Analysis: European offshore wind service sector will soon see period of sustained growth

Todd Jensen * MSI

European countries hoping for continued strong growth in offshore wind installation over the past few years have been disappointed, as governments and developers come to terms with a tight supply chain and soaring costs.

The substantial upfront costs of building a windfarm without an attractive energy rate provided by governments have left developers and operators opting to delay or cancel projects where they can.

These project delays have led to a short-term decrease in fixed-bottom installations forecast for 2024 and 2025, but potential energy rate increases offered by government authorities should lead to strong growth in installations towards the end of the decade as projects reach FID. Governments have been guilty of offering low guaranteed energy prices as part of offshore wind contracts. The UK’s last auction in September 2023 failed to attract any offshore wind projects. The government has since announced, in the next auction due to be held in mid-2024, that contracts will offer an energy price 66% higher.

Europe remains the leading region for offshore wind capacity in-situ with 34.5 GW installed to date. This will continue to be the case throughout MSI’s five-year forecast, during which we expect Europe to increase its capacity to 95 GW by 2028.

The current pipeline of projects in the UK alone consists of around 48 GW of capacity, and despite the majority of this being in the early planning stage just under 20 GW is made up by projects that have had consent authorised. Following the UK is Germany, which has 8.2 GW of capacity installed, with a further 3.5 GW having had consent authorized.

The longer-term future of offshore wind in Europe is set to be bolstered by auctions in Germany, Denmark, UK, France and the Netherlands during 2024. Germany plans to auction 8 GW, a significant statement considering just 13.5 GW was auctioned during 2023 across Europe as a whole.

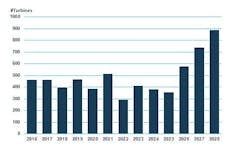

This year is forecast to see an 8% decrease in fixed bottom installations, but by 2028 we expect to see circa 900 fixed bottom turbines installed per year, 114% higher than 2023 levels.

The delays to fixed bottom projects have also led to delays in floating projects with developers/operators continuing to focus on more cost-efficient fixed bottom projects later into the decade. Floating wind farms are forecast to become a more prominent feature in the offshore wind market in the latter stages of the decade with 2028 forecast to see around 250 floating turbines installed.

There is, however, significant downside potential to floating wind installations with costs currently deterring investors, delayed fixed bottom projects taking priority and competition for the anchor handling tug supply (AHTS) vessels used to install the floating foundations currently heavily utilized in the oil & gas sector.

Vessel demand

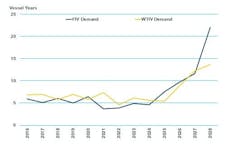

Demand for wind turbine installation vessels (WTIVs) typically offsets that for foundation installation vessel (FIV) demand by one year, due to the time required to install foundations before turbines can be erected. FIV and WTIV demand has been fairly consistent over the past eight years, varying between four and seven vessel years.

With turbine installations forecast to increase, we expect to see FIV demand reach over 22 vessel-years (a measure of the number of equivalent vessels operating during a given period) by 2028. WTIV demand will follow the same trend increasing to 14 vessel years by 2028 with a steeper increase expected in 2029.

SOV/CSOV (service operations vessel/commissioning service operations vessel) demand has seen a more gradual increase, typically increasing by 0-5 vessel years per year since 2016. 2024 demand is forecast to average circa 34 vessel years, a 12% year-over-year increase, by 2028 MSI forecasts SOV demand to reach 60 vessel years as larger wind projects come online.

Crew transfer vessel (CTV) demand is significantly higher than SOV/CSOV demand, with 2024 forecast to average 305 vessel years and reach 340 vessel years by 2028. Due to the short-term nature of CTV contracts, they can cover a number of projects in a short space of time and therefore year on year demand increases are less than we see for SOV/CSOVs.

The author

Todd Jensen is Senior Analyst–Offshore Energy Markets, MSI.

About the Author

Todd Jensen

Todd Jensen leads MSI’s offshore energy market analysis and has a focus on oil and gas field development projects, alongside offshore renewables. He is responsible for the maintenance and development of MSI’s proprietary offshore energy databases and sector models, while contributing to market reports and consultancy projects. Prior to working at MSI, Jensen worked as a research analyst for energy market intelligence companies Westwood Global Energy Group and Wood Mackenzie, covering upstream oil and gas and related oilfield services. He holds an MSci in geology from the University of Southampton.