US Gulf of Mexico deepwater discoveries survey shows another lean year

Key Highlights

- Only three deepwater discoveries were announced in the Gulf of Mexico in 2025, indicating another year of subdued exploration activity.

- Key discoveries include bp's Far South, Talos Energy's Daenerys, and INEOS's Nashville.

- Drilling activity in 2025 focused on high-pressure Miocene and Wilcox plays, and the high-temperature Norphlet play.

By Bruce Beaubouef, Managing Editor

The past twelve months have been a lean time for new oil and gas discoveries in the US Gulf of Mexico, with only three confirmed deepwater discoveries in the Gulf in 2025.

This equaled the number of deepwater discoveries seen in 2024, but contrasts significantly with the eight new discoveries in the deepwater Gulf of Mexico in 2023.

The discovery counts are based on public announcements from BOEM/BSEE-aligned reports, operator releases, and industry analyses. Private or non-public finds may exist but are not included.

These numbers can be seen as a significant decline, depending on the comparison year. For example, if one reviews the numbers seen roughly 20 years ago, there were nine recorded discoveries in 2005, and there were 12 discoveries announced in the deepwater GoM in 2004.

This continues the recent trend of subdued exploration, with drilling activity focusing on high-pressure Miocene and Wilcox plays, and the high-temperature Norphlet play, with operators emphasizing appraisal drilling and possible tiebacks to existing infrastructure.

One publicly announced discovery in 2025 came in April, when bp reported a new oil discovery at its Far South prospect in the western Green Canyon area. The company drilled the exploration well in Green Canyon Block 584, approximately 120 miles off the coast of Louisiana in 4,092 ft of water. The well was drilled to a total depth of 23,830 ft.

The Far South field is located four miles north of the Constellation field in the deepwater Gulf. The Far South co-owners are bp (operator, 57.5%) and Chevron U.S.A. Inc. (42.5%).

Both the initial well and a subsequent sidetrack encountered oil in high-quality Miocene reservoirs. Preliminary data supports a potentially commercial volume of hydrocarbons.

Andy Krieger, senior vice president, Gulf of America and Canada, said: “This Far South discovery demonstrates that the Gulf of America remains an area of incredible growth and opportunity for bp. Our Gulf of America business is central to bp’s strategy. We are focused on delivering more affordable and reliable energy from this region, building our capacity to over 400,000 barrels of oil equivalent per day by the end of the decade.”

Then in August of last year, Talos Energy announced what it described as “an important discovery” with its Daenerys exploration well in Walker Ridge blocks 106, 107, 150 and 151.

The company called the discovery as “a promising development for the US Gulf of Mexico, potentially involving nearby assets like Oxy’s Heidelberg.”

The deepwater drillship West Vela drilled the well to a TVD of 33,228 ft, with the well delivering oil pay in multiple “high-quality,” subsalt Miocene sands, according to an Aug. 19 Talos Energy report.

Drilling was completed 12 days ahead of schedule and about $16 million below budget, Talos said, with the well since temporarily suspended to preserve its integrity for future operations.

A wireline program during drilling involved acquiring core, fluid and log data to evaluate the reservoir. Talos has already begun planning for an appraisal well in 2Q 2026 to further delineate the find.

The company added that as operator of the well, it will hold a 27% interest in partnership with Shell Offshore (22.5%), Red Willow (22.5%), Houston Energy (10%), Cathexis (9%) and HEQ II Daenerys (9%).

Talos President and CEO Paul Goodfellow said that the results validated geologic and geophysical models, and they appear to support the pre-drill resource assessment, which was previously reported at 100 MMbbl to 300 MMbbl.

Then, just before the end of year, INEOS Energy announced a new oil discovery in the Norphlet play in the Mississippi Canyon area.

The Shell-operated well, Nashville, is located in Mississippi Canyon block 524 in a water depth of 7,381 feet. It marks INEOS' first successful exploration well in the region.

The Nashville exploration well was drilled more than five miles beneath the seabed and confirmed what INEOS describes as “high-quality oil in one of the Gulf’s most promising deepwater formations.”

The Norphlet play has been one of the hottest in the deepwater Gulf in recent years, containing prolific sand reservoirs. The discovery could be tied back to the nearby Appomattox production platform, which is operated by Shell and jointly owned with INEOS.

The Nashville discovery could be tied back to the nearby Appomattox production platform, which is operated by Shell and jointly owned with INEOS.

David Bucknall, CEO of INEOS Energy, said: “This is a good result for INEOS Energy and an important step in building our presence in the US Gulf where world-class resources are to be found and developed responsibly. We believe Nashville will help strengthen energy security and provide reliable supplies for many years to come.”

INEOS said that the discovery was drilled by the Deepwater Proteus, a seventh-generation ultra-deepwater drillship owned and operated by Transocean and designed for water depths down to 12,000 feet (3,658 meters).

Further technical work is now under way to determine the size of the find.

Heather Osecki, CEO of INEOS Energy’s US Gulf business, said: “The drilling results at Nashville are very encouraging and fully in line with what we hoped to find. This discovery is an important first step in our plans to grow our existing assets while we look to further strengthen our position in the Gulf. We look forward to continuing our work to bring further value to the Appomattox host platform.”

INEOS holds a 21% working interest with Shell, the operator, holding the remaining 79%.

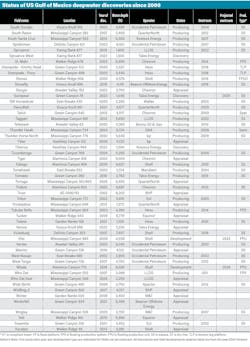

For more information on these and other past discovery wells, please see the “Status of US Gulf of Mexico deepwater discoveries since 2000” survey in the tables below.

About the Author

Bruce Beaubouef

Managing Editor

Bruce Beaubouef is Managing Editor for Offshore magazine. In that capacity, he plans and oversees content for the magazine; writes features on technologies and trends for the magazine; writes news updates for the website; creates and moderates topical webinars; and creates videos that focus on offshore oil and gas and renewable energies. Beaubouef has been in the oil and gas trade media for 25 years, starting out as Editor of Hart’s Pipeline Digest in 1998. From there, he went on to serve as Associate Editor for Pipe Line and Gas Industry for Gulf Publishing for four years before rejoining Hart Publications as Editor of PipeLine and Gas Technology in 2003. He joined Offshore magazine as Managing Editor in 2010, at that time owned by PennWell Corp. Beaubouef earned his Ph.D. at the University of Houston in 1997, and his dissertation was published in book form by Texas A&M University Press in September 2007 as The Strategic Petroleum Reserve: U.S. Energy Security and Oil Politics, 1975-2005.