Colombia’s offshore energy hopes wane on poor discoveries, strict regulations

Hopes among foreign energy companies that Colombia’s offshore acreage could serve as a key source of future oil and gas supplies are being dashed as many exploration projects lag expectations, with unwelcomed regulation further deflating optimism.

These findings were set forth in a Reuters report of Aug. 8.

The disappointing finds and regulatory roadblocks are pushing some oil and gas companies to abandon Colombia for neighboring countries like Peru, where incentives for E&P have become clearer.

Despite the country’s increasing reliance on foreign energy, the government of President Gustavo Petro has defended a ban on fracking and imposed stricter rules for exploration and production of conventional oil and gas, creating delays and limiting opportunities for private investors in the industry.

Chevron and Shell exiting, reducing presence in Colombia

Exploration along Colombia’s Caribbean coast has mostly ended in disappointment as major producers like Shell have left the country and others, including Chevron, have reduced their operations there.

Earlier this year, Chevron’s remaining offshore block in Colombia was removed from the regulator’s list of active areas at the company’s request.

Chevron, which had previously sold stakes in two other gas fields offshore Colombia, has now reduced its presence there to fuel retail, company sources said.

Shell said in April that Colombia projects no longer fit with its strategic ambitions, but added that it would continue supplying liquefied natural gas and other fuels to the nation.

Other companies that have exited onshore and offshore ventures in Colombia in recent years include Exxon Mobil, ConocoPhillips, and Spain’s Repsol. Experts and company sources said the exits and drawdowns are due to a combination of poor exploration results and adverse policies.

Investment in nearby countries

Analysts note that there have been no large discoveries in Colombia for some time, which means that growth-minded E&P companies must move to other more promising locations.

Some companies that had previously made Colombia the focus of their Andean region exploration – including TotalEnergies, Chevron, and Occidental Petroleum – are now expanding their interest in Peru, as terms and prospects there improve.

Meanwhile, majors like Exxon and Shell are investing billions of dollars in Caribbean and South American nations including Trinidad and Tobago, Guyana and Suriname, where discoveries dwarf most Colombian offshore prospects and there is governmental support for the offshore industry.

Infrastructure, permitting and regulation challenges

Even those Colombian projects showing promise are often tangled by infrastructure or permitting hurdles, the Reuters report said – even while Colombia runs low on gas reserves due to insufficient exploration. In addition, the gas that has been found will require new pipeline infrastructure, but that infrastructure still needs multiple permits to move forward.

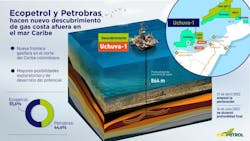

The country’s largest gas discovery is the Sirius offshore project (formerly known as Uchuva), where Brazil’s Petrobras and Colombia’s Ecopetrol are doing additional drilling after finding some 6 Tcf – enough to extend the lifespan of Colombia’s gas reserves for over a decade, analysts project.

But despite support from Petro and Brazil’s President Luiz Inacio Lula da Silva, the consortium’s efforts have been “costly and time-consuming,” the Reuters report said.

The project’s partners must complete over 100 public consultations with onshore communities and wait for two environmental licenses, according to the regulator and data from the Colombian Petroleum Association (ACP).

Ecopetrol said a second phase of consultations is about to start, which could lead to the environmental license, before building a submarine pipeline and onshore gas processing plants. Some analysts have commented that the official production start date from Sirius – in the 2029-2030 timeframe – is overly optimistic.

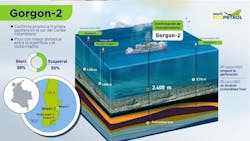

Elsewhere, a smaller offshore gas discovery by Shell at the Gorgon gas field failed to persuade the company to remain in Colombia.

And even Occidental’s plans to drill the Komodo ultradeepwater well, which could become the world’s deepest, could be derailed amid delays to get the drilling permits.

Occidental is waiting to see the results of an appeal filed in January over its drilling permit, whose terms threaten the project’s viability, it has argued. According to Reuters, Oxy declined to comment on Komodo and said it continues to evaluate seismic data to make a decision in offshore Peru.

Ecopetrol, for its part, has not provided updated plans to develop a gas discovery at its Orca project, also in the Caribbean, since it finished drilling last year, following the pattern with other offshore prospects that were ultimately shelved.

For many producers and operators in Colombia, over regulation and insufficient foreign investment are a challenge, executives have said.

Oil output across Colombia fell 4.8% year-on-year to 749,800 bbl/d in May, far from the 1 MMbbl/d produced a decade ago, while gas output declined 18.9% in a year to 800 MMcf/d, according to government data.

“Our oilfields are declining, especially our mature fields, and current exploration contracts only cover 14 wells per year through 2030. That is insufficient,” said Frank Pearl, head of the ACP, as quoted in the Reuters report.

Petro has not allowed any new rounds for exploration and production contracts, instead pushing renewables and power generation. Some political opponents are already promising an industry revival if they win a presidential election in 2026.