Middle East tensions could impact growth plans for Israel’s offshore gas fields

Offshore staff

OSLO, Norway — Europe’s LNG import prices could climb if the conflict between Israel and Hamas intensifies, Rystad Energy has warned.

Across the countries in the EU, said Aditya Saraswat, vice president Middle East Upstream Research at Rystad Energy, “EU storage currently stands above 97% and gas consumption is still below levels registered in 2022. Furthermore, there is a possibility of increased gas exports from the US.

“The ongoing conflict is likely to have a limited upward impact on near-term gas prices that will reflect a geopolitical risk premium already manifested in oil prices. However, there remains a risk of escalation into a broader conflict that could cause a short-term increase in energy prices.”

Israel has surplus gas production from its offshore fields that currently supports demand in Egypt and Jordan. Tamar, Leviathan and Karish are the country’s largest offshore developments.

However, the emerging situation could jeopardize further upstream investments and export plans.

Leviathan accounts for 44% of the country’s gas production, followed by Tamar (38%) and Karish (18%). Tamar also supplies more than 70% of Israel's domestic needs and is the main source of gas-fired electricity generation.

Rystad estimates that 5-8% of Tamar's production is exported.

Egypt imports about 7 Bcf/year from Tamar and Leviathan to support domestic demand and power liquefaction plants. Egypt exported 3.7 MM metric tons of LNG between October 2022 and January 2023, the consultant calculated, with just under 1 MMt exported last December alone.

This peak production is said to be roughly equal to Tamar's 33-day production shutdown, at current rates.

Israeli supplies less than 10% of Egypt's gas. During the first nine months of the year, exports of LNG fell by about 50% compared to last year due to increased domestic gas usage during the summer season.

This raises questions over the sustainability of gas exports to Egypt as winter draws near.

Tamar currently produces from six wells, with a daily output ranging from 7.1 MMcf/d to 8.5 MMcf/d. If the field underwent a short shutdown, Israel would use coal and fuel oil to generate electricity.

However, prolonged shutdowns might require drilling of additional wells, and this process would take months to complete. In which case, Israel would have to draw on gas from Leviathan to meet its own needs instead of selling it to Jordan and Egypt.

Jordan derives most of its gas imports from the Leviathan, which is also the exporter of the gas to Egypt. Worsening of the conflict could lead to Leviathan being shut down. In 2022 Leviathan exported 4.9 Bcm of gas to Egypt, compared to 3.1 Bcm in the first half of 2023.

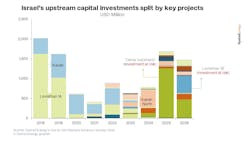

A protracted, unstable situation could also imperil the next planned wave of capital investments in these established offshore projects over the next three years, Rystad said.

The Tamar expansion project, planned for 2025, would be the most heavily impacted, with $1.2 billion earmarked for expansion of the gas reservoir.

And $435 million of capital investment associated with Leviathan Phase 1B would also be at risk, especially in 2026. The current plan calls for installation of an FLNG vessel with a capacity of 4 MM to 5 MM metric tons/year as a way of tapping into the European market.

Leviathan can produce up to 2.1 Bcf/d, with a ramp-up potential said to be about 700 MMcf/d.

Finally, Israel, Egypt and Cyprus are aiming to construct the Eastern Mediterranean pipeline to transport natural gas to Europe via Greece, at an estimated cost of $6.5 billion.

While the project could be profitable due to the low cost and substantial supply of natural gas in the region, and its capacity could be increased from 10 Bcm to 20 Bcm/year, investors may be discouraged if border disputes continue and worsen, Rystad suggested.

10.20.2023