GLOBAL E&P

Americas

Pemex has contracted ICA Fluor to build two lightweight platforms for its Cantarell field in the Gulf of Mexico. The new structures, to be supplied and installed by ICA Fluor and its Mexican subsidiary, Industria del Hierro, will link to the existing Akal-R and Akal-L production platforms.

Offshore Trinidad, BHP Billiton has contracted J. Ray McDermott’s yard in Morgan City, Louisiana, for a platform for its Angostura gas export project. This will comprise a 4,000-ton (3,629-metric ton) topside; an 800-ton (726-metric ton), four-leg jacket; and 1,000 tons (907 metric tons) of piles. The work should be completed during spring 2010.

Recently, J. Ray also supplied and installed a 9,100-ton (8,255-metric ton), four-leg jacket platform and 4,656 tons (4,224 metric tons) of piles for a platform for BG Trinidad & Tobago’s Poinsettia field in 530 ft (162 m) of water. The topsides were fabricated by the TOFCO joint venture in Trinidad, with Fluor providing overall project management.

Petrobras’ FPSOCidade de Sao Mateus has left the Keppel Shipyard in Singapore and is undergoing installation on the Camarupim field off the coast of Espirito Santo. The vessel, chartered from Prosafe, will have an initial six-year tour of duty, with a potential six-year extension. It has been designed to handle 35,000 b/d of fluids and 353 MMcf/d of gas. Produced gas will be exported through pipelines, while oil will be stored in the hull for later transportation to shore by shuttle tankers.

BPZ Resources and Shell Exploration have terminated talks on a farm-out agreement for blocks Z-1, XIX, and XXIII offshore Peru. BPZ will maintain its 100% interests in these and block XXII, which was not part of the discussions. The Houston-based company now will focus on a new oil development in block Z-1 centered on the Albacora and Corvina fields.

North Sea

StatoilHydro and its partners Marathon and GDF Suez expect to issue a development plan later this year for Gudrun field in the Norwegian sector. This will involve a fixed platform with seven wells and production tied back to existing facilities in the Sleipner area and the process plant at Kaarsto, north of Stavanger.

Gudrun, in 110 m (361 ft) of water, 55 km (34.2 mi) north of Sleipner, contains oil and gas, with estimated recoverable volumes of 150 MMboe. The reservoir is complex, with high-pressure/high-temperature. It was first proven in 1974, with StatoilHydro becoming operator in 1997.

There also are plans to connect a subsea system on the Sigrun field to the Gudrun platform at some point.

Offshore exploration activity on the UK continental shelf stayed high last year, according to Deloitte’s latest North West Europe Review. The report, compiled by Deloitte’s Petroleum Services Group, identified 121 exploration and appraisal well spuds in UK waters, only two down on the figure for 2007.

Appraisal drilling accounted for 54% of that total, with 46% exploration-related. The Central North Sea remained the most active region, attracting 27% of wells in these categories. But there was a more even spread of wells than in recent years, with 67% directed at the Southern and Northern North Sea and the Moray Firth, off eastern Scotland.

However, the sudden oil price slump and credit squeeze could transform the picture in 2009, Deloitte says. A downturn in new well activity late in 2008, is indicative of companies re-assessing their priorities.

Africa

Tullow Oil has proven further oil from two appraisal wells in its deepwater Ghana permits. Mahogany-3, drilled in 1,236 m (4,055 ft) of water in the West Cape Three Points license, penetrated 33 m (108 ft) of net pay from two intervals.

Wireline logs and reservoir fluid samples suggest the well encountered stacked oil-bearing sandstones, confirming a significant extension of the Jubilee field to the southeast. The well also found oil in sandstones at Mahogany Deep, a target at a previously untested stratigraphic level below the oil/water contacts recorded during earlier exploration on Jubilee.

Hyedua-2, drilled by the semiBlackford Dolphin, again to appraise Jubilee, flowed at rates of up to 16,750 b/d of oil, confirming good reservoir connectivity. It has been suspended for later use as a production well. Tullow says Phase 1 of the Jubilee development is on schedule to deliver first oil in the second half of 2010.

Total E&P Nigeria has started a two-year program of exploration and appraisal with a discovery on the shallow water Etisong prospect in OML 112. The Etisong-1 well, drilled in 70 m (230 ft) of water to a total depth of 2,207 m (7,241 ft), generated over 6,000 b/d of oil during tests from turbiditic reservoirs. Total aims to establish a new development pole in this license, taking in this discovery and other nearby structures.

Mediterranean Sea

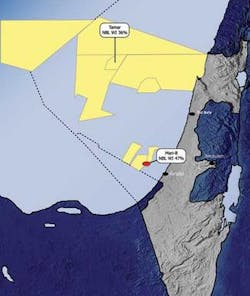

Noble has discovered gas in the deepwater Matan license offshore Israel. The well on the Tamar prospect, in 5,500 ft (1,676 m) of water, was drilled to TD of 16,076 ft (4,899 m) to test a subsalt lower Miocene target in the Levantine basin.

Formation logs indicated net pay of more than 460 ft (140 m) in three reservoirs. Thickness and quality of the reservoirs exceed expectations, the company adds. Analysis to date suggests pre-drill gross mean resources of over 3 tcf of gas.

Noble planned further production testing after completing the well, and may elect to keep the rig for two further wells in the basin. One could target a second subsalt, lower Miocene prospect.

Mediterranean Oil & Gas (MOG) is seeking an offshore production concession from Italy’s government for the Ombrina Mare field in the Adriatic Sea. The application covers an offshore area of around 150 sq km (58 sq mi).

Following successful appraisal drilling last year, MOG estimates the field’s 2P reserves at 20 MMbbl of oil and 6.5 bcf of gas. It plans to extract these via a single production platform with five wells, two of which will have dual completions for oil and gas. Produced oil would be sent to an FPSO with storage capacity for up to 50,000 metric tons (55,000 tons) of oil, while a 12-km (7.4-mi) submarine pipeline would be built to take the gas directly to an existing process plant onshore. MOG is targeting late 2011 for start-up, with production ramping up eventually to 7,500 b/d of oil and 3.5 MMcf/d of gas.

Offshore Libya, Hess has hit pay in the deepwater Arous Al-Bahar prospect. The A1-54/01 well, drilled to a depth of 11,077 ft (3,376 m) in 2,807 ft (856 m) of water, encountered a gross hydrocarbon section of around 500 ft (152 m) at various intervals.

Caspian Sea

A joint venture of Aker Solutions, CB&I, and WorleyParsons has won a $135 million front-end engineering and design services contract for Phase II of the Kashagan full-field oil development. The scope of work takes in both offshore and onshore facilities and pipelines, with options for early works, detail engineering, procurement services, technical assistance, and design/system integrity. It also provides for optional FEED programs for other fields in the Kazakh sector, including Aktote, Kairan, and Kalamkas.

Work on the project started last November following a letter of intent from operator Agip KCO, and should be completed early next year. But additional options could extend the program up to an eight-year period. Kashagan has estimated oil reserves of 12-15 Bbbl.

Saudi Arabia

Saudi Aramco has made a series of finds in the Arabian Gulf. Its Jurayd-101 well tested oil from three reservoirs, flowing at combined rates of around 1,700 b/d of oil.

The Arabiyah-1 well flowed 41.1 MMcf/d of gas during an open-hole test in the Khuff B reservoir, with a wellhead flow pressure of 5,865 psi on a 36/64-in. choke. Flow could be significantly higher under a normal production completion, the company added.

Another Khuff B well, Hasbah-16, generated 62.1 MMcf/d of gas from an open-hole test at 12,700 ft (3,871 m), while over the Jauf reservoir, a cased-hole test on the Rabib-1 well at a depth of 17,130 ft (5,221 m) flowed at 40.6 MMcf/d.

India

BP and Reliance Industries have been awarded deepwater block KG-DWN-2005/2, 40 km (25 mi) off India’s eastern coast, under the NELP VII licensing round. BP will operate with 30%, while Reliance holds the remaining 70% interest.

The block covers an area of 1,949 sq km (752 sq mi). In the first exploration phase, the partners will acquire 2D and 3D seismic and reprocess existing seismic data.

Asia/Pacific

CNOOC has budgeted $6.76 billion for its upstream projects this year, including $4.38 billion for development, $1.11 billion for exploration, and $1.12 billion for production. It expects to bring onstream 10 new projects, eight of them are offshore China, which also will be the focus of its exploration activity. In all, the company expects to drill over 80 wells and acquire over 30,000 km (18,641 mi) of 2D seismic, and 9,200 sq km (3,552 sq mi) of 3D seismic off China and elsewhere.

Production has started through two new fixed platforms in the Sakhalin II concession off Sakhalin Island. The PA-B installation is producing oil from the Piltun area of the Piltun-Astokhskoye field: the Astokh area has delivered oil since 1999 through the much smaller Molikpaq platform. In both cases, oil flows through the 800-km (497-mi) Trans-Sakhalin pipeline system to an export terminal in the south of the island.

Shortly after PA-B came online, the Lun-A platform began producing gas from two wells on the Lunskoye field off northeast Sakhalin Island. The gas is sent through multiphase subsea pipelines to an onshore processing terminal. The treated gas then heads to the LNG plant on southern Sakhalin via the Trans-Sakhalin pipeline system.

Otto Energy has agreed to farm out 60% of its interest in Service Contract 55 in the Philippines to BHP Billiton Petroleum. The permit covers a deepwater block off southwest Palawan Island. In return, BHP will bear the full costs of a 3D seismic acquisition program and two exploratory wells, also assuming operatorship of the permit. The agreement is conditional on securing joint operating agreements and government approvals.

Australia

Apache Corp. and Santos have agreed to supply gas from the offshore Reindeer field to CITIC Pacific’s Sino Iron project in Western Australia. Under a seven-year contract, the Reindeer partners will export 154 bcf of gas through a new 65-mi (105-km) subsea pipeline to a new process plant onshore at Devil Creek, capable of handling 210 MMcf/d. Exports should start during the second half of 2011.

Thailand’s PTTEP has signed a conditional shares agreement to acquire Australian company Coogee Resources for $170 million. Coogee has a 70.94% operated interest in the Jabiru and Challis oil field in the Timor Sea. The acquisition will also provide PTTEP with significant potential reserves from various Australian E&P licenses, including AC/L7, AC/RL7, AC/P32, AC/P34, and AC/P40.

Maersk Drilling has taken delivery of jackup,Maersk Resolve, its third of four newbuild jackups being built by Keppel FELS. The rig is designed to drill wells in up to 350 ft (107 m) of water to 30,000 ft (9,144 m) deep. The fourth rig in the series is scheduled for delivery in the second quarter of this year.