UK decommissioning continues despite market setbacks

Offshore staff

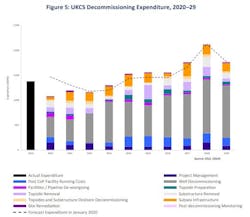

LONDON – Decommissioning spending looks set to rise steadily over the next few years, according to Oil and Gas UK’s (OGUK) Decommissioning Insight 2020 report.

During 2024-26, annual investments in the sector should reach around £1.5 billion ($1.99 billion), with the total for the decade as a whole projected to be £15.1 billion ($20.1 billion).

As for the current year, OGUK estimates that decommissioning will account for around 10% – £1.1 billion ($1.46 billion) – of all expenditure across the UK continental shelf, expected to total £10.9 billion ($14.5 billion).

Despite the twin setbacks of the oil price and coronavirus, it has still been a busy year for UK offshore operators, as Joe Leask, decommissioning manager of OGUK pointed out, with 15 topsides and 258 km (160 mi) of pipelines removed.

Thanks to good supply chain planning, Allseas’ Pioneering Spirit was able to remove Shell’s Brent Alpha topsides in less than 24 hours, he added, and to plan that lift as part of a campaign of work in the UK and Danish North Sea (for Total’s Tyra field redevelopment).

However, this year’s market conditions have impacted UK offshore well decommissioning, with activity markedly lower, at around 115 wells, compared with the previous six years. This is in line with general drilling cutbacks, with only four exploration wells having spud in UK waters over the year to date, the lowest since the early 1970s.

But over the remainder of the decade, wells will account for 49% of the UK’s decommissioning costs, with the projected total revised upwards to £7.4 billion ($9.85 billion) from £6.8 billion ($9.05 billion) in the 2019 report. OGUK has identified 1,616 candidate wells in line for decommissioning.

As for platforms, the report forecasts that up to 660,000 metric tons (727,525 tons) of topsides and just over 370,000 metric tons (407,855 tons) of substructures in UK waters will be decommissioned over the current decade. In terms of removal weight, 40% of these facilities are in the northern UK North Sea; 32% in the southern sector; and 28% in the central region.

Across the North Sea as a whole, the four major producing countries will likely decommission only 164 wells in total this year, but with activity picking up from 2021 onwards, fluctuating between 215 and 280 wells/yr over the period to 2026.

A total of 900,103 metric tons (992,194 tons) of topsides are set to be removed from all four jurisdictions over the next decade, with some of the larger removal scopes potentially pushed out beyond the end of the 10-year window.

In terms of substructures, the Netherlands looks set for the biggest jump in removals, rising from just below 8,000 metric tons (8,818 tons) in total in 2025 to 60,000 metric tons (66,139 tons) in 2026.

12/02/2020