Oil province emerging close to Vietnam/Indonesia median line

Jeremy Beckman, Editor, Europe

Vietnam is on the verge of producing its first oil from the Nam Con Son basin. London-based Premier Oil is looking to develop two faulted structures discovered recently in the south of the basin, which could yield up to 80 MMbbl. All previous finds in this region have been gas.

Both Dua and Chim Sao were drilled and appraised in 2006, flowing oil from previously untested clastic sequences. They are situated in the 12W block in relatively shallow water, around 400 km (248 mi) southeast of Ho Chi Minh City. Dua was actually tested first by Shell in 1974, with a well drilled into the crest of the structure (Dua-1X), which flowed oil at 1,500 b/d of oil.

According to Premier’s operations director, Neil Hawkings, Shell drilled an appraisal well down-dip of the discovery the following year, but found only water. The company then withdrew from Vietnam.

Activity on the blocks remained suspended until 1979, when new operator Agip drilled another big step-out on Dua. Again, the result was mainly water, the well-path heading too far down-dip, says Hawkings. In 1992, BP took the acreage as one of a new wave of western operators, but never drilled it, assuming the field had only 30 MMbbl of oil recoverable.

Thereafter, the license reverted to the Vietnamese government until September 1997, when Samedan Energy signed a production-sharing contract. After farming out part of its 100% interest to Israel’s Delek Energy, Samedan drilled the Lark prospect, southwest of Dua, the result being oil shows.

“This was actually an attempt to drill what turned out to be Chim Sao,” Hawkings explains, “but it missed, the target area being outside the structural closure.” The partners went on to drill the Swan prospect in the same area.

Late in 2003, Samedan opted out, leaving Delek with 100% of the license, until Premier came on board in September 2004. For Premier, one of the main attractions was the geological analogies with the West Natuna Sea area 300 km (186 mi) to the southwest off Indonesia. Here the company operates part of the West Natuna Gas project, exporting gas via a pipeline to Singapore.

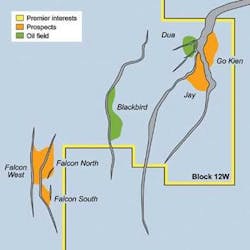

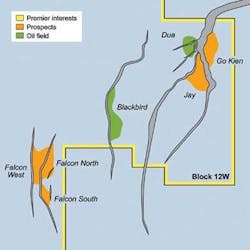

“Our producing fields in Natuna Sea block A are Kakap/Anoa, which are only 250 mi (402 km) south of the 12W block,” Hawkings points out. “Blackbird is as close to Anoa as it is to the Vietnamese mainland. The geology is all part of the Eastern Malay basin - our Indonesian fields are from the same clastic sequences.”

Revised model

During late 2004-2005, the new partners acquired over 1,500 km (932 mi) of 2D seismic over parts of the 12W block, and 3D seismic specifically over Dua and Swan, with a view to drilling these structures in 2006.

“We looked at the previous well data,” Hawkings says, “and realized that in the area between the very old data on the Shell well and the two subsequent big step-outs, there was room for an oil field on Dua. Based on interpretation of our own seismic mapping, we also saw that the previous drilling efforts had been outside the structural closure.”

In April 2006, Australia’s Santos agreed to fund Premier’s 75% of the drilling costs for two obligation wells in exchange for 37.5% of the license. One month later, the semisubmersibleDiamond Offshore spudded a vertical well and side-track on Dua’s northern flank (Dua-4X and Dua-4X ST1), encountering commercial rates of oil and gas.

The rig then moved to drill a second geological sidetrack (Dua-4X ST2) into Dua’s southern fault block, intersecting a gas column within limestones above the main target. Due to technical difficulties operating close to the foot of the limestone column, Premier plugged the well, re-drilling it as a vertical well (Dua-5X) into the southern flank.

This approach proved more effective, the new well encountering multiple gas and oil reservoirs.

One of the reservoir zones tested oil at a stabilized rate of 5,543 b/d with 6.76 MMcf/d of associated gas, via a 128/64-in. choke. A deeper-lying secondary reservoir flowed 247 b/d through a 28/64-in. choke.

“The one surprising outcome,” says Hawkings, “was finding oil and gas reserves above the main Dua horizon, where Agip had encountered oil.”

Premier then steered the rig 21 km (7 mi) to the southwest to drill well 12E-CS-1X vertically into a large tilted fault block on the newly identified Blackbird prospect, up-dip of the Lark well. This also had good results, encountering four oil-bearing intervals in the main Middle Dua target, and intersecting over 70 m (223 ft) of net pay. Two of these zones tested at a combined rate of 6,569 boe/d, with no associated water. This result led to the well being side-tracked down-dip to delineate the oil/water contact and the extent of the hydrocarbon-bearing reservoir.

Recently, Premier estimated oil in place across the two fields at 120-620 MMbbl. In an attempt to resolve uncertainties over Blackbird’s reserves, the partners acquired 1,600 sq km (618 sq mi) of 3D seismic this spring over the field and adjacent prospects, ahead of a second phase of exploration drilling in 2008.

“The wells we have drilled so far have been very successful,” says Hawkings, “giving us a lot of data. By combining the results with previous data sets, we built up a fairly good picture of what’s going on. The missing link was the 3D seismic over Blackbird.

“The key issues we have to determine are the extent of faulting, and the size and continuity of the sandstone reservoirs. This is not a traditional basement, but a clastic sequence - not every reservoir has oil in it. The results of the survey will also influence well engineering for the development.”

Premier anticipates recovering up to 80 MMbbl from Dua and Blackbird (since re-named Chim Sao). It aims to submit a reserves report and development plan to PetroVietnam by year-end.

“Even if we decide we do need another appraisal well,” he says, “that may not delay our final investment decision.” Assuming reasonably swift government sanction, first oil could be out by late 2009 or early 2010.

The partners have contracted theWilboss, a new jackup built in Singapore and operated by Premium Drilling, for a three-four well exploration campaign in the first half of next year.

“It will be drilling oil targets in the same clastic sequence, which if successful could be added onto the development.”

The four main prospects under scrutiny are Chim Ung (ex-Falcon), Jay, Go Kien, and Peacock, in no fixed order.

“We expect each well to take around six weeks, and we have options to keep the rig for up to two years - which would include development drilling.” Other leads have also been identified farther out which could be drilled at a later date.

Premier plans to install minimal facility wellhead platforms on each of the fields to be developed in the first phase program. These would be linked to an FPSO processing up to 25-30,000 b/d of oil, all offloaded to shuttle tankers. The chosen vessel, which could be spread- or turret-moored, will likely be stationed over Blackbird in around 115 m (377 ft) of water.

“This is to do with the different oil types. It’s easier to flow oil from Dua to Blackbird than vice versa. Also, we expect Blackbird to end up bigger in terms of production,” he adds.

Premier plans to handle most of the well engineering in-house. “We’re not expecting a strong aquifer, so we do envision applying water injection and artificial lift on Blackbird, although that may not be the case on Dua. At this stage, options for handling associated gas include flaring, re-injection, or export through BP’s Nam Con Son gas pipeline. Operatorship of the pipeline is about to switch to PetroVietnam, and they could make spare capacity available for associated supplies from our oilfields.”

Premier has invited potential FPSO suppliers to make their pitch.

“In that region, there are a wide variety of options,” says Hawkings. “We could opt for a new conversion, or an existing FPSO coming off station. Or it could be an FPSO conversion being done currently on a speculative basis - a few companies are doing this at the moment in Southeast Asia. That might help with the development schedule, although the cost advantage may be questionable.”

An early production system is also an option, but not really the plan.

“We’re looking at an FPSO being on station in 2010,” says Hawkings. The timing would depend on FPSO availability, but maybe more critically on securing a vessel spread to install the intra-field pipelines.

Assuming development goes forward, PetroVietnam has back-in rights to a maximum 15% stake in the 12W block. In that case, the state-owned company would fund its share of the development costs, though not of prior exploration drilling.

“All the partners must come up with their own financing arrangements,” says Hawkings. “Ours are already in place - we have sufficient funding to cover this and other anticipated expenditure. The investment in block 12 would be on the same scale as our Kakap/Anoa field developments in the West Natuna Sea. We are trying to do in block 12 what we did on those projects - oil production, followed by exploitation of the gas.”

Deeper water potential

Last December, Premier also acquired a 45% operating interest in block 7/8/97 (since re-named (07/03) from Vietnam American Exploration Co., a US independent. The acreage covers an area of 4,918 sq km (1,899 sq mi) immediately southeast of block 12W. According to Hawkings, wells were drilled on the block by previous license holders, but these targeted the big overlying carbonate reefs, rather than the equivalent to the Dua sandstones.

“We believe that the oil source kitchen in block 12W could extend into block 7/8/97, and into the Tuna block that we picked up recently on the Indonesian side of the median line. We are looking to extend the oil play into these two blocks, but the water depths are deeper, and will therefore require a semisubmersible to drill.”

Analysis of a new 2D seismic grid over 07/03 already suggests the same play elements are in place for oil prospectivity, and that the structures here could be significantly larger. Further geological and geophysical studies are under way to define drilling targets. If the partners can contract a semi, it could start drilling at the end of next year or early in 2009, and Premier would also like to take the rig for a well in the Tuna block.

Other consortia are starting to move into the area, Hawkings points out, with Pearl and Serica acquiring block 6, just to the north of 07/03, and Mitra taking blocks 28 and 29 to the west of block 12W.