Offshore wind developers, service groups under growing financial strain, report finds

Offshore staff

OSLO, Norway — Rising interest rates are putting pressure on the economics of new offshore wind projects. According to Rystad Energy, this is turning many schemes into a financial burden on developers’ balance sheets.

New projects require high up-front investment to secure development rights and sites and to then construct and install large turbines, with median rotor diameters now exceeding 150 m.

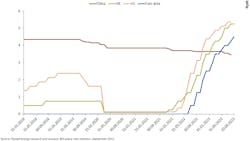

In Britain, the Bank of England has raised interest rates steadily since 2022 to the current level of 5.25%, while the European Central Bank increased its interest rate by 4.25% and then again to 4.5% earlier this month.

Rystad analyst Shradha Sood said 2022 was a lackluster year for new activity across Europe with no financial investment decisions taken for commercial offshore wind farms. Difficulties in obtaining financing and soaring service price inflation were big factors.

In July, Vattenfall halted development of its Norfolk Boreas project in the southern UK North Sea, blaming high interest rates and supply chain price inflation. The originally awarded strike price of £37.35/MWh ($45.7/MWh) in 2012 prices translates to about £47.2/MWh ($57.51/MWh) in current terms, and it was critical to Vattenfall’s decision as the project’s profitability had been adversely affected by high capital costs.

Orsted won the contract for difference (CfD) for its Hornsea 3 wind farm on the same terms as Norfolk Boreas and still has to take FID on the project, noting a risk that it may put the development on hold in the current economic climate.

In the US, developers have been seeking to renegotiate strike price agreements to cover growing costs of financing and components. Complicating factors include a shortage of key components, port infrastructure and Jones Act-compliant installation vessels.

While last year’s Inflation Reduction Act provides credits to offshore wind developers, conditions to receive these include wage and apprenticeship stipulations and domestic content requirements.

Costs of debt for service providers and equipment contractors is also increasing the strain on their profits. Day rates for wind turbine installation vessels may rise further as contractors pass on their increased cost of debt to developers.

Policy support and an overhaul of the auction mechanism will be needed to revive investments in offshore wind, Sood concluded.

09.22.2023