NOD predicts steady lower exploration levels offshore Norway in 2026

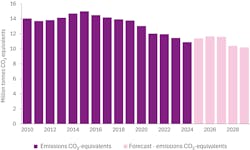

Investments in E&P across the Norwegian Continental Shelf this year should total about NOK256 billion ($25.37 billion), down 6.5% on 2025, said the Norwegian Offshore Directorate (NOD) in its annual review of the sector.

Investment will likely continue to decline steadily over the period to 2030.

The main cause is the gradual completion and start-up of various major ongoing offshore development projects, as these will not be replaced by other new projects of an equivalent scope.

Largest discoveries still awaiting development are Wisting in the Barents Sea, Linnorm in the Norwegian Sea, and Peon in the North Sea.

Another factor in the projected spending dip is the suspension of certain planned projects aimed at transitioning existing production facilities to power from shore, due to profitability concerns.

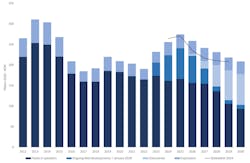

For 2026, the NOD expects around 40 exploration wells, comprising 28–32 in the North Sea, four to six in the Norwegian Sea, and four to six in the Barents Sea.

Last year’s tally of 49 exploration wells completed was the highest across the shelf in the past decade, aside from 2021, and yielded 21 discoveries. The Directorate estimates the combined recoverable reserves at 424 MMboe, with liquids far outstripping the new gas volumes proven.

Stand-out discoveries were Aker BP’s Omega Alfa exploration campaign, which delivered oil in four wellbores close to the Yggdrasil development in the North Sea; the Lofn/Langemann gas/condensate discoveries in the North Sea; and the Kjøttkake oil and gas find, again in the North Sea.

Technological highlights included drilling of two ultra-long wellbores.

The Omega Alfa 24/1-14 C wellbore, at 10.7 km, was the longest drilled to date on the NCS.

OKEA’s Talisker (31/4-A-15 B) on the Brage field, at 10.2 km, was one of the sector’s longest-ever exploratory wells. These results demonstrate how drilling advances are increasing flexibility in exploration, the Directorate said, providing the opportunity to test multiple targets in a single well.

Over the last two years, there has also been a strong focus on improving recovery in tight reservoirs. Producing large volumes of oil and gas from these reservoirs will only be possible with new technology and cost reductions, the NOD added, helped by close co-operation between the sector’s main players.

The Directorate highlighted the following solutions for tight reservoirs offshore Norway:

- Dynamic fracturing: Fracturing the reservoir rock and keeping the fractures open by filling them with sand, helping the oil and gas flow more easily into the well.

- Low-cost drilling: Drilling wells using a continuous length of flexible pipe spooled off a drum, particularly profitable for smaller accumulations.

- Controlled acid jetting to increase productivity in long horizontal wells.

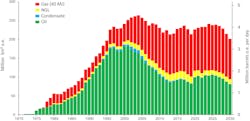

Norway’s total oil production of about 106 MMcm last year was the highest since 2009.

The Equinor-operated Johan Sverdrup field in the North Sea accounted for almost 40% and will continue to generate large volumes of oil, with further development of the field under way.

Johan Castberg in the Barents Sea, which went onstream, was another major oil producer, reaching peak output last summer. Plateau production should continue for several more years.

Other field start-ups in 2025 were at Halten Øst and Verdande in the Norwegian Sea, with no existing fields shut down.

About the Author

Jeremy Beckman

Editor, Europe

Jeremy Beckman has been Editor Europe, Offshore since 1992. Prior to joining Offshore he was a freelance journalist for eight years, working for a variety of electronics, computing and scientific journals in the UK. He regularly writes news columns on trends and events both in the NW Europe offshore region and globally. He also writes features on developments and technology in exploration and production.