Global E&P

Judy Maksoud • Houston

Europe

Almost all of the exploration wells drilled on the Norwegian shelf this year have yielded positive results. According to Bente Nyland, Norwegian Petroleum Directorate explorations director, "The first six months of 2004 have been very good in terms of successful discoveries on the Norwegian Shelf." Only two of the exploration wells that were spudded in 2004 were completed without discovery.

As of June 15, 2004, five appraisal wells and seven wildcats were spudded on the Norwegian shelf.

"We expect exploration activity for the whole of 2004 to be slightly above 20 exploration wells," Nyland said.

Three exploration wells are now underway: Statoil's well 34/10-48 S in the Gullfaks area, Hydro's well 30/11-6 in the Oseberg area, and Shell's well 6406/9-1 in the Norwegian Sea.

So far this year, two new oil discoveries have been made in the North Sea.

Activity in the Black Sea is heating up. Calgary's Stratic Energy Corp. has entered into a farm-out agreement with Toreador Resources Corp. to participate in drilling an exploration well offshore Turkey. The well was spudded in July and should be complete this month.

Stratic agreed to pay 25% toward the costs of the Ayazli-1 exploratory well to earn a 12.25% working interest in eight contiguous permits covering 3,893 sq km in the shallow water of the western Black Sea.

Toreador will operate the well through subsidiary Madison Oil Turkey Inc. and will pay 75% of the well costs to retain a 36.75% working interest. The Turkish national oil company TPAO is carried through the well but can exercise back-in rights under Turkish petroleum law to take the remaining 51% working interest.

Stratic will also pay 25% of the cost of the 1,275-line-km 2D seismic survey, acquired by Madison in 2002, over the four westernmost permits.

The Ayazli-1 well holds an estimated 350 bcf of gas and will be the first offshore well drilled in Turkish waters of the Black Sea for five years. Total resource potential of the permit area exceeds 1.5 tcf. Assuming Ayazli-1 is successful, further drilling will follow in early 2005.

Middle East

Qatar Petroleum and Shell have signed a development and production-sharing agreement for the Pearl GTL project.

The project comprises development of upstream gas production facilities as well as an onshore GTL plant that will produce 140,000 b/d of GTL products and significant quantities of associated condensate and liquefied petroleum gas. The project will be developed in two phases with the first phase operational in 2009, producing around 70,000 b/d of GTL products. The second phase is to be completed less than two years later. The project includes developing a block within Qatar's North field gas reserves.

The first of two appraisal wells in the North field was drilled in February 2004.

Africa

Mauritania will soon see more exploration drilling. The Mauritania joint venture partnership, which includes Woodside Energy Ltd., BG Group, Hardman Resources, Fusion Mauritania, Premier Oil Plc., and ROC Oil, has agreed on details for the 2004 exploration and appraisal drilling campaign.

Drilling was scheduled to begin this month and will continue until Chinguetti development drilling begins in 4Q 2004. Five exploration wells are planned in PSC areas A and B, with up to four appraisal wells on the Tiof discovery in PSC B.

The exploration program includes work on the Tevet, Capitaine, and Merou prospects in PSC B. Tevet is a lower risk prospect with potential to be the first satellite tieback to the Chinguetti hub. Capitaine and Merou have the potential to be similar in size to Tiof, as does Sotto, which lies in PSC Area A.

The drilling program on Chinguetti will follow in 4Q 2004 and will comprise up to six oil production wells, four water injection wells, and one gas injection well as part of the phase 1 development on PSC B.

Gas from Namibia's offshore Kudu field could soon feed a local power plant. In early 3Q 2004, Tullow Oil subsidiary Energy Africa concluded a joint development agreement with the National Petroleum Corp. of Namibia (Namcor) and NamPower, the Namibian power utility company, to develop the Kudu field as part of a gas-to-power project. The Kudu field lies 130 km offshore southwest Namibia.

Gas from the Kudu field could soon power a domestic facility in Namibia.

The project involves offshore development of the Kudu gas field by Energy Africa and Namcor, and piping gas to shore for treatment and delivery to an 800-MW power station to be developed and commercially operated by NamPower near Oranjemund. The produced electricity will be sold to NamPower for resale into the Namibian market and to Eskom for the South African market.

The primary objectives of the next phase of the Kudu gas field development are to confirm project viability, complete detailed engineering and design work, and procure appropriate financing, leading to a final investment decision by the end of 2005.

Energy Africa operates the Kudu gas field with 90% interest. Namcor holds 10% interest.

Mediterranean

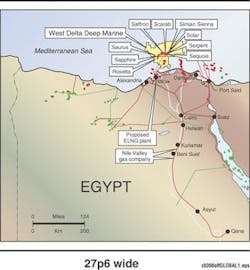

Weatherford International Ltd.'s Pipeline & Specialty Services (P&SS), in alliance with Norson Services Ltd., was awarded a multi-million-dollar contract by Technip Offshore UK Ltd. to provide pipeline pre-commissioning services as part of the Simian, Sienna, Sapphire development project offshore Egypt in the West Delta Deep Marine concession.

The scope of work includes pipeline flooding, cleaning and gauging, pipeline hydrotesting, and pipeline dewatering/nitrogen packing. Norson Services will provide subsea pigging technology as well as hydrotesting services.

The first phase of offshore work was to begin last month and will continue through October 2005.

The Simian, Sienna, and Sapphire fields are being developed to supply the Egyptian LNG export project. The three fields will be integrated with the Scarab/ Saffron development.

All of the pipelines from the fields are to be linked using subsea manifolds and subsea distribution assemblies and will be routed to an existing pipeline end manifold (PLEM).

Egypt's West Delta Deep Marine concession will supply gas for the Egyptian LNG export project.

The PLEM is part of the existing Scarab/Saffron offshore pipeline system and will be used to transport all the gas from the fields to an onshore gas liquefaction plant.

Central Asia

The American Bureau of Shipping has signed a memorandum of understanding with the Republic of Kazakhstan's agency for emergency situations to devise a formal framework for technical collaboration between the two organizations for offshore oil and gas operations.

The agreement recognizes ABS' classification and certification services for offshore oil and gas facilities in the Kazakhstan sector of the Caspian Sea, which is in the northeast portion of the sea and home to some of the largest known oil fields.

According to Ibrahim Fawzy, ABS district manager for ABS Europe, "The Kazakhstan area is most active in field development work, but with water depths of approximately 20 ft, the dynamics of floating structures and shallow hazards for moving vessels are particularly challenging."

Reserves in the shallow-water area off the Kazakhstan and Russian coastlines are estimated at upwards of 50 Bbbl.

Kazakhstan's southern neighbor is seeing some more activity from Dragon Oil. The company began a work-over program for several wells in the Lam field in the Cheleken contract area, offshore Turkmenistan. The old wells on the field were drilled before Dragon signed its production-sharing agreement and conducted more recent drilling. According to Dragon, the old wells have significant potential for untapped behind-pipe reserves.

Asia-Pacific

Murphy Oil Corp. has had more good fortune offshore Malaysia. The company's deepwater Kakap No. 1 exploration well encountered significant oil and natural gas pay in multiple reservoirs in block K, offshore Sabah.

"This latest discovery at Kakap further confirms our view that there is significant exploration potential across our deepwater Sabah acreage," Claiborne P. Deming, Murphy's president and CEO, said. Kakap is a new discovery in block K, and the company is evaluating development options.

"We found high quality oil in multiple sands with excellent reservoir properties in the Kakap No. 1 well, and subsequently sidetracked the discovery well and recovered full cores in each of the main reservoirs," Deming said.

Murphy operates the four-million-acre block K with 80% interest. Petronas Carigali Sdn. Bhd. holds the remaining 20%.

Americas

Falkland Islands Holdings recently formed a new oil exploration company, Falkland Oil & Gas Ltd., set up with Global Petroleum and funds managed by RAB Capital. The new company will team with Hardman Resources to invest $4.5 million in funding a work program offshore the Falkland Islands, an area the companies estimate to hold 200 MMbbl to 2.5 Bbbl of oil.

Over the next year to 18 months, work on the petroleum exploration license will include the design, implementation, processing, and interpretation of a 2D seismic survey. The new survey follows mapping in 2003 of 4,340 km of purchased seismic data, which has been used to identify a number of leads in water depths of 400-1,850 m.

The licenses cover an area of 33,700 sq km and are located to the south and east of the Falkland Islands. To date, no wells have been drilled in these areas.