Crude oil production in the US Gulf expected to increase slightly over next two years

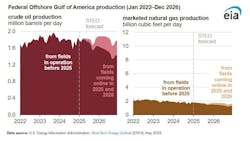

The US EIA is forecasting that crude oil production on the US outer continental shelf will average 1.80 million barrels per day (b/d) in 2025 and 1.81 million b/d in 2026, compared with 1.77 million b/d in 2024.

The EIA offered these projections based on its most recent Short-Term Energy Outlook, issued on May 6, 2025.

At the same time, the EIA expects that natural gas production on the US OCS will experience slight but consistent declines. The EIA projects that natural gas production on the US OCS will average 1.72 billion cubic feet per day (Bcf/d) in 2025 and 1.64 Bcf/d in 2026, compared with 1.79 Bcf/d in 2024.

At these volumes, the US Gulf is forecast to contribute about 13% of US crude oil production and 1% of US marketed natural gas production in 2025 and 2026.

The EIA also said that it expects operators to start crude oil and natural gas production at 13 fields in the Gulf during 2025 and 2026, “without which GOA [Gulf of America] production would decline,” the agency wrote.

Eight fields will be developed using subsea tiebacks or underwater extensions to existing floating production units (FPUs) at the surface. Five fields will produce from four new FPUs, with one of the new FPUs (Salamanca FPU) targeting production from two fields.

The EIA also said that it expects that the additional crude oil production from all new fields will contribute 85,000 b/d in 2025 and 308,000 b/d in 2026. The agency expects that associated natural gas production from the new fields will average 0.09 Bcf/d in 2025 and 0.27 Bcf/d in 2026.

The EIA noted that three Gulf fields began producing earlier this year:

- Whale, one of the largest fields expected to come online in 2025 and 2026, started producing in January 2025 from a new FPU of the same name. The Whale FPU, located in more than 8,600 feet of water, is expected to produce around 85,000 b/d of crude oil at its peak.

- The Ballymore field started production in April 2025 as a subsea tieback to the existing Blind Faith facility, and it is expected to produce 75,000 b/d from the Ballymore wells in the emerging Upper Jurassic/Norphlet play.

- The Dover field also started production in April as a subsea tieback to the existing Appomattox facility with expected peak production of around 15,000 b/d.

Production coming online in the second half of 2025 is expected to include the following:

- The Shenandoah field, which will produce from an FPU of the same name, is scheduled to start production in June 2025 with an initial capacity of 120,000 b/d, which will be expanded to 140,000 b/d in early 2026. The Shenandoah Phase 1 development will use new technologies to produce from a deepwater high-pressure field.

- The Leon and Castile fields, which will produce to the Salamanca FPU, are expected to come online in the second half of 2025. The Salamanca project involved refurbishing a previously decommissioned production facility and it has a capacity of 60,000 b/d of oil and 40 million cubic feet per day of natural gas.

The EIA also said that it expects other subsea tiebacks to existing facilities to enter production in late 2025, including Katmai West, Sunspear, Argos Southwest Extension, and Zephyrus Phase 1.

Three new subsea tiebacks are expected to begin production in 2026. They include Silvertip Phase 3, Longclaw, and Monument, which will be a subsea tieback to the Shenandoah FPU.