Offshore bidding model enhances performance

Michael R. Walls, Ph.D.

Michael B. Heeley, Ph.D.

School of Mines

Analyses of recent lease sales in the Gulf of Mexico suggest that bid outcomes can be highly uncertain and the associated results for E&P companies who compete in the bid environment are mixed at best.

Data indicates significant over-bidding that can materially impact the economics of E&P activities and overall company performance. We observe average overbids that at times exceed $10 million per block and total overbids that exceed $1 billion on a single lease sale basis. Given recent events in the Gulf of Mexico, operators are even more compelled to improve their strategic and operating decisions. Bid-setting decisions can significantly impact the economic viability of being a successful player in this producing basin.

Recent developments in bidding models offer companies a more robust alternative for evaluating blocks of interest. The decision models we present can replace bidding behaviors that are often due to incomplete information, poor analysis, or emotions. These models predict the likelihood of competition and the magnitude of competing bids on blocks of interest, as well as recommend the optimal bid amount to maximize firm value. We discuss these econometric and decision analysis models and show how they can better inform decision makers and significantly improve the firm’s performance in the competitive bid environment. The competitive bid model that we discuss has broad implications for firms active in the Gulf of Mexico, as well as firms operating in other international competitive bid environments.

Bidding results

Bid amounts and bid activity have varied dramatically over the last 10 years in the Gulf of Mexico. Figure 1 shows the average bid in dollars per acre for federally-owned lease blocks in the Central Gulf of Mexico over the period 2002 through 2010 for a representative group of operators. These bids include both the winning and losing bids. Chevron, Newfield, Noble, and Woodside are all very active in the Gulf of Mexico. The Figure also shows a plot of the spot price of West Texas Intermediate oil over that same period. As expected, bid amounts are highly positively correlated with product prices.

Figure 1 also shows the average bid in dollars per acre for All Firms (red line) who participated in the Central Gulf of Mexico lease sales over this period. Note that the Central Gulf lease sales are highlighted on the vertical lines in Figure 1. Across all operators, average bids in 2006 were $256/acre, increased to $977/acre in 2008 and have subsequently decreased to $367/acre in the last Central Gulf of Mexico lease sale in March 2010. In addition, we see significant differences in the average bid per acre for the four operators highlighted in Figure 1.

The extent to which operators overbid is of particular interest in this data, since significant overbidding can lead to capital destruction and low rates of return on acquired blocks. “Overbid” can be viewed in a number of different ways. In the case of multiple bids for a single block, the overbid is defined as the difference between the highest (and generally) winning bid and the second highest bid. In the case of a sole bidder for a block, it is the difference between the single bid and the Bureau of Ocean Energy Management, Regulation, and Enforcement’s (BOEMRE) designated minimum bid or Mean Range of Values (MROV). Of course, to win a block an operator’s bid will have some amount of overbid; the challenge is to minimize the overbid amount.

Average overbid

Figure 2 shows a plot of the average overbid per block for all firms (red line), as well as Chevron, Newfield, Noble, and Woodside Energy over 2002 to 2010. The overbid amounts represent when there was more than one bidder for a given block. Note that the average competitive overbid in the most recent lease sale was about $2.5 million per block. It has been has high as $8.3 million per block.

Moreover, we see from Figure 2 that in our representative group there are overbids that range considerably higher than the average. In fact, we observe overbids as high as $83 million per block in recent lease sales.

Another way to characterize these findings is in terms of the “overbid rate.” This metric represents the percentage of overbid as compared to the next closest bid. In the last Central Gulf lease sale, the average overbid rate for cases where there were two or more bidders was more than double the next closest bid.

In the case of sole bidders, the average overbid rate was almost six times the minimum acceptable bid set by the BOEMRE. Even more striking is that in the 2008 Central Gulf lease sale, the total overbid amount for all firms was in excess of $2.3 billion.

Recent advances in decision models can go a long way toward improving the quality of bid decisions. The technology provides decision makers with an econometric-based analysis that enables them to better understand previous bidding behaviors in the Gulf of Mexico and their impact on current bidding outcomes. It also offers a forward-looking decision analysis model that recommends an optimal bid amount, given the likelihood of winning at alternative bid amounts, and the operator’s estimated asset value.

Multiple variables

The general purpose of regression models is to learn more about the relationship between several independent or predictor variables and a dependent or criterion variable. Most real world phenomena are multi-factorial in nature, meaning more than one factor impacts, or causes changes to the dependent variable. To predict the dependent variable as accurately as possible, it is usually necessary to include multiple independent variables in the model. In our discussion we refer to the lease block of interest as the “focal” block and the nearby blocks as the “proximal” blocks.

We use logistic regression to estimate the likelihood that a focal block of interest will receive a bid. In statistics, logistic regression (sometimes called a binary logit model) is used for prediction of the probability of occurrence of an event by fitting data to a logistic curve. In the context of bidding analysis, this form of regression is designed to capture the impact of predictor variables that may influence the likelihood that a focal block of interest receives a bid.

For example, the probability that a focal block of interest will receive a bid might be predicted from knowledge of the focal block’s attributes such as water depth, offset production, a block that is newly available, estimated MROV, etc. The likelihood the focal block receives a bid may also depend on proximal competitive bidding behavior in prior lease sales, that is, the number of proximal blocks receiving single or multiple bids, the magnitude of bids for proximal blocks, consortium bidding activity, etc.

We employ a multiple regression model to estimate the expected bid amount on a focal block of interest. Much like the logistic regression model, we use the proximal block attributes such as water depth, size of the block, estimated MROV, offset production, as well as the competitive bidding behaviors on proximal blocks in prior lease sales to assist in the prediction of the expected bid amount. Multiple regression helps us understand how these measures (the independent variables) relate to the predicted bid amount (dependent variable) on the focal block of interest.

In some cases, for example, we find that consortium bidding is more important than multiple bids. One may also detect “outliers,” that is, blocks that should really sell for more, given their location and block attributes. The goal of the multiple linear regression models is to correctly predict the bid value on a focal block of interest using the most parsimonious model.

Proximal blocks

Figure 3 shows an example of the focal and proximal block selections for the Walker Ridge 90 lease block in the Central Gulf of Mexico, which was offered for sale in 2009. Note that the proximal blocks may be selected in a number of different ways and the term proximal is relative. For example, proximal blocks may be selected by a geographic distance (i.e., 7 nautical miles) as shown in Figure 3, by a geologic or reservoir trend, or by area of competitive bidding behaviors that is relevant to the focal block of interest.

Block attributes and competitive bidding behaviors associated with the selected proximal blocks, and partially shown in the table in Figure 3, are then populated into the regression models to predict the likelihood the block will receive a bid and predict the expected bid amount. In the case of Walker Ridge 90, the statistical models predict a 90% probability that the block will receive a bid and a bid amount of $313/acre ($1.8 million total bid). In fact, this block was won by a consortium of ENI, Cobalt, and Samson at a bid price of $329/acre or $1.9 million. Three other bids were tendered for this block at $182/acre, $89/acre, and $56/acre.

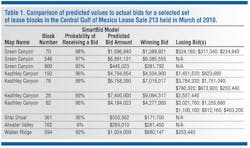

Table 1 shows a sample of selected blocks from the most recent Gulf of Mexico lease sale in the central Gulf. The table indicates the block name and number, the statistical predictions of the probability of receiving a bid and the predicted bid amounts, as well as the actual winning and losing bids, where applicable.

Using block attributes and prior competitive bidding behaviors from the prior eight lease sales, the predictive power of the regression models are very robust. A significant portion of the variability in bid amounts and likelihood of receiving a bid can be explained by the model parameters. As in the case of any regression model, the predictive capabilities are somewhat limited in certain cases as we are utilizing past bidding behaviors to assist in the prediction of future activity.

However, the approach provides powerful decision support in terms of understanding competitive bid behaviors and how it may impact bidding activity on blocks of interest in a competitive bid sale. This bid-setting technology can improve the chance of winning blocks of interest while at the same time reduce the chance and amount of overbidding that can lower the overall economic value of the asset.

Optimal bid

The optimal bid analysis (Figure 4) provides a forward-looking approach that considers the likelihood of winning at alternative bid amounts and the estimated net present value of the block. The peak of the expected value line (red) represents the optimal bid when the firm is attempting to maximize expected value.

Figure 4. An analysis of the Walker Ridge 90 block using the optimal bid approach. The Probability of Winning Bid line (green) is derived from the prior winning bid amounts in the Walker Ridge map area of the Gulf. The Total Value line (magenta) represents the value of the asset at alternative bid amounts and the Expected Value line (red) is simply the product of the probability of winning at a selected bid amount and the asset value minus the bid amount.

The peak or turnover point of the expected value line represents the optimal bid when the operator is attempting to maximize the expected monetary value associated with the block. The decision-maker can also consider the asset value from a probabilistic perspective and view the change in the optimal bid amount as a result of different estimations of asset value. In Figure 4 we can compare the econometric analysis that uses past bidding behaviors and block attributes, with the forward-looking decision analysis approach that estimates the optimal bid amount. In the case of the Walker Ridge 90 analysis, the econometric estimation and decision analysis approach converge to a similar bid amount (approximately $320/acre) and, in fact, an amount that was close to the winning bid.

Conclusions and implications

Competitive bidding decisions have strategic and economic importance for E&P companies operating in the Gulf of Mexico, as well as other oil and gas competitive bidding environments across the world. There is significant empirical evidence that firms systematically overbid for lease blocks in amounts that can dramatically impact the economic viability of these assets. Improving the quality of bid decisions can provide a strong foundation and help increase the overall performance of business activities in the Gulf of Mexico and other producing areas that are subject to a competitive bidding environment.

The technology described in this paper goes a long way toward improving the quality of bid decisions. Using prior bidding behaviors and lease block attributes, the econometric analysis provides robust estimates of the likelihood of bid activity on blocks of interest, as well as a prediction of the bid amounts.

Coupled with a forward-looking decision-analysis model that integrates the bidder’s estimate of the likelihood of winning at alternative bid amounts with the estimated asset value, the technology provides guidance for an optimal bid strategy. Decision support models such as this provide valuable insights with regard to competitive analysis in the bid environment, a more systematic and rational approach to bid-setting, and the ability to improve the chance of winning blocks of interest and reducing the likelihood of significant overbidding.

Offshore Articles Archives

View Oil and Gas Articles on PennEnergy.com