Parkmead drops North Sea Perth oil project

Offshore staff

ABERDEEN, UK – Parkmead Energy has decided not to pursue its oil development in the Perth Area in the UK central North Sea, citing high costs and a negative environment for investors following the UK government’s recent petroleum tax increases.

Over the past few years, the company had been working to resolve the complex issues associated with the development, including problems handling sour gas and offtake through nearby ageing offshore infrastructure.

Its team had undertaken transportation, engineering and processing studies and engaged in commercial negotiations with infrastructure owners including INEOS and the Scott Area partners.

The company had taken heart from positive initial conclusions from a net-zero feasibility study, conducted with CNOOC and Worley; this demonstrated the technical feasibility of using the Scott platform for reinjection of the associated sour gas into a nearby depleted reservoir.

However, the mounting development capital costs for Perth, including the additional costs of achieving the UK government’s net-zero requirements, had soared to almost $1 billion.

According to Parkmead, this appeared to be a technically sound central North Sea development that could have produced significant oil volumes for the UK.

In addition, the company had held discussions with numerous oil and gas companies active nearby and with the North Sea Transition Authority on extending the licenses to provide more time for submitting a revised concept select report, following completion of the net-zero studies. And it initiated a farm-out process that drew interest from multiple parties.

But there were also concerns over the longevity of potential nearby host infrastructure, the inability to pursue a standalone FPSO development option under the net-zero stipulations, and the impact of last year’s two sets of fiscal changes via the Energy Profits Levy.

These collectively undermined both project economics and the usual risk-reward equation associated with making major offshore oil and gas field investment decisions, Parkmead said.

At the same time, the lack of public and political support for new oil projects in the North Sea had engendered a cautious and conditional approach from the industry during partnering discussions. The company concluded it would not be practical to progress the Perth development to FID, particularly in light of the high level of capital investment required.

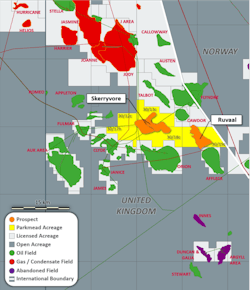

Parkmead added that it would not now seek an extension of the P588 and P2154 licenses containing the Perth discovery. Instead, it plans to focus on simpler and lower-cost UK North Sea projects such as Skerryvore.

06.30.2023