Offshore's readers see modest upside for Venezuela’s offshore oil output after political shift

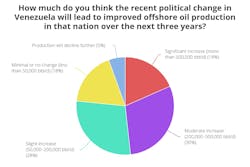

The Offshore editorial team surveyed more than 200 of its readers this month asking about the impacts of the recent political change in Venezuela on offshore oil production in that nation over the next three years.

The survey results indicate guarded optimism among Offshore readers regarding Venezuela’s offshore oil production outlook over the next three years following recent political changes.

A strong majority—nearly 77% of respondents—expect some level of production growth, with the largest share (29.85%) anticipating a moderate increase of 200,000–500,000 bbl/d, suggesting confidence that improved operating conditions could unlock meaningful, though not transformative, gains. Another 28.36% foresee a slight increase of 50,000–200,000 bbl/d, reinforcing the view that progress is likely to be incremental rather than rapid.

More bullish expectations remain a minority, with 18.41% predicting a significant increase exceeding 500,000 bbl/d, reflecting skepticism that structural, technical and investment barriers can be fully resolved in the near term.

On the more cautious end of the spectrum, 17.91% expect minimal or no change, while just 5.47% believe production will decline further.

| Moderate increase (200,000-500,000 bbl/d) | 29.85% |

| Slight increase (50,000-200,000 bbl/d) | 28.36% |

| Significant increase (more than 500,000 bbl/d) | 18.41% |

| Minimal or no change (less than 50,000 bbl/d) | 17.91% |

| Production will decline further | 5.47% |

Overall, the findings suggest the industry sees a path to recovery for Venezuela’s offshore sector, but one constrained by execution risk, capital availability, and the pace of regulatory and operational reform.

About the poll respondents

Offshore is a global resource for the offshore energy industry; thus, its readership and poll participants reflect that.

The majority (54%) of this poll's respondents were from the US, and of those 62% were from Texas. Other poll participants hailed from the UK, Mexico, Brazil, The Netherlands, Singapore, Canada, Cyprus, Spain, Ghana, Indonesia, India, Japan, South Korea, Malaysia, Trinidad and Tobago, Taiwan and Venezuela.

The majority (30.77%) of participants selected that they are with a consulting company engaged in projects or providing services to oil and/or gas companies. And 15.38% reported they are with an engineering company, while another 11.54% stated they are with a major oil and gas operating company.

While poll respondents remain anonymous, it can be shared that some of the participants are from Aker Solutions, Baker Hughes, Equinor, Exmar, Halliburton, Huisman, MODEC, Occidental Petroleum, Petronas, Siemens, S&P Global, Westwood Global Energy Group, Woodside Energy, Worley and Yinson Production, among many others.

The majority of respondents (28.3%) identified themselves as executive management (e.g., CEO, president, COO, owner, VP, managing director, etc.) and as consultants (another 28.3%). Another large chunk of participants (26.4%) identified themselves as management (e.g., production manager, engineering manager, exploration manager, etc.).

The other poll respondents identified as engineers (7.55%) and field professionals (3.77%) as well as CTO, CIO, VP of technology, VP of digital, or other technical executives (1.89%), G&G professionals (1.89%) and other industry roles (1.89%).

This poll remained open on Offshore's website from Jan. 7-23, 2026. During this time, it was routinely shared across Offshore's social media channels as well as featured in the Offshore Daily e-newsletter.

Expert insights: Political signals help, but structural risks still cap upside

Ken Medlock, Ph.D., is senior director of Rice University’s Center for Energy Studies at the Baker Institute for Public Policy and co-director of the Master of Energy Economics program. He shared his perspective with Offshore on Venezuela’s onshore and offshore oil and gas outlook.

Medlock sees Venezuela’s hydrocarbon sector as a classic case of world‑class resources constrained by above‑ground risk. While political shifts and selective sanctions relief may enable some near‑term production gains, he cautions that any recovery, especially offshore, is likely to be incremental and asset‑specific, constrained by institutional weakness.

“Resources in place and technical recoverability are necessary conditions for production growth, but they are far from sufficient,” Medlock added.

He noted that Venezuela’s resource base, including offshore oil and gas and gas export optionality via Trinidad, is not the primary limiting factor.

“There are offshore production opportunities in oil and gas, with potential for natural gas to feed power generation domestically and possibly exports through Trinidad—but much remains to be done,” he said.

Instead, Medlock emphasized that legal uncertainty, deteriorated infrastructure, PDVSA’s financial weakness, and unresolved arbitration and debt claims continue to deter sustained investment.

“Capital is fungible, and it always chases returns,” he said. “Venezuela must establish conditions with acceptable levels of political and regulatory risk to become attractive to foreign investors.”

Without credible reforms, including contract sanctity, reserve‑booking rights and durable sanctions relief, Medlock sees limited potential for major offshore or greenfield investment. Any near‑term gains, he added, are more likely to come from rehabilitating existing assets than launching new megaprojects.

Want deeper insight on Venezuela and global energy politics?

Explore more exclusive analysis from our sister publications and industry partners.

US Treasury ready to open Venezuela to more oil companies: API

Venezuela to turn over 30-50 million bbl of oil to US; Washington seizes additional tankers

In Venezuela and Panama, US actions are all about energy dominance

Rice University's Baker Institute Center for Energy Studies:

The limits of Venezuela’s oil recovery

Fixing the Venezuelan oil industry will take time, money and—most importantly—institutional change

About the Author

Ariana Hurtado

Editor-in-Chief

With more than a decade of copy editing, project management and journalism experience, Ariana Hurtado is a seasoned managing editor born and raised in the energy capital of the world—Houston, Texas. She currently serves as editor-in-chief of Offshore, overseeing the editorial team, its content and the brand's growth from a digital perspective.

Utilizing her editorial expertise, she manages digital media for the Offshore team. She also helps create and oversee new special industry reports and revolutionizes existing supplements, while also contributing content to Offshore's magazine, newsletters and website as a copy editor and writer.

Prior to her current role, she served as Offshore's editor and director of special reports from April 2022 to December 2024. Before joining Offshore, she served as senior managing editor of publications with Hart Energy. Prior to her nearly nine years with Hart, she worked on the copy desk as a news editor at the Houston Chronicle.

She graduated magna cum laude with a bachelor's degree in journalism from the University of Houston.