UK set for offshore drilling upturn

Offshore staff

LONDON – Exploration drilling offshore the UK could rebound strongly in 2021, according to Westwood Global Energy Group.

A webinar organized by the consultants, “How has the UK and Norway E&P sector reacted to the oil price crash – 6 months on?”, revealed that this year’s line-up of wells – some in potentially high –impact plays, had been decimated as UK operators responded to the oil price and COVID-19 by slashing exploration budgets.

Norway was less badly hit, due partly to incentives introduced by the government in mid-year to sustain new offshore activity.

Only five exploratory wells have been drilled so far this year in UK waters, 70% fewer than Westwood had expected at the beginning of 2020, according to technical manager Alyson Harding. At best, two appraisal wells could spud between now and the end of December, she said.

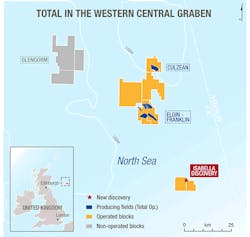

However, the success rate has been relatively high, with two commercial discoveries: Total’s potentially large, HP/HT Isabella gas-condensate find in the UK central North Sea, and Apache’s Solar oil find to the north, a probable tieback to the Beryl platform.

Offshore Norway, Harding counted 33 exploration and four appraisal wells this year – 30% down on expectations, but still healthier than the picture in the UK. The largest find of the year has been Neptune Energy’s Dugong in the North Sea, thought to hold 40-120 MMboe.

Much of this year’s drilling has been infrastructure-led exploration in the North and Norwegian Seas, she added, with some operators seeking to keep down costs through measures such as dual-derrick drilling, or focusing on shallower targets. In the Barents Sea, a further three wells could spud before year-end.

As for 2021, indications from oil companies point to 23 exploration and 10 appraisal wells across the UK continental shelf, she said, which if confirmed would be the highest total since 2010, with high-impact drilling set to continue.

However, analysis by Westwood subsidiary RigLogix suggests there may be an insufficient supply of semisubmersibles next summer to satisfy these plans. Operators may therefore need to consider forming rig-share clubs for multi-well programs.

With some planned wells also having been deferred offshore Norway, more than 40 should spud across the sector next year, Harding said.

Westwood senior analyst David Mosely, speaking on the outlook for production and development, estimated the UK’s remaining recoverable offshore resources at 6.2 Bboe, compared with 18.6 Bboe offshore Norway.

Despite this year’s events, the UK’s production appears not to have changed significantly, he said, although there may be an impact next year due to the Forties Pipeline System maintenance shutdown having been shunted to 2021.

In Norway, there has been a 5% dip in production, but this was a temporary measure imposed by the government on various oilfields to support OPEC and OPEC+ measures to prop up the oil price. This has also had a short-term impact on new project start-ups, he added

Early in 2020, Westwood expected 12 new UK offshore projects to get the go-ahead this year, with combined reserves of 300 MMboe. But the oil price collapse caused Siccar Point Resources and Shell to apply the brakes to Cambo Phase 1 west of Shetland and Jackdaw in the central North Sea (200 MMboe in total).

Decisions on these and smaller developments, mostly subsea, have been pushed back to 2021. As for future UKCS projects, two of the largest remaining in the locker – Clair South and Bressay in the Shetlands area – are both technically challenging, Mosely pointed out, and much will depend on the oil price recovering.

Offshore Norway, the government’s temporary tax changes, announced in June, apply to new project sanctions up to the end of 2022. This may stabilize the pipeline of new projects, he suggested.

Westwood has identified 30 Norwegian discoveries that are potentially commercial and which could go forward for plans for development and operation before January 2023. The combined resources are 2.6 Bboe, the largest field being Wisting in the Barents Sea.

09/25/2020