Asia emerging as offshore wind supply chain powerhouse

Editor's note: This story first appeared in the September-October 2022 issue of Offshore magazine's first annual Offshore Wind Special Report. Click here to view the full Offshore issue or click here to view the special report.

By Ruth Chen, Westwood Global Energy Group

Asian markets have some of the most ambitious offshore wind development targets, including Japan targeting 10 GW and South Korea 12 GW by 2030. To effectively construct and install such a large capacity of offshore wind projects requires a robust supply chain. While supply chains are at different levels of maturity across the region, they are marked by their growing self-sufficiency, localization as well as its potential to supply to the world.

Component level supply chain dynamics

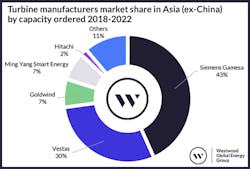

A combination of home-grown expertise as well as the localization of international contractors means Asia has the capability to supply a significant portion of its offshore wind components and installation needs. Of the top five turbine manufacturers in Asia (excluding China), three are Asia-based: Goldwind and Ming Yang Smart Energy with 7% of ordered capacity each and Hitachi with 2% in 2018-2022.

Mainland China boasts 17 home-grown offshore wind turbine manufacturers such as Goldwind and Shanghai Electric. Global turbine manufacturer Siemens Gamesa has set up an offshore wind regional hub in Taiwan as well as a nacelle assembly facility in Taichung port, the company’s first outside Europe.

Another global turbine manufacturer, Vestas, was selected for the Japanese government subsidy “Program for Promoting Investment in Japan to Strengthen Supply Chains.” Though recently cancelled, Vestas initially had plans to develop a local turbine nacelle facility. From this example, available government subsidies clearly encouraged the development of the local supply chain.

Nonetheless, despite government help, Vestas commented publicly that it is a challenge to cost efficiency, after initially pursuing plans to set up several manufacturing facilities within Asia (i.e., in Japan and South Korea, which are in close proximity) to meet local content requirements.

Local content

Asia’s offshore wind supply chain is characterized by local content policies, similar to those in countries such as the US and Poland.

At year-end 2021, Taiwan announced a localization policy for Phase 1 of Round 3 auctions for wind farms operational from 2026-2027, set at 60% local content with the remaining 40% on a bonus point mechanism for engineering service segments, which usually has limited local content. According to some quarters within Taiwan, this policy is setting back the progress in offshore wind development and needs to be reviewed.

Elsewhere in Asia, Japan also hopes to achieve 60% Japanese content by 2040, while South Korea has an informal preference for local contractors. It remains to be seen if these will limit the ambitious capacity goals.

Internationalizing Asian supply chain

Another key characteristic of Asian offshore wind supply chain providers is the degree of their internationalization. A recent example is Ocean Winds’ contracting China-based Dajin Heavy Industry for the supply of 48 XXL monopile foundations for the Moray West wind farm offshore Scotland.

Asian offshore wind supply chain providers do face challenges when competing globally. An Asian cable manufacturer, for instance, shared with Westwood that its pricing is not as competitive in Europe due to the expensive sea transportation costs. Strategic partnerships, however, may be a factor in winning tenders. In March 2022, TenneT awarded a consortium between Boskalis and China’s Orient Cable a cable contract for the Hollandse Kust West Alpha/Beta offshore substations.

Another Asian turbine manufacturer has developed long-term strategic plans is Ming Yang Smart Energy. Besides having supplied turbines for Renexia’s Taranto/Beleolico project off Italy, Ming Yang has just listed on the London Stock Exchange and plans to build manufacturing facilities in the UK.

Tremendous potential in Asia

There is tremendous potential in Asia’s offshore wind supply chain with $294 billion forecast EPCI spend from 2026 to 2030, of which $194 billion or 66% is to be spent on turbines. Much of this growth is coming from emerging markets like Japan, South Korea and Australia, besides more mature markets like Mainland China. This spells a promising future for Asia’s offshore wind supply chain, as long as they can navigate local content rules developing depth and maturity while hitting the ambitious targets set forth. Beyond Asia, the rest of the world’s offshore wind markets beckon.

Ruth Chen is a senior analyst with Westwood Global Energy Group.