More upstream M&A deals likely offshore Southeast Asia

Offshore staff

LONDON – Wood Mackenzie predicts that up to $14 billion worth of upstream assets could be traded this year across Southeast Asia.

So far $2.8 billion of deals have gone through, led byMurphy Oil’s $2.1-billion divestment of its Malaysia business to Thailand’s PTTEP.

“We have observed for a while now the trend of oil majors exiting countries in the region as their portfolios mature and contracts expire,” said Wood Mackenzie research director Andrew Harwood.

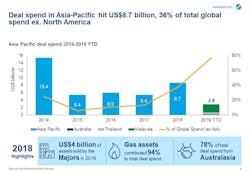

Asia/Pacific upstream deals totaled $8.7 billion last year, accounting for over one-third of global spending (excluding North America), the analyst said, with activity driven primarily by reshuffling of portfolios in Australia and New Zealand.

This year in Southeast Asia, more than 5.5 Bboe of (mainly gas) assets could come on the market.

Aside from retrenchment by traditional E&P players, merger and acquisition (M&A) activity will likely be led by regional NOCs farming down assets to bring in technical and financial partners to manage their newly-expanded portfolios.

Pertamina and PTTEP will need to spend a cumulative $32 billion over the next five years to maintain their domestic supply commitments, the analyst claimed.

“Pre-development projects that been stalled during the oil price downturn is also another theme for smaller players and new entrants to take note of,” Harwood said.

“As economic conditions improve, there could be new owners and new capital looking to monetize these assets…

“We think regional NOCs, Middle Eastern operators, and regional specialists will continue to be active players shoring up assets in Southeast Asia.

“Recent global corporate activity will have a knock-on effect on Southeast Asia portfolios. And changes in the regional investment climate following recent elections, fiscal adjustments, and exploration success could spur new activity.”

04/26/2019