UK offshore sector needs collaboration to capitalize on renewable energy

Offshore staff

LONDON – Emerging technologies such as hydrogen production, carbon capture and underground storage, as well as offshore wind power are set for significant expansion across the UK continental shelf, according to Westwood Global Energy Group.

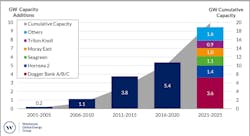

However, a successful transition will depend on collaboration between existing offshore oil and gas and new technologies, the consultant claimed. So far, the oil and gas and wind sectors have operated in relative isolation from one another despite the installation of 10 GW of offshore wind capacity throughout UK waters.

The situation is starting to change through the emergence of joint initiatives such as the ‘Energy Transition Alliance’ formed this summer by the Oil & Gas Technology Centre and Offshore Renewable Energy Catapult.

Areas of expertise where the oil and gas sector’s experience in offshore infrastructure might benefit offshore wind, according to David Linde, head of Energy Transition at Westwood, could be in foundations/structures, project management, vessel operations, working with moving cables, seabed survey/investigation, or Balance of Plant operations and maintenance.

Oilfield support/services specialists could also provide tugs, mooring systems, heavy lifting vessels and cabling, with the most likely synergies in floating wind, as this will require capabilities that many offshore wind players do not have.

But the oil and gas sector needs to understand how the offshore wind market functions, including the different tender processes, contracting terms, supplier relationships, and the focus on innovation combined with cost reduction.

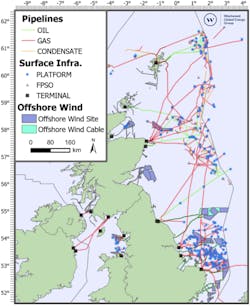

Potential exists for collaboration between the two sectors through oil and gas platform electrification and repurposing of existing infrastructure. Platform electrification could be supplied through renewable electricity generated by a nearby fixed or floating offshore wind farm, in place of gas and/or diesel power generation.

This could cut emissions from the platform and make available hydrocarbons that would previously have been consumed as fuel on the facility, thereby extending the field’s life.

However, offshore wind-generated electricity is variable, Linden pointed out, so backup is needed in the form of batteries, hydrogen fuel cells, or connection to the main grid.

And Equinor’s current 88-MW Hywind Tampen floating wind project, the first at an oil and gas complex in the North Sea, will only satisfy 35% of the annual power demand of the five Snorre and Gullfaks platforms.

Platforms nearer to land could make power-from-shore a more viable alternative to offshore wind, he added, while others may be too old to justify the investment required to sustain field life.

But oil and gas infrastructure can also be repurposed, mainly to support the development of green hydrogen generated by offshore wind.

At sea, hydrogen can be produced via electrolysis – either on a repurposed oil and gas platform, on a dedicated energy hub island (i.e. the North Sea Wind Power Hub), or directly from an electrolyser contained within an offshore wind turbine. It can then be re-delivered to shore through repurposed subsea gas pipelines.

Neptune Energy’s PosHYdon pilot project in the Dutch North Sea is one example, and similar projects are under consideration across the North Sea.

However, projects need to be considered in the context of market dynamics and the subsidy regime in the UK.

Joint developments with the oil and gas sector could either prove to be a benefit or hindrance to renewable projects. This would depend on the offshore wind capture price outlook (the average price achieved in the wholesale market when the wind blows), or the level of revenues already supported by a subsidy (such as the current Contact for Difference regime or Power Purchase Agreement).

11/17/2020