Africa

Judy Maksoud • Houston

Africa

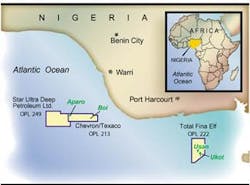

ChevronTexaco Corp. affiliate Star Ultra Deep Petroleum Ltd. had a significant oil discovery on its deepwater license OPL 249 offshore Nigeria.

The wildcat Nsiko-1 well, drilled to a total depth of 13,968 ft, discovered hydrocarbon pay in multiple zones. The well was abandoned upon completion of testing operations. Appraisal drilling on the Nsiko discovery is planned for the first half of 2004.

Star Ultra Deep is 100% equity holder and technical advisor to Oil & Gas Nigeria Ltd.

ChevronTexaco also saw positive results from an appraisal well drilled on the Aparo field that shows the field extends into neighboring OPL 249. The well, drilled in 4,270 ft of water to a total depth of 12,000 ft, encountered a substantial amount of net oil sand. The results from the Aparo-3 well indicate OPL 249 Aparo, OPL 213 Aparo, and OML 118 Bonga SW share a common structure. This could lead to joint oil development by shareholders in OPL 249, OPL 213 (operated by Texaco Nigeria Outer Shelf Ltd. with 100% interest), and OML 118 partners (where ChevronTexaco has no affiliate interest).

null

Further south, ChevronTexaco Corp. affiliate Chevron Petroleum Nigeria Ltd. reported a significant extension of the Usan field discovery in deepwater OPL 222. The Usan-4 appraisal well, 3 mi south of the Usan-1 well in 2,460-ft water depth, is the third successful appraisal of the Usan field, discovered in 2002.

Two zones were tested in the Usan-4 well and flowed at 4,400 and 6,300 b/d under restricted flow conditions. Usan-4 has confirmed the presence of commercial quantities of oil, as well as additional potential in previously untested reservoirs.

Nigerian National Petroleum Corp. is concessionaire for OPL 222 under a production sharing contract operated by the Nigerian subsidiary of Total Elf Petroleum Nigeria Ltd., a 20% stakeholder in the field. Partners are Chevron Petroleum Nigeria Ltd. with 30%, Esso Exploration & Production Nigeria with 30%, and Nexen Petroleum Nigeria Ltd. 20%.

Americas

Greg Noval, president and CEO of independent Canadian Superior, told participants at the Canadian Offshore Resources Exhibition and conference in Halifax in October that his company sees tremendous potential off Nova Scotia. "We're very upbeat about Nova Scotia or we wouldn't be here," Noval said. "It is the last great mega-play in North America."

Despite the high cost of drilling offshore, the seismic data has kept Canadian Superior's interest high, Noval said.

With majors and supermajors moving more slowly than the independents, Noval predicts independents like Canadian Superior will be the first to find the elephants in the Eastern Atlantic. "Big companies are sometimes whiners," Noval said, but that is not a bad thing for independents. "Every time a big guy whines and says he's going to leave town, it creates an opportunity for independents," Noval said. "We're not here to whine. We're here to produce some results."

In late October, Canadian Superior Energy Inc. signed a contract with Rowan Companies Inc. for super Gorilla-class jackup Gorilla V to perform initial drilling on the company's Mariner block.

Canadian Superior's Mariner block on license EL 2409 is north of the eastern tip of Sable Island on the Scotian shelf. The first Mariner well, 5.5 mi northwest of Sable Offshore Energy Project's Venture natural gas producing field, will be one of the deepest offshore wells drilled in Canada this year. The block covers 101,800 acres and directly offsets five significant discoveries near Sable Island. Drilling began in November.

Most of the recent drilling off Nova Scotia has not found hydrocarbons. But the dry holes to date have provided critical information that has been evaluated in making the decision for subsequent drilling, according to Noval.

"I think Nova Scotia is truly a world class basin," he said.

Extreme volatility in gas prices is pushing exploration into deepwater. According to David Brown of the Canada-Nova Scotia Offshore Petroleum Board, increasing demand and decreasing production create a situation that is "simply unsustainable." The petroleum industry is looking toward deepwater to meet demand.

According to numbers Brown presented, there is a 90% chance of finding 5 tcf of gas in Nova Scotia's deepwater, and there is a good chance that much larger reserves will be discovered. Brown believes better seismic interpretation and more deepwater drilling will turn up the elephants lurking in Atlantic Canada's deepwater plays.

Middle East

Qatar Petroleum and Qatar Shell GTL Ltd. signed a heads of agreement for the construction of the world's largest gas-to-liquids (GTL) plant in Ras Laffan, Qatar.

The agreement was signed by His Excellency Abdullah Bin Hamad Al-Attiyah, second deputy prime minister and minister of energy and industry of Qatar, and by Sir Philip Watts, chairman of the committee of managing directors of the Royal/Dutch Shell Group of companies.

The agreement includes fiscal terms for the project, which will be executed under an integrated development and production sharing agreement. The project includes developing a block within Qatar's North field gas reserves, the world's largest natural gas accumulation, with reserves of over 900 tcf.

Shell plans to invest $5 billion to develop upstream gas and liquids facilities and an onshore GTL plant that will produce 140,000 b/d of GTL products as well as significant quantities of associated condensate and LPG. The project will be developed in two phases with the first phase operational between 2008 and 2009, producing around 70,000 b/d of GTL products.

Only days earlier, ExxonMobil Corp. signed an agreement with Qatar Petroleum to supply LNG from Qatar to the US for an expected period of 25 years. His Excellency Abdullah bin Hamad Al-Attiyah, and Harry Longwell, director and executive vice president of Exxon, signed the agreement at a ceremony in Doha.

The agreement covers development of two large LNG trains with combined capacity of 15.6 million tons per year of LNG, or about 2 bcf/d of gas, by Ras Laffan LNG Co. Ltd. II. The feed gas for these trains will be sourced from the North field. More than 26 tcf of the field's reserves will be dedicated to this project.

The project is the largest LNG import project that has been announced for supplying natural gas to the US. LNG delivery to the US is projected to begin in 2008/2009.

Several locations are currently under evaluation for developing a receiving terminal.

Mediterranean

Centurion's Gelgel field in the company's South Manzala development lease in Egypt's Nile Delta began production on Oct. 20.

The Gelgel field has brought total production from the South Manzala area to 33 MMcf/d and has raised company-wide production to approximately 9,900 boe/d.

Late this year, Centurion completed compression facilities that will increase production from the South Manzala area and stabilize production to the contracted production rate of 35 MMcf/d.

This increase in production will allow Centurion to begin a new phase of high impact exploration.

Europe

Melrose Resources has floated the Galata platform out of the shipyard in Varna, Bulgaria, and is installing it on the Galata gas field 19 km from shore. The 80-bcf field is expected to produce for seven years, with first production scheduled for January 2004.

And Total and Rosneft have signed a joint venture agreement to explore and develop the 12,000-sq-km Tuapse depression offshore Russia in water depth ranging from 500 to 2,000 m.

The first phase of activity will be 2D and 3D seismic surveys, followed by an exploration well.

Rosneft won the exploration license in mid 2003. The license is to be transferred to a 50-50 joint venture.

Central Asia

Lukoil is energetically pursuing all of its current Kazakhstan projects, and the list of Lukoil initiatives in Kazakhstan will grow in the near future. Oil production of programs with Lukoil involvement increased by 30% year-on-year in the first nine months of 2003.

According to Lukoil, the company is reducing operating costs on its Kazakhstan projects as well as increasing investment efficiency and improving management systems.

Nursultan Nazarbayev, the president of the Republic of Kazakhstan, and Lukoil President Vagit Alekperov met to discuss Lukoil's expanding activities in Kazakhstan. Lukoil's plans are particularly important in view of the state program for Caspian Region Development, recently adopted by the Kazakhstan government.

Lukoil, the largest Russian investor in Kazakhstan, has invested more than $1.5 billion in the republic's economy over the last eight years. The company participates in seven oil and gas projects, including production projects for development of the giant western Kazakhstan Tengiz and Karachaganak fields and the Kumkol field in southwest Kazakhstan. Lukoil is also a member of the Caspian Pipeline Consor-tium and is implementing two promising geological surveys in the Russian sector of the Caspian Sea. The surveys will evaluate the Khvalynskaya structure (jointly with Kazakhstan state oil and gas company KazMunaiGas) and the Centralnaya structure (jointly with Kaz-MunaiGas and Gazprom). KazMunaiGas is also Lukoil's partner in preparatory work for the Dostyk offshore project in the Kazakhstan sector of the Caspian Sea.

"We consider Kazakhstan as a key strategic region for company activities, and all the necessary conditions for efficient investments in the oil and gas sector in Kazakhstan have been put in place," Lukoil President Vagit Alekperov said.

Asia-Pacific

In early 3Q, China National Offshore Oil Corp. Ltd. signed an agreement with the Gorgon Venture participants on one of the biggest LNG deals in the industry's history.

The agreement calls for the parties to set aside a significant volume of Gorgon LNG for use in the growing Chinese market.

Cnooc Ltd. will purchase an equity stake in the Gorgon gas development, while parent company Cnooc will arrange to purchase a certain volume of LNG directly from Gorgon.

Cnooc is already involved in two LNG receiving terminal projects in China, in Guangdong and Fujian.

The Gorgon Joint Venture participants consist of ChevronTexaco (57.1% and operator), Shell (28.6%) and ExxonMobil (14.3%).

Esso Australia and BHP Billiton are planning an exploration and production drilling program in the Gippsland basin that is expected to be the largest since the 1980s.

Depending on the success of initial wells, the program is expected to extend into 2005.

The planned drilling program is based on 2002 3D seismic data.

Drilling will target both oil and gas opportunities, and all planned wells will be located within existing production license areas.

"We believe there are new oil and gas resources still to be found in the Gippsland basin. From an exploration viewpoint, the program is all about finding new potential in a mature basin," said Doug Schwebel, Esso Australia exploration director.

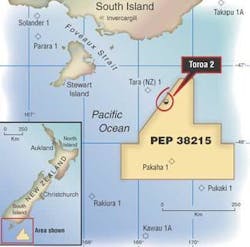

Australia's Bounty Oil & Gas NLand its co-venturers have farmed out a 25% interest in PEP 38215 in New Zealand's Great South basin.

UK-based Electro Silica Plc. has agreed to fund the acquisition of 2,000 km of 2D seismic in the permit to earn a 25% interest in the permit and an option to drill an exploration well to earn a further 50%. The seismic is scheduled to be acquired in the first half of 2004.

null

Tom Fontaine, Bounty's managing director, said the partnership with Electro Silica confirms the joint venture's belief in the prospectivity of the permit.

"The permit contains a large structure called Toroa that was drilled in 1976 but not tested. We believe this may hold commercial quantities of recoverable gas. We have also identified a number of features that each have the potential to hold in excess of a billion barrels of oil. The next step for us is to acquire the seismic to allow us to optimize our drilling location. Once we have done that, we plan to bring in a rig and drill our best prospect."

The PEP 38215 permit covers 13,614 sq km in the Great South basin off the south coast of New Zealand. Probable recoverable gas reserves of 900 bcf and additional possible recoverable gas reserves of 2.2 tcf have been estimated in the Toroa structure.