Hydrogen uptake at risk of being too slow for energy transition, report says

Offshore staff

HOVIK, Norway – Hydrogen has a crucial role to play in decarbonizing the world’s energy system, but uptake will likely be too slow, according to a new report from DNV. In its Hydrogen Forecast to 2050, the classification society says that governments need to make “urgent, significant policy interventions.”

In Hydrogen Forecast to 2050, DNV predicts that the amount of hydrogen in the energy mix will be only 0.5% in 2030 and 5% in 2050. However, to meet the targets of the Paris Agreement, hydrogen uptake would need to triple to meet 15% of energy demand by mid-century.

According to the report, electricity-based green hydrogen – produced by splitting hydrogen from water using electrolysers – will be the dominant form of hydrogen produced by the middle of the century, accounting for 72% of output. But, the report says that this will require a surplus of renewable energy. To power an electrolyser capacity of 3,100 gigawatts, the report notes, would require more than twice the total installed generation capacity of solar and wind today.

Blue hydrogen – produced from natural gas with emissions captured – has a greater role to play in the shorter term (around 30% of total production in 2030), but its competitiveness will reduce as renewable energy capacity increases and prices drop.

Global spend on producing hydrogen for energy purposes from now until 2050 will be US$6.8 trillion, with an additional US$180 billion spent on hydrogen pipelines and US$530 billion on building and operating ammonia terminals, according to DNV’s forecasts.

Cost considerations will lead to more than 50% of hydrogen pipelines globally being repurposed from natural gas pipelines, as the cost to repurpose pipelines is expected to be just 10-35% of new construction costs. Hydrogen will be transported by pipelines up to medium distances within and between countries, but not between continents.

Global hydrogen trade will also be limited by the high cost of liquefying hydrogen for ship transport and the low energy density of hydrogen. The hydrogen derivative ammonia, which is more stable and can be more readily transported by ship, will be traded globally.

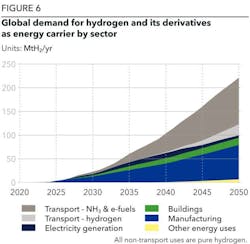

Early uptake of hydrogen will be led by hard-to-abate, high-heat manufacturing processes such as iron and steel production which currently use coal and natural gas. Hydrogen derivatives, such as ammonia and methanol, are key to decarbonizing heavy transport like shipping and aviation, but these fuels will not scale until the 2030s according to DNV’s forecasts.

Hydrogen will not see uptake in passenger vehicles, and only limited uptake in power generation. Hydrogen for heating of buildings will not scale globally, but will see early uptake in some regions that already have extensive gas infrastructure.

The uptake of hydrogen will differ significantly by region, heavily influenced by policy. Europe is the forerunner with hydrogen set to take 11% of the energy mix by 2050, as enabling policies both kickstart the scaling of hydrogen production and stimulate end-use. The OECD Pacific (hydrogen 8% of energy mix in 2050) and North America (7%) regions also have strategies, targets, and funding pushing the supply-side, but have lower carbon prices and less concrete targets and policies. Greater China (6%) follows on, recently providing more clarity on funding and hydrogen prospects towards 2035, coupled with an expanding national emissions trading scheme. These four regions will together consume two-thirds of global hydrogen demand for energy purposes by 2050, according to DNV projections.

06.14.2022