developers.

"In theory, that makes it a little bit easier for us because we don't have to do as much scope; we can focus on our key skills, which is the offshore wind portion of it, and not the transmission and grid portion of it," Byars said. "But it also introduces a huge risk, because that's a big necessary part of your project. If you develop your project and then you don't have anywhere to plug it in, you're just sitting there waiting, sometimes for multiple years. And we've seen that happen in other markets where the plant's transmission didn't go very well. So it also has to do with timing between the offtakes and when the transmission is ready. And knowing which way you're gonna go—if you're going to go into plant transmission or if you're going to do your own radio line."

It's imperative to have a clear understanding of that plan when developers are completeing permitting and a bid in the states. "And if it's not clear then you have sort of all these optionalities that you have to carry, and it's more technically difficult and more work for the team," she added.

A learning process

What makes the US particularly challenging, Byars said, is the "learning curve."

"Anytime you are starting a new industry in a new place, there's a lot of learning that has to be done on all parts. And nobody can get the industry off the ground by themselves," she continued.

The developers, supply chain and states must work together to get the industry off the ground, because "they can't do it by themselves."

She added, "There's a lot about community building and having all of these conversations between all of the key stakeholders and making sure we understand each other's needs and making sure we understand what we can bring to the to the table from our respective backgrounds and understanding what good looks like from all of these different perspectives and really build it together."

Byars said the shared goal is clean energy across the US and the world, but it's the process of how to get there that sectors and partners struggle with navigating. "The pathway to get there... People have different opinions about the best way to go, the timing [and] the technology," she added.

What takes so long?

Offshore projects in the US can take a long time to get off to the ground. On average, it can take 10 years to develop a wind farm in the US, more if you count in the federal state planning process that happens before the work or the development even starts. Byars walked attendees through the timeline of this process.

Step 1: Developers acquire a lease.

The leases are acquired through auctions that are held by the US Department of Interior (DOI). The DOI spends years before the auction reviewing all possible constraints, stakeholders, where to site offshore wind farms to be safe and not interfere with existing navigation and uses, and how to be gentle on the environment, Byars explained.

Step 2: Start engaging with customers.

For Atlantic Shores, the team communicated with the state officials of New Jersey and New York to determine what they want out of offshore wind projects, why they want offshore wind, what they want it to look like, and what types of impacts they want it to have on their communities.

Step 3: Start engaging with the supply chain to understand what is possible.

There is a very limited supply chain for a lot of the vessels and also a lot of the equipment that we're installing in these offshore wind farms," she said.

Step 4: Start interconnection.

For the interconnection process, a position request is filed with the transmission system operator, and they complete their grid upgrades and give an in-service date. "That alone can take it eight to 10 years," Byars said. "So you sometimes have to file these two positions before you've even figured out if you can get a route to that offshore/onshore substation. So that's a challenge."

Step 5: Gather data.

In the meantime, data are being gathered via in-field vessels for geoscience and with aircraft to look for protected species. Developers perform onshore sampling, review the seafloor and metocean conditions, place buoys in the water to measure the wind resources, measure the waves, and assess what the currents and temperatures are like.

"All of these things that go into the design—that can take one to two years to get a good dataset," she said.

Step 6: Start permitting (state permitting and federal permitting).

The permitting process, which is done through DOI's BOEM, can take three to four years, Byars said. They are the coordinating agency, and they're working with 12 to 14 different federal agencies, she added. BOEM consults with state environmental groups and with the public.

Step 7: Assess design options.

During the permitting process, developers are also reviewing design options (e.g., turbine sizes, foundation types, interconnections and export routes) trying to mature those designs, all while continuing to engage with customers, the public and the supply chain.

Step 8: Get an offtake.

"Offtakes are typically through competitive bids with the state to get a long-term power contract. So that's a fixed price per megawatt hour contract that lasts for 20 years," Byars explained. "And yet, we've participated in several in New Jersey. We're evaluating a couple that are upcoming in New Jersey and New York for this year and in the coming years."

Step 9: Start doing detailed design and contracting.

Step 10: Start onshore construction.

Once a company has an offtake and permits, developers can start construction and contracting.

"Construction typically starts onshore," she said. "So even a few years before, infrastructure that supports our project is starting construction. So when you think about ports, you think about the fabrication facilities to build the structures that we'll use. Our onshore construction typically starts with our operations facilities and within our production.

Step 11: Start offshore construction

"Finally, you can move on to offshore construction, commissioning, and then you can start your 30 years of operation after that. So that process does take a long time. And there's many, many stakeholders involved," Byars said.

Navigating the uncertainty

In this space, developers don't always know the outcome of decisions that are being made or the technology that's going to be used. To deliver a project on a timeline, developers have to make decisions based on what is known. Byars said the key to navigating the uncertainty is continuous community engagement and being flexible and adaptable.

"Having those engagements with all of your stakeholders from day one and really using them to iterate your design and almost doing a co-design with your stakeholders is critical for having the outcome of your project move up to the vision that you have at the beginning," she said. "You have to understand what the customer wants. You have to understand what the existing users need and how you can coexist together, because you're coming into their waters. So you want to coexist with them; you don't want to push them out. You have to understand the regulators and the things that might be coming down the pipe there."

US has an advantage

Safety and minimizing risks is one of the big opportunities in the US offshore wind sector because of the country's experience offshore, Byars said.

"Even though it's a new industry in the US, doing things safely offshore is not new for us," Byars said. "And doing things safely in wind turbines is not new for us. We've been doing that in the US for decades. But I think taking those lessons learned offshore to offshore wind is really, really important."

She also emphasized the importance of having standardized processes between different operators and owners. "I think that having that standardization of approaches is really important, and that's a huge opportunity that we can work on right now," she said.

Automation and safety benefits

Another advantage to offshore wind involves how heavily the technologies are automated, increasing efficiencies with 24/7 monitoring and safety features. The structures have been designed to be unmanned, minimizing risks to personnel.

If there are 100 turbines, plus a substation out on the project, they all wake up when the wind wakes up.

"They're checking their systems, they're turning themselves on, they're moderating their power output, depending on the wind, and not just over long term, but microsecond to microsecond," Byars said. "When the wind is shifting, they turn into the wind. When they sense a fault, like low oil or overheat, they've shut themselves off slowly and safely, and then they turn themselves back on when the fault is cleared. When there's a storm or an extreme event, they again, safely turn themselves off and then do checks before they turn themselves back on."

She said another goal is to minimize the amount of time that people need to be sent offshore. Whether it's a vessel crossing the shipping channel, transfering a person from the vessel to the structure, or when somebody climbs up a turbine, that presents a safety risk.

"We want to keep our people safe while they're doing their job, but we also want to design the systems so that there's as little human interference needed as possible," she added.

AI advances and data gathering

During the design and operation of a wind farm, tons of data are created and gathered. Much of the data are in geophysical and geotechnical databases, Byars said, and they also collect large amounts of wind and wave data from their buoys. Then during operations, there are sensors all over the wind turbines (and there are hundreds of turbines in the fleet) as well as sensors all along the electrical system.

"All of that data goes somewhere, so what you do with it is hugely important," Byars said. "If it just sits in somebody's desk drawer or on the cloud somewhere, it doesn't really do much good. But if you can put computing power to work to organize that data to make it very accessible and understandable, to analyze it and look for trends, and feed that into things like predictive maintenance, feed that into design improvements in the future, these are going to be performance enhancements for the wind turbines so you can make them more powerful."

Leveraging the data

Byars stressed a need to communicate, developer to developer, about data being collected.

"It's hard to know what other companies are doing, right? So this is an area where we really don't talk to each other as much as we could maybe," she said. "It's definitely considered proprietary information for a lot of customers. We have a lot of conversations with industry groups of how can we sort of pool a lot of our data to answer some questions about safety, for example; that's one one area where we can usually get people on board with sharing data."

Another topic for potential knowledge sharing is environmental protection (e.g., the collection of wind and wave data).

"Atlantic Shores was one of the first projects that publicly shared all of our belief data, and I think there's opportunities for all of the developers to get together and pursue things like that," Byars said.

However, operational data is more difficult to share. "You also have to work through the confidential nature of the information from the OEM," she added. "But if we can find ways to anonymize that data and collect it, I think we can do some really interesting things with that and look for trends [and] look for opportunities that can help all of us."

HVDC technology opportunities

Byars said technology opportunities lie within HVDC, which has a lot of demand.

"We will need this a lot in the future, both on and offshore globally," she said. "There are huge upgrades that need to be done to our grid to make it more efficient. And it's also a key technology for us to be able to bring power from further offshore to the centers where it's needed."

There are also constraints in the supply chain, and there are only a few companies that that work in this type of technology. With all the demand, she said developers can expect to wait five to 10 years for reservation agreements for getting that equipment.

There are also competing technologies. "So the states eventually would like to be able to interconnect all of these offshore wind farms to be able to have almost an offshore grid to increase reliability," Byars explained. "But if you have each of the different wind farms using a different technology, it makes it more difficult to interconnect in the future. So how do we introduce some of that standardization now?"

Life extension options

It's also important to consider life extension risks and opportunities, Byars said.

"So we designed these wind farms for 30 years, but there's a lot of safety factors in the fatigue calculations that we do," she said. "So if you measure those loads during that lifetime, you can see how close were my predictions about the wind and waves and about the number of storms and about the fatigue cycles that I'm seeing; how close were they to actually what I was seeing in the field; and do I actually have two years, five years [or] 10 years of useful life and structures left? That can really boost your project performance."

Life extension is mainly about the structure. "If you think about the useful life, and when you really have to make a decision to take the structure down to decommission and either return it to, like ocean, or if you put larger structures, larger turbines there, that's really about the steel," she said. "So the steel that's in the foundation, the steel that's in the tower—when you get close to the fatigue life on those, that's when we need to remove the structure because it wouldn't be safe to keep operating it."

Note, a lot of the internal components (e.g., generators, gearboxes, oil manifolds, coolers) are all replaceable in the field. While it's not cheap or easy to replace the blade, Byars said, it can be done without the complete repower. "In some cases, it can actually be beneficial to go out and do enhancements or do replacements that can increase the power," she added.

Synergies and skills demand

Byars said many of her colleagues come from oil and gas backgrounds, and there are a lot of synergies that exist between the offshore wind and oil and gas sectors.

"We have colleagues that were structural engineers, and that obviously transfers very nicely," she continued. "Geoscience transfers very nicely. We have pipeline engineers who became cable engineers, so there's a lot of a lot of good expertise that we can we can bring over there."

While she admits there isn't so much a skills gap in the offshore wind sector, she stated there is a large demand for people with a certain skill set.

"There's a lot of competition for technical skills, for project management skills [and] for leadership skills," she added. "There are many companies that are trying to develop these projects, not only in the US, but globally. So there is a big, big demand for those people."

In regards to an offshore wind turbine alone, many job disciplines are involved (e.g., sciences, geoscience, metocean, electrical and mechanical, structural), and with the components, there are control systems, advanced power electronics, composites and cast iron.

"So there's all of these different materials and disciplines. So no matter what your skillset is, there's a there's a place for you there," she said.

05.09.2024

About the Author

Ariana Hurtado

Editor-in-Chief

With more than a decade of copy editing, project management and journalism experience, Ariana Hurtado is a seasoned managing editor born and raised in the energy capital of the world—Houston, Texas. She currently serves as editor-in-chief of Offshore, overseeing the editorial team, its content and the brand's growth from a digital perspective.

Utilizing her editorial expertise, she manages digital media for the Offshore team. She also helps create and oversee new special industry reports and revolutionizes existing supplements, while also contributing content to Offshore's magazine, newsletters and website as a copy editor and writer.

Prior to her current role, she served as Offshore's editor and director of special reports from April 2022 to December 2024. Before joining Offshore, she served as senior managing editor of publications with Hart Energy. Prior to her nearly nine years with Hart, she worked on the copy desk as a news editor at the Houston Chronicle.

She graduated magna cum laude with a bachelor's degree in journalism from the University of Houston.