Eastern Mediterranean remains key E&P focus area

Editor's note: This feature article first appeared in the January-February 2024 issue of Offshore magazine. Click here to view the full issue.

By Gina Cohen, GINA ENERGY and Alexander Kislov, NATURAL GAS ANALYST & CONSULTANT

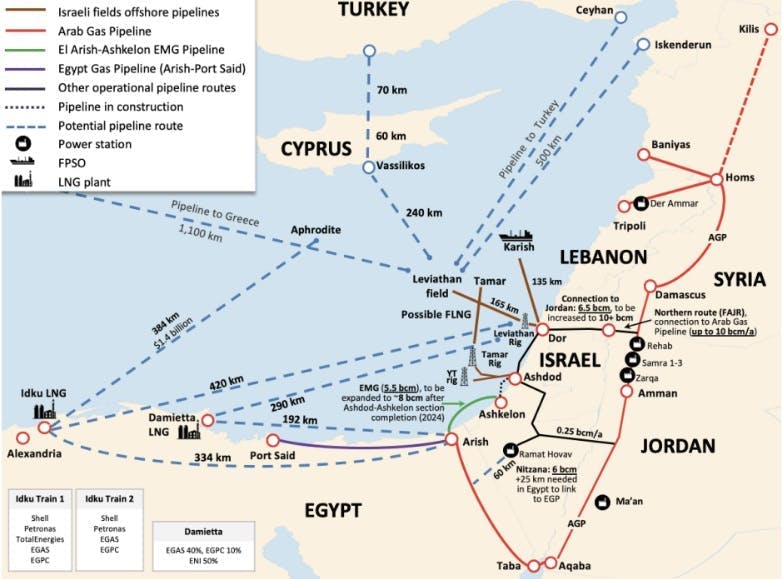

There have been several shocks to the international energy market since 2020, including an oil price shock, pandemic-related restrictions, the Ukraine-Russia war, and the more recent and ongoing Israel-Gaza conflict. These tensions and uncertainties have brought even greater focus on the E&P potential of the Eastern Mediterranean region, which includes Israel, Egypt, Cyprus, Turkey, Jordan and Lebanon.

An interesting element of the region is the ebb and flow of inter-state relationships. These play a role on whether the Eastern Med can fully integrate into a regional player so that countries with surplus gas can feel secure in supplying most of their excess to regional markets. These relationships also play a key role in the mutual use of existing and/or new infrastructure that could be built to reach international markets. If these relationships fail to develop or progress, there are risks that some countries will remain short of gas, and that reserves that could benefit European markets could remain stranded.

Let us first have a look at the supply and demand equation of each country, and then delve into potential export projects.

Israel. With reserves of ~1,000 bcm, Israel currently produces ~25 bcm/a and consumes ~13 bcm. It exports ~3 bcm/a to Jordan and ~6 bcm/a to Egypt. Expansion plans include FIDs taken to increase the capacity at the Tamar field from 11 to 12 bcm, of the Leviathan field from 12 to 14 bcm/a, and Karish to 7.5 bcm/a. In October 2023, the Ministry of Energy awarded 12 new exploration licenses to six companies, including a group led by Italy’s Eni and a group involving Azerbaijan’s Socar along with BP. Both consortiums include Israeli partners.

Egypt. With reserves of 2,200 bcm, in 2022 Egypt produced ~67 bcm, consumed ~61 bcm, imported ~6 bcm/a of pipeline gas from Israel and exported ~10 bcm of LNG. Egypt has and continues to carry out exploration bidding rounds, but the only latest discovery was a modest 100 bcm by Chevron and Eni. Several of its legacy fields suffer from water infiltration problems and are depleting fast. The country has suffered hours a day of black-outs recently due to insufficient gas for its power generation.

Cyprus. With reserves of ~430 bcm, Cyprus has significant potential but currently has no gas production or development projects underway. Nor does it have much of an internal consumption market. In 2024, the country is expected to start consuming LNG via an FSRU, while it hopes to move ahead also on taking FID to develop its first discovery, the 105 bcm Aphrodite field.

Turkey. With reserves of over 700 bcm, Turkey aims to reach ~3.5 bcm output from the first phase of its offshore Sakarya field. Turkey consumes 45-60 bcm/annum and is thus strongly dependent on imports from Russian, Iran, Azerbaijan and LNG.

Lebanon. Despite exploration carried out by TotalEnergies, Eni and QatarEnergy, Lebanon has not had discoveries to date and is not consuming any gas. Plans to import gas from Egypt, albeit from Israeli molecules via Jordan and Syria, are not moving ahead for now.

Export projects

Currently, as aforementioned, regional exporters include small to mid-size volumes from Israel (about 9 bcm a year to Jordan and Egypt) and from Egypt (about 10 bcm a year of LNG to the global market).

In order for the region to be able to export another 10-20 bcm of gas a year, the following projects are under consideration.

Cyprus. Hopes to reach FID to develop Aphrodite and export 6 bcm/a to Egypt. The partners in the field are due to conduct a one-year FEED to examine development options.

Egypt. Has long-standing ambitions to become a gas hub, but failing further discoveries and a recovery in its economic situation it may find itself rapidly becoming a net importer of gas. Indeed already in 2023, it is expected that its LNG exports will be close to half those in 2022.

Israel. Hopes to reach FID on Tamar to increase capacity by another 4 bcm/a and to increase Leviathan capacity by another 4-9 bcm/a. Export projects being examined to sustain such development include:

- Additional sales to Egypt – Tamar hopes to export an additional 38-43 bcm to Egypt from 2025 to 2034. Additional volumes to Egypt, also coming from Leviathan, would require both further upstream and midstream developments. Partners in Israel would want to see that Egypt’s financial situation stabilizes, and that its gas supply and demand ratio ensures that additional Israeli gas to Egypt would be safeguarded to the higher paying global LNG market.

- A pipeline to export gas to Turkey – Although relations between Israel and Turkey had improved over much of last year, the Oct. 7 Israel-Gaza war saw Turkey President Erdogan supporting Hamas and pausing plans for energy cooperation. This effectively buries an option for exports via Turkey and from Turkey to eastern Europe for the medium term. The project could be revisited in the future.

- FLNG offshore Israel – The Leviathan partners are considering a 6.4 bcm/a FLNG project. The capex of such a project however is considerable and the security implications of a nearshore Israeli facility may require further analysis to see if and how to proceed with such an option.

- Poseidon project – This would involve an offshore pipeline from Israel which would gather supplies from Cyprus and move them onwards via Greece and Italy. FEED for this project was completed last year and it is part of the EU’s project of Common Interest. Although this is a complex $6.4-billion project, its feasibility has potentially become more prominent considering some of the complexities involved in other regional projects.

Each project is feasible but requires further investigation and decisions to be taken. Despite a complex regional situation, energy security remains of paramount importance to local, regional and global gas consumers.