North Sea capex, exploration spending set to grow over next few years

Editor's note: This story first appeared in the July-August 2022 issue of Offshore magazine. Click here to view the full issue.

Olga Savenkova, Jack Baxter, and Emil Varre Sandøy * Rystad Energy

Both the UK and Norway have recovered from the historic investment lows seen in 2021 but, despite the two countries sharing a continental shelf boundary, the investment outlook in each shows some significant differences. The next few years will see a positive trend in investment on both the Norwegian Continental Shelf (NCS) and the UK Continental Shelf (UKCS), with capital expenditure (capex) and exploration expenditure (expex) set to grow from $28 billion in 2022 to $32 billion by 2025 across both combined. On the NCS, however, spending will total $87 billion between 2022 and 2025, while $30 billion is expected on the UKCS over the same period. In terms of exploration wells, 57 wildcats are set to be drilled this year off both countries combined, with 44 set to be completed on the NCS and 13 on the UKCS.

NCS upstream outlook

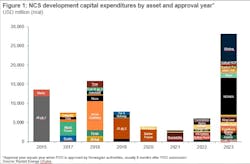

Even though they will still be significantly lower than pre-2015 levels, investments on the NCS are expected to remain fairly high towards 2025, primarily driven by spending on new development projects sanctioned under Norway’s beneficial temporary tax regime. This was introduced in June 2020 to incentivize upstream activity in Norway following the initial impacts of the COVID-19 pandemic and a price war in the first half of 2020. The scheme offers beneficial terms for the development phase of projects sanctioned under the regime.

To qualify for the temporary regime, developers must submit a plan for development and operation (PDO) by the end of 2022. This is likely to result in a record-high sanctioning of Norwegian upstream projects in 2022. Figure 1 shows the sum of the associated development capex for the projects grouped by the year in which project PDOs have been approved, which typically happens six months after PDO submission. We expect a total $28 billion worth of investments to be sanctioned by end-2022 and approved in 2023. This represents a new all-time sanctioning high for the NCS and a 50% increase on the previous high in 2012 which totaled $19 billion. The current project list is dominated by small tieback projects, either subsea tiebacks or wellhead platforms, with short lead times, limited investments and located near existing production hubs. Some mid-sized projects also feature, but the only truly large developments in the pipeline are the Equinor-operated Wisting project in the Barents Sea and the NOAKA project operated by Aker BP in the North Sea. The spending related to all the projects will primarily take place in the coming years, driving the investment trend on the NCS.

UKCS upstream outlook

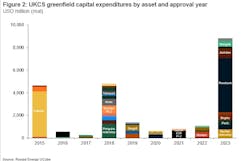

Capital investment in the UK will be far smaller, with combined greenfield and brownfield spend totaling $28 billion between 2022-2025, with many new projects hailing from small independents typically focused on niche or late-life developments. While investments will steadily increase year-on-year, spending is not set to reach pre-pandemic levels until 2025.

Approximately $10 billion worth of projects are expected to be sanctioned over the 2022-2023 timeframe, with those such as Rosebank (Shell), Jackdaw (Shell), Nailsworth (IOG) and Murlach (BP) set for sanctioning next year. Beyond 2023, there is also potential for Cambo to reach a final investment decision (FID) after a series of setbacks, with the North Sea Transition Authority (NSTA) extending the license by two years in March 2022. Soon after, Ithaca Energy announced its acquisition of Siccar Point Energy, and thence an operating stake in Cambo and a non-operating stake in Rosebank. Ithaca highlights both Rosebank and Cambo as the “most strategically important discoveries in the UK North Sea”, making the case that, if “operated without the need for routine flaring or venting of hydrocarbons”, they would be important stepping-stones in the UKCS’ journey through the energy transition and towards improved energy security.

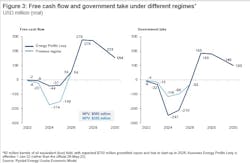

In May 2022, the UK government announced a windfall tax, called the Energy Profits Levy, on UKCS producers. The levy represents an additional 25% tax on top of the previous headline tax rate of 40%, which is comprised of 30% corporate tax and a 10% supplementary charge. Several companies on the UKCS, especially those with portfolios weighted towards cash-generating producing assets, have expressed concern that a switch up to the fiscal regime will threaten future investment at a time when the UK government hopes to improve energy security by boosting domestic supply. However, the UK government has tacked on a new Investment Allowance to the levy, incentivizing companies to invest in projects by offering significant cost relief. The new allowance has the potential to fast-track several ‘development ready’ projects on the UKCS and improve the economics of many pre-development assets if companies are willing to commit capital prior to the end of the Energy Profits Levy (set to end in 2025 at the latest). Figure 3 shows the potential improvement in economics to a 60 million barrel of oil equivalent (mmboe) field, with an expected $700 million in greenfield capex investment and due to start-up in 2026.

Decarbonization trends

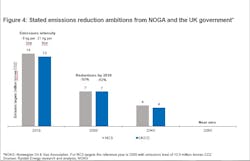

Moving on to decarbonization trends, we see that European companies are leading in this space with ambitious emissions reduction targets announced so far, including aspirations to become net zero companies by 2050 or sooner. North Sea-focused players are now implicitly committed to reaching net zero since the target was first enshrined by regional regulatory authorities overseeing both the NCS and UKCS. Figure 4 shows the upstream reduction targets that both regions have pledged to. The plan is to reduce emissions to 50% by 2030 and to become net zero by 2050. Even though the regional targets seem largely aligned, due to far lower production on the UKCS, emissions intensity there is much higher, which means that Norwegian players have already made substantial efforts to decarbonize on the supply side. For example, there are currently nine fields partly or fully electrified and another 20 fields with sanctioned electrification projects.

By contrast, the UKCS is lagging in the area of decarbonization. The impetus for change is enshrined in the North Sea Transition deal agreed between industry and the UK government in March 2021. However, a year later, little progress has been made with the realities and complexities of delivering on the task, apparent in a study undertaken by the Orcadian consortium, one of three winners of the North Sea Transition Authority’s Electrification Competition in September. The study designed and described a viable, reliable, off-grid option for powering North Sea platforms, a concept which has been delivered to the NSTA and operators of facilities in the Central North Sea.

With three to four years of planning, platform modification and installation, and only eight years left until the 2030 deadline, time is of the essence. The largest sources of upstream emissions in the North Sea (88% of total upstream emissions) come from hydrocarbon-fueled electricity generation, process heat generation and direct powering of gas compression and pump systems, known collectively as extraction emissions. For the UKCS to achieve its emissions reduction targets, it will ultimately require a step change in performance by focusing on reducing or removing extraction emissions. Abatement options under consideration include full or partial electrification of offshore assets via connection to onshore power networks in the UK or Norway. This could also potentially include linking to offshore renewables and the creation of integrated energy hubs and provide significant synergy for other offshore sectors such as offshore wind development and green hydrogen through the energy hubs they create and infrastructure they provide.

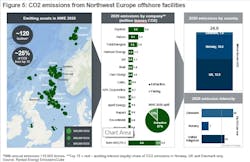

Figure 5 shows the majority of emitting upstream assets in 2020 in the North Sea. About 120 of the facilities emitted more than 10,000 tonnes of CO2 in 2020, with the 10 largest accounting for more than a quarter of total upstream emissions in the region. The top 25 emitting assets were responsible for half of total emissions from Northwest Europe’s upstream sector. There are plans for several of these facilities to be powered from onshore renewables or other low-emission sources in the short term, a move that should significantly reduce their emissions.

In total, the region’s upstream sector emitted roughly 24 million tonnes of CO2 in 2020, mostly related to the extraction process with under 15% from flaring. The emissions are calculated based on working interest holdings in the various fields (equity view). The top 15 companies together represented more than 70% of the region’s upstream emissions in 2020, with another 70 or so companies accounting for the remaining 6.9 million tonnes. Collectively, the latter group emitted less than 500,000 tonnes of CO2 individually, less than the UK North Sea’s Ninian Central Platform. At the other end of the scale, it is worth noting that the region’s top emitters – Equinor, Petoro and TotalEnergies – all have much lower production intensities than the global average of 18 kilograms (kg) of CO2 emitted per boe produced, at around 7 kg/boe for Equinor, 6 kg/boe for Petoro and 13 kg CO2 for TotalEnergies in 2020.

Emissions intensity varies significantly by country, with Norway leading with an emission intensity of just under 7 kg/boe, significantly below the global average of 18 kg/boe. This is primarily driven by a ban on routine flaring, a strict CO2 tax regime and the electrification of large platforms. The UKCS is significantly more mature than Norway with an emissions intensity of between 21-22 kg/boe, slightly above the global average – which is also partly due to the UK being more dominated by liquids production (as opposed to gas). The trend in recent years has been quite positive for the UKCS, especially on the flaring side, with an overall decrease in intensity just shy of 10%.

Upstream emissions from mature UKCS producing assets are hard-to-abate emissions and require substantial facility improvements and investments to achieve emission reduction targets. However, it is still achievable if timely actions for platform electrification are undertaken. It is probable that with North Sea Transition Deal targets in place, plans to electrify platforms should move forward from long lasting conceptual studies to actual project realization. The West of Shetland area’s green electrification and Buchan Area’s electrification projects may be prioritized since these areas include significant projects at pre-FID stage (Cambo, Rosebank and Buchan redevelopment). Green electrification may be crucial for these projects to go ahead given that emissions intensity is likely to be a crucial factor for companies in determining whether to proceed.

The authors

About the Author

Olga Savenkova

Olga Savenkova is a senior analyst on the Global E&P team at Rystad Energy, responsible for coverage of UKCS operations and the analysis of global oil and gas investments trends. Prior to joining Rystad Energy, Olga worked as a risk manager and strategy consultant in both the upstream and downstream sectors for one of the largest vertically integrated oil and gas companies in Russia. She holds an MSc in Energy Economics from the State Polytechnic University in Saint Petersburg.

Jack Baxter

Jack Baxter is an analyst in the Upstream E&P team at Rystad Energy, responsible for coverage of United Kingdom Continental Shelf operations. Prior to joining Rystad Energy, Jack worked as an Analyst at Westwood Global Energy Group. He holds an MSc in Petroleum Geoscience from Royal Holloway University, UK.

Emil Varre Sandøy

Emil Varre Sandøy is a Vice President on Rystad Energy’s Upstream Research team specializing on the Norwegian Continental Shelf. His main responsibilities include analytical coverage of the upstream operations on the Norwegian Continental Shelf and company coverage in this geographical area, together with global upstream industry expertise. He holds an MSc in Economics and Business Administration from The Norwegian School of Economics.