Presalt projects underpin market recovery offshore Brazil

Brazil is likely to play a major role in the offshore oil and gas industry’s recovery from a tumultuous 2020, especially in the floating production market. As it has in the past, presalt development will provide the foundation for this recovery, led by Petrobras and a number of international oil companies.

The country is expected to deploy 18 FPSOs by 2025, according to GlobalData. Eight are planned while nine are early-stage announced FPSOs that are undergoing conceptual studies and may be approved for development. Petrobras leads the operators’ list with seven FPSOs.

The data and analytics company’s report ‘Global FPSO Industry Outlook, 2020−2025 – Petrobras Drives Global Upcoming FPSO Deployments’ reveals that Brazil also leads crude oil production capacity globally through upcoming FPSOs with more than 200,000 b/d during the outlook period.

Mero 3

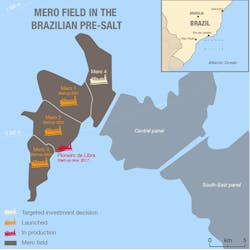

Last August, Petrobras and its partners took the final investment decision for the third development phase of the ultra-deepwater Mero project in the Libra block in the presalt Santos basin.

The company has signed a letter of intent with Malaysian contractor MISC Berhad for the charter and services for the FPSO Marechal Duque de Caxias. This marks MISC Berhad’s entry to the Brazilian market.

The Mero 3 FPSO is expected to have a processing capacity of 180,000 b/d of oil and 12 MMcm/d of gas. The charter and service agreements run for 22.5 years from final acceptance of the vessel, scheduled for the first half of 2024.

Development will involve the tieback to the FPSO of eight producer and seven water and gas injector wells via rigid production and injection flowlines, flexible service flowlines, and control umbilicals.

In addition, the Libra consortium plans a pilot test in the Mero 3 area of Petrobras’ HISEP – High Pressure Separation – technology. This involves subsea separation and reinjection, via centrifugal pumps, of much of the carbon dioxide produced with the oil, easing the strain on the FPSO’s oil processing plant and allowing oil production to increase.

HISEP is currently undergoing definition and testing. After qualification, Petrobras says that a pilot can be installed in Mero 3 to perform longer-term tests and to assess the technology.

Mero, 180 km (112 mi) offshore Rio de Janeiro, is said to be Brazil’s third largest presalt discovery. It is thought to hold up to 4 Bbbl of recoverable oil. The field has been undergoing test production since 2017 through the 50,000-b/d FPSO Pioneiro de Libra. Other partners in the Libra block are Shell, Total, CNOOC, and Pré-Sal Petróleo S.A., which serves as manager of the agreement.

According to Total, the Mero 1 FPSO (Guanabara) is due to start operating in 2021 and Mero 2 (Sepetiba) in 2023.

Arnaud Breuillac, president Exploration & Production, added that Total is now targeting production of 150,000 b/d in Brazil by 2025.

Búzios

In September 2020, Petrobras entered contract negotiations with SBM Offshore for use of the FPSO Almirante Tamandaré on the Búzios field in the presalt Santos basin. This will be the sixth production system on the field, with start-up scheduled for the second half of 2024. It will also be the largest oil production platform operating offshore Brazil and one of the largest in the world, Petrobras claimed, with a processing capacity of 225,000 b/d of oil and 12 MMcm/d of gas.

Bids are also out for two more FPSOs for Búzios, the P-78 and P-79. Each will have a processing capacity of 180,000 b/d of oil and 7.2 MMcm/d of gas, and are expected to start operating in 2025. The company is expected to award contracts this year.

There are currently four units in operation at Búzios, which account for more than 20% of Petrobras’ total production and more than 30% of production in the presalt fields. On July 13, 2020, these platforms (P-74, P-75, P-76, and P-77) achieved a collective production record of 674,000 b/d of oil and 844,000 boe/d.

MODEC is constructing the field’s fifth FPSO, the Almirante Barroso. The vessel is expected to have a production capacity of 150,000 b/d of oil. Production is scheduled to start in the second half of 2022.

Petrobras expects to have 12 FPSOs installed at the Búzios field by the end of the decade. At the end of the development phase, the Búzios field is expected to produce more than 2 MMboe/d, becoming the company’s largest asset, with the highest production.

In November 2019, Petrobras acquired operatorship and 90% interest in the Búzios field. CNODC Brasil Petróleo e Gás Ltda. and CNOOC Petroleum Brasil Ltda. each acquired a 5% stake.

Bacalhau

This year operator Equinor and its partners ExxonMobil and Petrogal Brasil are expected to take the final investment decision for Phase 1 of the Bacalhau field development in the presalt Santos basin. Bacalhau will be the first greenfield development in the presalt by an international operator.

In January 2020, Equinor awarded the front-end engineering and design contracts. MODEC, which started pre-FEED work for the FPSO in late 2018, will handle the full FEED, with Subsea Integration Alliance (SIA) between Subsea 7 and OneSubsea responsible for the SURF (subsea, umbilical, risers, and flowlines) FEED.

The contracts are based on a two-step award. FEED and pre-investment start now, with an option to progress to the execution phase under a lump sum turnkey contract that includes engineering, procurement, construction, and installation for the entire SURF and FPSO scopes.

The Bacalhau field is 185 km (115 mi) from the coast of the State of São Paulo in water depths of around 2,050 m (6,726 ft). First oil is planned for 2024.

MODEC will be responsible for the design and construction of the 220,000-b/d FPSO, including topsides processing equipment, hull and marine systems, with SOFEC supplying the spread-mooring system.

This will be the second application of the company’s M350 hull, a newbuild double-hull design said to accommodate larger topsides and larger storage capacity than conventional VLCC tankers, also providing a longer design service life.

Dalian Shipbuilding Industry Co. in China will construct the hull. During the first year of production, MODEC will operate the vessel with Equinor taking on the role thereafter until the end of the license period in 2053.

Development will include 19 wells, around 130 km (80.8 mi) of rigid risers and flowlines and 35 km (21.7 mi) of umbilicals. SIA’s scope will include post-start up life of field support. Offshore installations are scheduled for 2022 and 2023.

SIA added that Bacalhau is Brazil’s first ever integrated SPS and SURF project, while Equinor highlighted the high degree of standardization and industrialization for both the SURF and FPSO contracts, with around 60% Brazilian local content expected for the SURF.

Equinor has contracted Baker Hughes for drilling services and completion, Halliburton for intervention services and liner hanger, and Schlumberger for wireline services.

About the Author

Jessica Stump

Editor

Jessica Stump is editor of Offshore Magazine. She uploads and writes news to the website, assembles surveys and electronic newsletters, and writes and edits articles for the magazine. She was the summer editorial intern at Offshore in 2009 and 2010 before joining full time in April 2011. She has a journalism degree from Texas Tech University.