NOV enlisted for North Sea oil and gas electrification project

Offshore staff

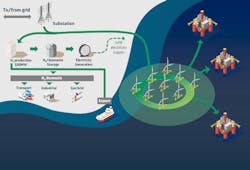

LONDON – Cerulean Winds has appointed NOV as the first of its delivery partners to fabricate a proposed 200-turbine floating wind/hydrogen development offshore Scotland.

NOV would serve as the exclusive provider of floating and mooring systems in support of the venture, which according to Cerulean, could accelerate decarbonization of oil and gas facilities in UK waters, by 2025 more than halving the 18 MM metric tons/yr (19.8 MM tons/yr) of CO2 they currently emit.

The company cited NOV’s two decades-plus of experience in the offshore wind sector as a provider of marine equipment and wind vessel designs, and with installation and maintenance of floating structures.

Cerulean founders Dan Jackson and Mark Dixon estimate the cost of their proposed project at £10 billion ($13.84 billion). Development would involve:

- Installation of more than 200 large floating turbines at sites west of Shetland and in the UK central North Sea with 3 GWh of capacity, supplying power to the offshore facilities and excess 1.5 GWh power to onshore green hydrogen plants

- Potentially electrifying the majority of current UK continental shelf facilities and potential future production from 2024, curtailing emissions above abatement targets

- Delivering 100% availability of green power to offshore platforms at a price below current gas turbine generation via a self-sustained scheme, with no upfront cost to operators

- Green hydrogen at scale and £1 billion ($1.38 billion) of hydrogen export potential

- No subsidies required, with hundreds of millions of pounds in revenue to the UK via leases and taxation through 2030 and beyond.

Cerulean has submitted a formal request to Marine Scotland for seabed leases. It is targeting an investment decision in 1Q 2022 and to start construction shortly afterwards so that the infrastructure can be in place by 2024-2026.

Jackson said: “If assets don’t reduce their CO2 emissions by the mid-2020s, increased emissions penalties through carbon taxes will see many North Sea fields become uneconomical and move them towards decommissioning by the end of the decade at the cost of thousands of jobs.

“This project will accelerate that process enabling assets to not only cut their emissions in line with targets but to greatly exceed them. There are no other proposals currently in the pipeline with the scale and capacity to deliver that result, but to achieve it, the process must begin now, which is why a favorable decision on seabed leases by 3Q 2021 is essential.”

06/30/2021