Southeast Asia set for offshore gas renaissance

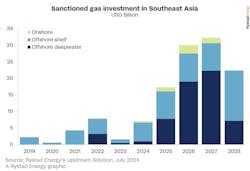

Planned FIDs on new offshore gas projects in Southeast Asia could lead to $100 billion of investments, according to Rystad Energy.

The main drivers are deepwater developments, recent successful discoveries offshore Indonesia and Malaysia, and advances in carbon capture and storage (CCS).

Oil and gas majors will likely account for 25% of the planned investments through 2028, and national oil companies (NOCs) about 31%.

East Asian upstream companies should have a 15% share with growth potential via mergers and acquisition and upcoming exploration ventures. The role of the majors could strengthen further to 27% based on TotalEnergies' recent upstream acquisitions in Malaysia.

Rystad cautioned, however, that persistent delays to projects in the region remain concerning. These are due to a combination of deepwater and sour gas economics, infrastructure readiness and regional politics. Some of the issues have been in place for over two decades.

But the emergence of CCS hubs in Malaysia and Indonesia could alter the deadlock. The high CO2 content in some of the planned offshore projects will require CCS for financing and regulatory compliance.

Both countries are also assessing converting depleted reservoirs from mature fields to CO2 storage sites.

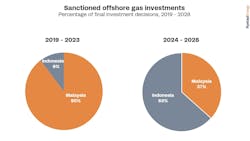

Prateek Pandey, Rystad Energy's vice president of upstream research, said, “We recognize the potential of new project investments and capital commitments in the region, which surged from $9.5 billion in 2022-2023 to approximately $30 billion in 2024-25.

“As we delve deeper into the data, it becomes increasingly clear that this upward trajectory is projected to continue until 2028. Recent discoveries and the involvement of NOCs will play a vital role in this growth, particularly in deepwater developments, which are pivotal in determining how much of this anticipated $100 billion boom can be realized.”

In Indonesia, the stand-out prospective gas projects are headed by the Inpex-operated Abadi LNG, Eni’s Indonesia deepwater development, and bp’s Tangguh Ubadari Carbon Capture.

These, along with recent discoveries in the East Kalimantan and Andaman regions, should account for 75% of Indonesia's total offshore gas investments set for FID, according to Rystad.

Malaysia's upcoming FID projects should include discoveries since 2020, overseen mainly by Petronas, PTTEP and Shell. Across Southeast Asia as a whole, more than half the planned gas projects are said to include a CO2 content above 5%, with a trend toward cluster developments for the deepwater projects.

Projected gas resources from FIDs could reach 58 Tcf by 2028, Rystad added. But there are economic challenges, particularly in deepwater and sour gas developments. Many projects may require gas prices above historical averages of $4 per Tcf to be profitable, with an optimal threshold nearer to $6/Tcf.

Supply chain companies could reap benefits from floater-based projects and deepwater drilling.