Integrated E&Ps accelerating offshore wind market share, report finds

Offshore staff

LONDON – A paradigm shift is occurring in the offshore energy industry with the recent surge in momentum to achieve net-zero emissions by 2050 having a profound impact on oil and gas company strategies, according to Westwood Energy subsidiary WindLogix.

Michelle Gomez, research manager, WindLogix, said European supermajors are at the forefront of this energy transition with the results of February’s UK seabed leasing auction a clear signal of intent. Of the 8 GW up for grabs, joint ventures including European supermajors were awarded 56%.

bp, in partnership with German utility EnBW, were a big winner, receiving the rights to 3 GW of this new capacity. This was preceded by bp’s first foray into the offshore wind market, the 50% acquisition of the Empire Wind and Beacon Wind prospects in the US from Equinor in September 2020. Combined, the Empire Wind 1, 2 and Beacon Wind 1 could add up to 1.7 GW of further generation capacity for bp.

Equinor has arguably led the pack. They entered 2021 with almost 400 MW of generation capacity at Sheringham Shoal, Dudgeon, and Hywind Scotland off the UK and Arkona offshore Germany. In addition to the US projects being developed with bp, Equinor is also investing heavily in Poland and South Korea with 2.4 GW of generation capacity being planned. The Norwegian E&P is also pioneering commercial scale floating wind with the 2019 sanction of the 88-MW Hywind Tampen development which will link to the Snorre and Gullfaks platforms in the North Sea.

Total has also been busy with the acquisition of a 23% interest from WPD in the 640-MW Yunlin development off Taiwan in April. This move builds on the French E&P’s 51% interest in the up to 1.5-GW Seagreen complex off the UK.

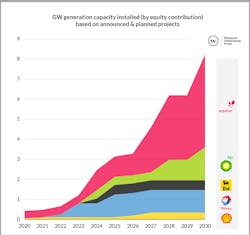

Currently, European supermajors are expected to increase their offshore wind generation capacity from around 400 MW in 2020 to 8,200 MW by 2030, Gomez claimed. Although this only accounts for 3% of WindLogix’s expected total installed capacity. This figure represents only current equity participation with significant potential for upside given the rapid momentum observed over the past 12 months.

According to Gomez, all eyes will be on the results of the upcoming ScotWind leasing round with a further 10 GW potentially up for grabs, and bp and EnBW hoping to enjoy similar levels of success.

05/24/2021