North Sea deal targets may require further industry actions

Offshore staff

LONDON – Wood Mackenzie has identified various issue concerning the recent North Sea Transition deal between the UK government and Britain’s oil and gas sector, aimed at helping the UK North Sea reach net zero by 2050.

There are four main pillars:

- Supply de-carbonization: reduce emissions from oil and gas production by 50% by 2030

- Carbon capture and storage (CCS): 10 MMt/yr of carbon capture by 2030

- Hydrogen: 5 GW of low-carbon hydrogen capacity by 2030

- Supply chain/people: investment of £14-16 billion ($19-22 billion) into low-carbon technology by 2030.

All the targets are supported by measures including pledged sector and government funding, policy and regulatory development, and assistance for research and action plans.

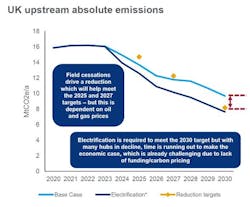

Neivan Boroujerdi, principal analyst, Europe upstream, at Wood Mackenzie, said: “Achieving 50% lower emissions by 2030 will require either full electrification of the west of Shetland and central North Sea or earlier-than-expected field cessations.”

Wood Mackenzie’s research also suggest that the lack of near-term projects will make achieving the hydrogen target of 5 GW by 2030 problematic.

And while the CCS capacity target of 10 MM metric tons (11 MM tons) per annum could be realized based on planned projects, there are other hurdles to overcome before final investment decisions can be taken.

“Progress is required around funding, carbon pricing, and regulation to really kick-start investment and turn the deal into a reality,” Boroujerdi said.

“The UK has an opportunity to set its own path with carbon pricing as current EU area prices are not high enough to incentivize low-carbon energies. COP26 is likely to come with even more ambitious long-term proposals, but our analysis shows action is required in the short term.”

Wood Mackenzie’s base-case forecast of emissions intensity is below the government’s supply decarbonization target of 50% lower emissions by 2030.

A commitment to a zero routine flaring initiative is positive, the consultant added, although flaring accounts for less than 20% of gross upstream emissions.

“Over 70% of the UK North Sea’s gross upstream emissions come from processing and production, but this can be negated through electrification,” Broroujerdi noted. “However, with many key hubs in decline, time is running out to make the economic case for action.”

The government’s carbon capture, utilization and storage target of four clusters and 10 MMt/yr by 2030 is in line with Wood Mackenzie’s Accelerated Energy Transition 2-degree (AET-2) scenario – i.e. to keep global warming to the 2°C cap set by the Paris Agreement.

“We think the UK target is achievable given the number of projects in the pipeline, but the timing is tight. But an even bigger ramp-up beyond 2030 will be required – we estimate over 50 MM metric tons [55 Mm tons] per annum by 2050 in our AET-2 scenario.”

“The UK government’s target of 5 gigawatts – or 800, 000 metric tons [881,849 tons] per annum – by 2030 is not ambitious enough. The target is also challenging given the lack of near-term projects… a big ramp-up in capacity is required to meet our 2-degree scenario in 2050, where we see green hydrogen playing an increasing role.

“However, the case for upstream is still strong. While tax revenues have fallen, the sector still makes a significant contribution to the UK’s economy, with most spend being incurred locally. Even in the greenest scenario, UK demand for oil and gas will outstrip supply.”

But Boroujerdi cautioned that UK upstream investment is heading for a 50-year low and could dip below $1 billion by 2023 unless new projects are sanctioned.

“The government needs to strike the right balance between promotion of net zero initiatives and keeping the sector alive while new energy spend is in its infancy.”

05/06/2021