Norway offers new licenses to 29 companies

Offshore staff

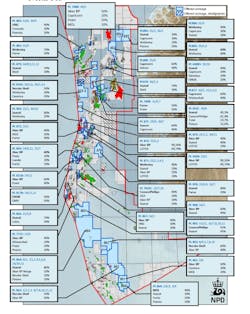

OSLO, Norway – The Norwegian Petroleum and Energy Ministry has awarded 56 new production licenses to a total of 29 companies under the country’s Awards in Predefined Areas (APA) 2016 round.

Thirty-six of the licenses are in the North Sea, 17 in the Norwegian Sea, and three in the Barents Sea. Twelve are additional acreage to existing licenses, while three more are stratigraphically divided and only apply to levels below/above a defined stratigraphic limit.

Sissel Eriksen, exploration director at theNorwegian Petroleum Directorate (NPD), said: “This year, interest has been particularly high for areas in the North Sea. The APA scheme demonstrates that exploration in mature areas provides further geological understanding and improved data, which creates exciting, new exploration possibilities.”

Sixteen of last year’s 18 Norwegian discoveries came from areas covered by the APA scheme.

“It is an advantage that the geology is quite familiar, though surprises still occur,” Eriksen said. “There are both shutdown fields and existing fields that are approaching the end of their production in the APA areas, with infrastructure that can be exploited. It is therefore important that we fully explore the surrounding acreage, to ensure potential resources are not lost.”

This year, there were numerous bids for areas around the shutdown Frigg field in the North Sea, where new discoveries have been made in recent years.

Additionally, interest was strong in areas close to previous finds in theBarents Sea and Norwegian Sea.

Of the companies that applied, 29 will receive an offer of ownership interests in at least one production license. State organization Petoro will participate as a licensee and administrator of the State Direct Financial Interest in 13 of the licenses.

Among the companies to comment on their awards wasStatoil, which gained interests in 29 exploration licenses, 16 as operator.

One license, PL894 in the Norwegian Sea operated by Wintershall, carries a commitment to drill within three years. A discovery could be tied into theAasta Hansteen infrastructure.

Jez Averty, Statoil’s senior vice president for exploration in Norway and the UK, said: “Over the past two years we have replenished our portfolio with interesting prospects. This is reflected in the exploration plan we have published for 2017.

“There we focus on theBarents Sea after high-quality awards in the 23rd round and APA 2015. The awards in the APA 2016 round bolster our position in the Norwegian Sea,” he added.

“Our commitment to the Norwegian Sea is demonstrated by [this week’s] oil and gas discovery in well 6608/10-17Cape Vulture… This license was awarded in APA 2015, and the well completed within one year of award. This is in line with our ambition to quickly clarify the prospectivity acreage we are awarded.”

Statoil’s full list is as follows:

Barents Sea

50% share and operator for production license 901 (blocks 7122/5, 6 and 7123/4)

Norwegian Sea

64% share and operator for production license 128E (block 6608/10)

30% share and partner in production license 255C (block 6406/5)

20% share and partner in production license 847B (block 6707/4)

40% share and operator for production license 890 (blocks 6507/7, 8)

40% share and partner in production license 894 (blocks 6604/5, 6 and 6605/4, 5, 7)

40% share and partner in production license 895 (blocks 6609/2, 3, 4, 5, 6)

20% share and partner in production license 896 (blocks 6610/2, 3 and 6611/1,2)

50% share and operator for production license 897 (blocks 6606/2, 3 and 6706/12)

70% share and operator for production license 898 (blocks 6707/10, 11, 12)

60% share and operator for production license 899 (blocks 6706/12 and 6707/10)

North Sea

49.3 % share and operator for production license 053C (block 30/6)

40% share and operator for production license 630BS (block 35/10)

20% share and partner in production license 782SC (block 25/7)

20% share and partner in production license 860 (blocks 2/6, 9 and 3/4)

40% share and operator for production license 864 (blocks 6/3, 7/1, 2, 4, 5, 6, 8 and 16/10, 11)

45% share and partner in production license 865 (blocks 15/12 and 16/7, 8, 10, 11)

70% share and operator for production license 866 (blocks 15/5, 8)

30% share and partner in production license 867 (block 16/1)

40% share and partner in production license 868 (block 16/1)

80% share and operator for production license 870 (blocks 25/6, 9 and 26/7)

20% share and partner in production license 871 (blocks 25/1, 2, 4, 5)

40% share and partner in production license 873 (blocks 25/1, 2 and 30/11)

70% share and operator for production license 878 (blocks 30/2, 3)

70% share and operator for production license 879 (blocks 34/8, 9, 11, 12)

60% share and operator for production license 883 (blocks 35/5, 8)

30% share and partner for production license 884 (block 35/3)

30% share and operator for production license 885 (blocks 35/3 and 36/1)

80% share and operator for production license 903 (blocks 25/1 and 30/10)

Aker BP was offered interests in 21 new production licenses, 13 as operator. Sixteen of the concessions are in the North Sea, four in the Norwegian Sea, and one in the Barents Sea.

“We are very pleased with the award, which forms the basis for further growth,” said Gro G. Haatvedt, senior vice president Exploration.

DEA secured two new licenses, one as operator. “We focused on getting an operated license with a strong partnership in an attractive area in the Norwegian Sea, and we succeeded,” said DEA Norge’s exploration manager Svend Erik Pettersson.

PL 896 is in one of DEA’s focus areas, northeast of the Aker BP-operated Skarv field and DEA’s currentDvalin development. The company also gained 20% of North Sea PL 782SC, operated by ConocoPhillips.

Over the next few years, DEA plans to participate in four to five wells a year, both as partner and as operator.

Lundin Norway received interests in four licenses:

License | Lundin Norway interest |

PL869 (blocks 24/9, 12 and 25/7): | 20% - Central North Sea |

PL886* (blocks 6306/6, 8, 9): | 40% - Norwegian Sea |

PL896 (blocks 6610/2, 3 and 6611/1, 2): | 20% - Norwegian Sea |

PL902* (blocks 7120/1, 2, 3, 4, 5, 6): | 50% - Southern Barents Sea |

*operator

Wintershall picked up shares in five licenses, two as operator. Two – PL 777C and 877 – are in the North Sea – while the other three are all close to Aasta Hansteen (847B, 894, and 898).

ENGIE E&P Norge will operate PL 817B, add-on acreage to the company’s PL 817 in the South Viking Graben area of the North Sea and immediately west of the Gudrun field, where ENGIE has a 25% interest.

This new award could provide tieback potential to Gudrun, prolonging the life of the platform.

The company will also work with operator Statoil in PL 630BS, a stratigraphic licence for additional acreage for PL 630 in the North Viking Graben area, 10 km (6.2 mi) west of the infrastructure in the greater Fram -Vega Sør area in which ENGIE is a partner.

Faroe Petroleum was awarded three new licenses in the Norwegian North Sea area:

PL740 B Brasse extension – block 31/4 and 31/7 (50% and operator), containing a possible northward extension of last year’s Brasse discovery on the eastern side of the Brage field. The work program is the same as the PL740 Brasse license.

PL870 Pabow – blocks 25/6, 9, 26/7 (20% - Statoil as operator): the Pabow prospect is on the edge of the Stord basin, east of Faroe’s existing Shango license. The main prospect is a large stratigraphic closure of Upper Jurassic Ula reservoir sands - the work program includes G&G studies ahead of a drill-or-drop decision in 2018.

PL881 Goanna – block 33/9 (30% - Wellesley Petroleum as operator): the Goanna prospect, on the Tampen Spur on the northwestern margin of the North Viking Graben, is a structural and stratigraphic prospect of Upper Jurassic age sandstones, updip of well 33/9-16.

In the Norwegian Sea, Faroe was awarded operatorship of PL888 Canela – blocks 6507/7: the acreage is on the Revfallet fault complex on the Halten Terrace. The Canela prospect consists of down faulted blocks west of the producing Heidrun field - reservoirs are expected to be the same Fangst group sands as found in Heidrun. There is a drill-or-drop decision in 2019.

Fortis Petroleum gained interests in four licenses:

PL 870 (blocks 2/6, 9 and 3/4 – MOL operator)

PL 869 (blocks 24/9 and 25/7 – Aker BP operator)

PL 872 (block 25/1- Aker BP operator)

PL 893 (6608/9 and 6609/7 – Aker BP operator).

Fortis CEO Michael Haagaard said: “The licenses represent a number of very exciting exploration opportunities mainly close to existing infrastructure in our core focus areas.”

Eni Norge secured operatorship of PL 900 in the Barents Sea, and a share of the Statoil-operated PL 901 in the same region.

In the Norwegian Sea the company partners with Statoil in PL 128E, adjoining the PL128/PL128D licenses containing the two companies’Cape Vulture oil and gas discovery.

01/19/2017