Future lease sales may include more offshore carbon capture bids

In January 2021 federal offshore lease sales in the Gulf of Mexico were suspended by executive order, effectively creating a leasing moratorium that hearkened back to the drilling moratorium of 2010. The court-ordered Lease Sale 257, which took place last month, effectively ended the moratorium, at least as far as we can tell. But perhaps the most interesting thing about Lease Sale 257 is that it can be considered the first time that an oil producer, namely ExxonMobil in this case, acquired offshore blocks for the purpose of offshore carbon capture and storage (OCCS) activities.

For context, the leasing moratorium was put in place by an executive order from President Biden in January. And it was not a coincidence that shortly after that, the US rejoined the Paris Agreement, thereby affirming its pledge to environmental protection and the energy transition. It is further worth noting that the concept of OCCS has received support from the United Nations, the organizing body of the 2015 Paris Agreement. As such, it may perhaps be considered ironic that the US energy transition and decarbonization efforts may have converged with Lease Sale 257 which, of course, was created for the purpose of offshore hydrocarbon production.

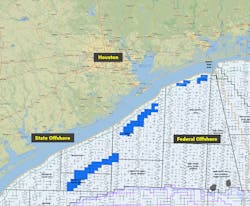

Notably, the blocks related to the area that ExxonMobil placed bids on (see the “blue blocks” in Figure 1) are considered to be in shallow water, an area that had scant interest during the lease sales of 2020. Importantly, over 90% of US offshore production takes place in deepwater, per BSEE’s 2020 released data. The fact that ExxonMobil’s blocks are not in deepwater suggests that the company has another purpose for them. Looking at the map, one can further easily note that these “blue blocks” are near the company’s flagship Houston Ship Channel endeavor. With this project, ExxonMobil says that it intends to decarbonize industrial sources by sequestering captured CO2 in offshore reservoirs via underwater pipelines. It seems likely that future OCS lease sales will include more bids focused sequestration.

OCCS trends

OCCS projects are not a new idea, and ExxonMobil has experience in this area. Notably, it joined with Equinor on the Sleipner project in 1996. There, over 19 million tons of CO2 have been permanently sequestered in subsea reservoirs offshore Norway. This sequestration experience no doubt bolsters ExxonMobil’s readiness to deploy and execute OCCS projects in the Gulf of Mexico.

The recently formed joint venture between Talos Energy and Carbonvert is a further testament to the growth of the OCCS market in the Gulf. In August, the joint venture acquired 40,000 acres in Texas state waters near Beaumont/Port Arthur in Jefferson County, for the purpose of carbon sequestration. Interestingly, the offshore blocks acquired by ExxonMobil lie in close proximity to the acreage acquired by the Talos Energy/Carbonvert venture.

In addition, just days prior to Lease Sale 257, Talos Energy and Storegga announced their intentions to sequester CO2 from Freeport LNG’s facility into reservoirs in the Gulf. (This author described emerging UK-US OCCS collaboration here). This effort is separate from and in addition to the Talos Energy/Carbonvert joint venture. Tim Duncan, CEO of Talos Energy, has pointed out that his company’s collaboration with Freeport LNG “is complementary to our larger hub-based project in Jefferson County.”

Moreover, it has been shown that an onshore LNG facility can successfully utilize offshore reservoirs for sequestration, as was realized by Equinor in Norwegian waters via an 88-mile subsea pipeline at Snøhvit.

Federal vs state waters

There is of course a key distinction between federal and state waters, and it will be interesting to see whether OCCS blooms in state or federal waters. The Talos Energy/Carbonvert venture opted for Texas state waters, while ExxonMobil is targeting federal shallow-water areas offshore Texas. The leasing moratorium that took place this year may not augur well for future OCCS projects in federal waters – a point that would be ironic, given that the moratorium was ostensibly designed to protect the environment. But companies investing millions of dollars in OCCS projects may not wish to have those projects be subject to the disposition of changing presidential administrations and shifting political sentiment. For example, the Talos Energy/Carbonvert joint venture was able to obtain acreage in (Texas) state waters even while the federal leasing moratorium was ongoing.

It should be noted that the Submerged Lands Act (SLA) of 1953 ratified the different jurisdictions between state and federal waters, and gave the US executive branch regulatory authority over the latter. The legislation also limited state waters to just a few nautical miles, with the federal government having jurisdiction over the vast remaining portion of national waters. Obtaining acreage in state waters may be preferable for OCCS activities, in that it constrains the ability of the federal government to intervene, one way or another. However, there is a significant downside to acquiring acreage in state waters, since these areas are typically limited to a few nautical miles.

A new emerging marketplace

The US is on the cusp of realizing an offshore sequestration marketplace. This was bolstered by the recently passed infrastructure bill, which pledges to support companies that sequester CO2. To be sure, potential sequestration projects in the US Gulf are likely to also require tax credits such as those that can be found in section 45Q of the IRS tax code. From a feasibility standpoint, there is precedent for subsea carbon storage, and the US Gulf of Mexico has a long history of technological and business innovation. It must be noted that should support from government be withdrawn, the viability of this marketplace could be called into question. In the context of these trends and parameters, it will be interesting to see how many additional energy companies enter this space.