Shenandoah gets the go-ahead in the deepwater Gulf of Mexico

Offshore staff

STEINHAUSEN, Switzerland – Beacon Offshore Energy (BOE) has awarded Transocean Ltd. a $252-million firm contract for the newbuild ultra-deepwater drillship Deepwater Atlas to work at the Shenandoah field in the Gulf of Mexico.

This award results from Beacon and its partners taking the final investment decision (FID) to sanction the Shenandoah project, the drilling contractor said. Partner Navitas Petroleum has confirmed the project’s sanction.

Shenandoah is 160 mi (257 km) offshore Louisiana in Walker Ridge blocks 51, 52, and 53.

According to Transocean, the Shenandoah program comprises two phases. Once delivered from Jurong Shipyard, the Deepwater Atlas is expected to start operations in 3Q 2022, initially using dual BOPs rated to 15,000 psi. The initial drilling program is expected to last about 255 days.

Then a 20,000-psi BOP will be installed on the rig, making it Transocean’s second asset with a 20,000 psi-rated well control system. The BOP installation and commissioning is expected to last 45 to 60 days. The Deepwater Atlas will then start the second phase of the project – the well completion program. This phase is expected to last about 275 days.

Transocean President and CEO Jeremy Thigpen said: “This is a significant milestone for Transocean, BOE and the Shenandoah partners, as we jointly venture into this new frontier of ultra-deepwater drilling.”

Thigpen also said: “We are extremely pleased to have secured the maiden contract for the Deepwater Atlas; the first of our two 8th generation ultra-deepwater drillships that will enter the market in 2022, both of which will be outfitted for 20,000-psi ultra-deepwater well operations.”

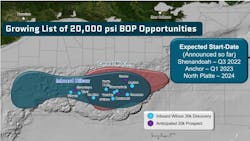

Thigpen concluded: “We are very encouraged by the growing list, across multiple customers, of 20,000-psi opportunities in the US Gulf of Mexico…”

Mfon Usoro, senior research analyst at Wood Mackenzie, said: “After years of research and development, 20-kpsi technology is taking huge leaps in the US Gulf of Mexico.”

In 2019, Chevron sanctioned Anchor, the Gulf of Mexico’s first ultra-high-pressure field.

Usoro said that Shenandoah will transform Beacon’s portfolio in the Gulf of Mexico. She claimed production from Shenandoah is expected to catapult the company from being the 20th to the 10th-largest producer in the region.

She added: “The Shenandoah joint venture secured funds to the tune of $900 million for the first phase of development, highlighting our view that even with net-zero goals, both oil and gas companies and the global capital market still see value in high-return, low-emission oil and gas projects.”

Wood Mackenzie estimates a rate of return for Shenandoah at 37%, she said.

Developing Shenandoah will be challenging, Usoro warned, as deploying a new technology carries a higher risk. “Although the company has safely and successfully drilled subsalt Miocene-aged wells,” she said, “it has not drilled any Paleogene-aged wells. All eyes will be on Beacon as it executes the 20-kpsi project. We have seen other smaller companies like LLOG take on successful Paleogene projects including Buckskin.”

However, this project sanction unlocks growth opportunities in the Gulf of Mexico, according to Usoro. “The arrival of the Shenandoah semisubmersible facility will breathe life to the western Walker Ridge area. Three discoveries with combined reserves in excess of 300 MMboe – Yucatan, Coronado, and Monument – now have a higher chance of commerciality,” she said.

The US Gulf of Mexico remains an attractive basin for investment, she concluded, as the North Platte and Leon/Moccasin greenfield projects could also achieve FID in 2021.

08/26/2021