NEO on North Sea growth path with Zennor acquisition

Offshore staff

LONDON – NEO Energy, backed by HitecVision, will acquire UK North Sea independent Zennor Petroleum for up to $625 million, subject to regulatory approvals.

Zennor, supported by Kerogen Capital, has 2P net reserves of 40 MMboe and more than 90 MMboe of net 2C resources.

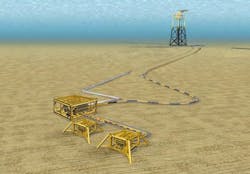

Since Kerogen’s initial investment in 2015, the company has appraised and developed the Finlaggan field in the UK central North Sea via a subsea tieback to the Britannia platform, due to come onstream later this year.

Other development opportunities in the company’s portfolio are the operated Greenwell and Leverett projects (tiebacks to Britannia), and Murlach (a tieback to bp’s ETAP complex). In addition, Zennor has stakes in the producing Mungo & Monan, Britannia, Bacchus, and Cormorant East fields.

The transaction follows NEO/Hitec’s agreement signed last month to acquire ExxonMobil’s oil and gas interests in the UK central North Sea for $1 billion.

NEO estimates its production, following the two deals, will reach 90,000-100,000 boe/d during 2022, with around 55% operated.

Zennor’s team will be integrated into the NEO organization, raising the company’s headcount above 180.

Russ Alton, CEO of NEO Energy, said: “Our combined teams will operate a large asset portfolio providing us with greater control and flexibility to maximize value and to invest in further expanding our asset base in the UKCS.”

John Knight, senior partner at HitecVision, added: “The European offshore oil and gas industry has many exciting opportunities for growth, with increasingly low CO2 emissions built into that growth. It is a sunrise industry that contributes to the climate agenda when approached with a positive and determined mind set.

“In the world of energy production, it is possible to have two thoughts in mind at the same time.”

03/09/2021