Report upgrades liquids volumes at Energean fields offshore Israel

Offshore staff

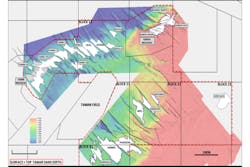

ATHENS, Greece – DeGolyer and MacNaughton (D&M) has delivered its competent persons report (CPR) on various licenses offshore Israel operated by Energean.

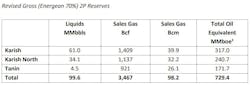

According to Mathios Rigas, CEO of Energean, the CPR has confirmed 2P gas volumes of 98 bcm across the Karish, Karish North and Tanin discoveries, with around 100 MMbbl of 2P liquids reserves.

The liquids figure is higher than Energean’s previous estimate.

Energean expects to take a final investment decision on the Karish North development later this year, leading to first production in 2023. The tieback to the FPSO Energean Power should cost $100 million and completion of the existing well as a producer in the C-sands around $50 million.

D&M forecasts plateau gas production from Karish, Karish North, and Tanin fields of 7.2 bcm/yr through the 8-bcm/yr FPSO and export pipeline.

Production rates above 6.5 bcm/yr will require the installation of a second riser on the vessel, Energean said, at an anticipated cost of around $50 million. The riser would likely become operational by end-2023.

D&M estimates liquids production from Karish Main and Karish North (excluding the potential oil rim) could peak at 28,400 b/d, levelling off to around 27,800 b/d over five years.

The FPSO is designed currently to accommodate 21,000 b/d, although a second liquids processing train and associated gas compressor could be installed to raise liquids production capacity to 40,000 b/d. Associated costs would be around $40 million.

Onboard storage capacity is up to 800,000 bbl – if production needed to be raised, this could be handled more frequency tanker offtakes, Energean said, typically in the range of 350-450,000 bbl.

Israel’s Ministry of Energy has approved an extension of the company’s offshore licenses 12, 21, 23 and 31 through Oct. 31, 2021. The company is currently progressing well planning and design operations for potential drilling of prospects on block 12.

A commercial discovery here would be prioritized ahead of the Tanin development, with the associated costs of a tieback to the FPSO thought to be significantly lower.

11/10/2020