M&A activity set to stay strong

Jeremy Beckman • London

Global upstream asset deals reached a new peak last year of $117 billion, according to analysts Wood Mackenzie. High-profile sellers included BP, ConocoPhillips, Devon, and Cheseapeake, which collectively sold $45 billion of assets. Wood Mackenzie foresees further wheeling and dealing this year, notably for LNG, unconventional gas, and deepwater resources. However, the impact of last year’s Macondo incident on mergers and acquisition activity in the Gulf of Mexico has yet to be seen, with only Plains E&P to date announcing major restructuring in this sector.

North America

Suncor Energy expects first oil to flow from the West White Rose development offshore Newfoundland by the second quarter of this year. Drilling results from Stage 1, combined with production and reservoir evaluation, should allow the partners to define the full field development scope. In the same region, the Hibernia South Extension project should come onstream this spring, Suncor adds, while submission of the approved development plan for the Hebron field is imminent.

Cairn Energy plans to drill up to four exploration wells this year offshore Greenland, having secured two deepwater rigs. The company is assessing 10-12 potential locations in a variety of geological settings, and will select its targets in May. Last year the company drilled its first three wells in the Disko Bay area, one of which – Alpha1S1 – could be re-entered at some point. It also was awarded the Ingoaq, Napariaq, and Pitu blocks under the Baffin Bay bid round, and more recently was confirmed as operator of the Atammik and Lady Franklin blocks.

South America

Petrobras has discovered further oil in its BM-S-9 block in Brazil’s Santos basin. The Carioca North-East well intersected a light-oil accumulation in a 200-m (656-ft) reservoir section. The location is 275 km (171 mi) off Sao Paulo state, in a water depth of 2,151 m (7,057 ft). Block BM-S-9 comprises the Guara and Carioca appraisal areas.

Brazil’s other leading indigenous E&P company, OGX, also struck promise in the Campos basin. Its latest well in block BM-C-41 OGX on the Illimani prospect encountered a 52-m (171-ft) hydrocarbon column in carbonate reservoirs. General Executive Officer Paulo Mendonca said the new find significantly extends the carbonate platform in the Albian section in the southern part of the basin.

Falkland Oil and Gas (FOGL) has commissioned a site survey over its southern licenses off the Falkland Islands, ahead of a planned drilling program. The survey was due to take in various prospects in Tertiary channel and mid-Cretaceous fan plays. The survey vessel could extend its stay to acquire new 2D seismic to assist selection of drilling locations. FOGL has also been scouting for a deepwater rig.

West Africa

Tullow Oil says planning is already under way for Phase 1a of the Jubilee development. Jubilee came onstream in November. Phase 1a, designed to maintain production rates and to extract further reserves, will comprise five to eight infill wells. Another project could follow on the Mahogany-East (ex-Southeast Jubilee) discovery, for which operator Kosmos Energy has issued a Declaration of Commerciality. The extensive, but generally thinner Mahogany-East reservoirs will require either a tieback to Jubilee’s subsea infrastructure or another standalone development.

Afren was hoping to deliver first oil last month from its shallow water Ebok field off Nigeria. Facilities include two wellhead platforms and a mobile offshore production unit connected to a floating storage and offloading vessel. Ebok is being developed in two concurrent phases, which will deliver over 35,000 b/d combined. The nearby Okwok field could be tied in following successful results from a recent appraisal well.

Noble Energy has contracted McDermott International in Morgan City, Louisiana, for offshore facilities for the Alen gas/condensate project offshore Equatorial Guinea. The yard will fabricate a 15,000-ton (13,607-metric ton) central production platform, including living quarters, and a 2,000-ton (1,814-metric ton) wellhead jacket and pile. Alen is off the east coast of Bioko Island in block O, in 240 ft (73 m) of water.

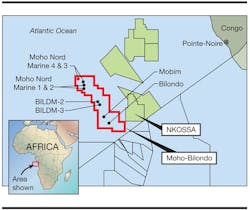

Total has discovered further reserves in its Moho-Bilondo license off the Republic of Congo. The Bilondo Marine 2 and 3 wells were drilled in the central part of the license in 800 m (2,624 ft) water depth, around 70 km (43 mi) offshore. Both wells reached a TD of 1,800 m (5,905 ft) in the Tertiary series, encountering 77 m and 44 m (252/144 ft) gross reservoir sections, respectively. The results confirm the potential for a second development hub. Moho-Bilondo in the south of the permit area currently produces 90,000 b/d of oil from 13 subsea wells tied to an FPU.

Angola has conditionally awarded new deepwater blocks under its Pre-Salt Licensing Bid Round in the Kwanza basin. Successful bidders must negotiate definitive agreements with state company Sonangol concerning planned operations before the awards can be confirmed.

Among the applicants, Cobalt Energy was offered a 40% operating interest in block 20, 75 mi (120 km) west of Luanda. ENI was nominated operator of block 35, 93 mi (150 km) from the capital, with work commitments including two wells and 3D seismic surveys. Statoil was granted operatorships of blocks 38 and 39, and interests in blocks 22, 25, and 40. Tim Dodson, the company’s executive VP for Exploration, said there were analogies in this frontier play with pre-salt Brazil.

Development of the Kudu gas field off northern Namibia could finally go ahead, after operator Tullow Oil and the Ministry of Mines ratified a new Petroleum Agreement. A revised 25-year production license should be approved shortly. Tullow has completed a concept selection study, and is in discussions with local utility NamPower on how to optimize design of the proposed offshore facilities and an onshore power station. Detailed design of the offshore development should start this spring.

Mediterranean Sea

Spain’s government has awarded Cairn Group two hydrocarbon exploration licenses off the country’s east coast, comprising five contiguous blocks in the Gulf of Valencia. Water depths range from 50 m (164 ft) to nearly 1,000 m (3,281 ft).

The consortium behind the proposed Trans-Adriatic Pipeline (TAP) is watching developments in the Caspian Sea. Next month, SOCAR and its partners are expected to decide which companies can procure gas from the Shah Deniz II development offshore Azerbaijan. This will lead to a decision on which transportation solution is adopted to take Caspian gas to countries in southern Europe. The TAP trio of Statoil, E.ON Ruhrgas, and EGL claim that their proposed line, with its 20 bcm/yr (706 bcf/yr) capacity, offers the shortest and most cost-effective route for Shah Deniz exports.

Tunisia has renewed the Kerkouane exploration license for three years into February 2014, with options for a further three-year extension. Work commitments, according to operator ADX Energy, include a well test on the Lambouka discovery, and relinquishment of part of the license area, which now stands at 3,080 sq km (1,189 sq mi).

Just prior to the recent unrest in Egypt, RWE Dea discovered gas in the offshore North El Amriya concession, 40 km (25 mi) north of Alexandria.

The well encountered gas in a Lower Pliocene sand in the Kafr El Sheik formation, and following a side track, a conventional gas-filled channel overlain by an unconventional reservoir. Here a successful drillstem test flowed up to 14 MMcf/d of gas. RWE Dea described this as a promising new play, which could lead to an expansion of activities, although shortly afterwards the company felt obliged to evacuate its international employees to Germany for reasons of security.

Russia

Rosneft and ExxonMobil have agreed to form a joint operating E&P company in the Black Sea, to focus on the deepwater Tuapse Trough area off Russia’s Krasnodar region. The partnership will extend to deepwater technology R&D, crude oil sales to local markets, and development of regional transportation infrastructure.

Exxon Neftegas is claiming further extended reach drilling records offshore Sakhalin Island. The Odoptu OP-11 well on the Odoptu field, part of the Sakhalin-I project, achieved a total measured depth of 40,502 ft (12,345 m), and an unprecedented horizontal reach of 37,648 ft (11,475 m). Drilling was performed from an onshore location under the sea, using the company’s Fast Drill Process and Integrated Hole Quality technology.

Middle East

Maritime Industrial Services (MIS) is providing engineering support for RAK Petroleum’s Saleh field redevelopment offshore Oman. Production from the field tailed off rapidly after its initial development in the mid-1980s. MIS in consultation with RAK is investigating requirements for rehabilitating Saleh’s four platforms.

Iran and Syria have determined a route for a new 2,000-km (1,242-mi) trunkline that eventually could export gas to Europe. The route would traverse Iraq, Syria, and Lebanon before reaching the Mediterranean Sea. National Iranian Gas Co. says the 110 MMcf/d, 56-in. (142-cm) diameter pipeline would cost $2-2.5 billion to construct.

Asia/Pacific

Two oil field development projects should move forward in the Beibu Gulf in the South China Sea, following internal approvals from CNOOC. The WZ 6-12 and WZ 12-8 fields have combined reserves estimated at 24 MMbbl.

According to partner Roc Oil, a new CNOOC-operated integrated processing platform will host production from two unmanned installations on the fields, with 11 development wells due to be drilled during 2012-13. First oil could flow before end-2012.

The Philippine Department of Energy has approved Shell Philippines Exploration’s 45% farm-in to the offshore SC 54B permit. Operator Nido Petroleum says the semisubAtwood Falcon, which worked for Shell last year off Malaysia, will mobilize to SC 54B by end-May to drill the Gindara-1 prospect.

Petronas and MISC Berhad have contracted Technip and DSME for front-end engineering design of a floating liquefied natural gas unit for the Malaysian sector. This would have capacity to process 1 MM metric tons/yr (1.1 MM tons/yr).

Also in Malaysia, Mustang is forming a joint venture in Kuala Lumpur with Sime Darby’s Energy & Utilities division. Mustang Sime Darby will provide project management, design, and procurement support for oil and gas projects in the Southeast Asia.

Australasia

PTTEP has awarded SapuraAcergy a $160-million contract for the Montara development project in the southern Timor Sea. The work scope includes removal and disposal of the existing topsides and transport/installation of replacement topsides, in a water depth of 80 m (262 ft), using the construction vesselSapura 3000. Sapura-Energy will also install new pipelines, subsea production facilities, and FPSO mooring systems.

Capital expenditure for the Esso Australia-operated Kipper and Turrum projects in the Gippsland basin offshore Victoria has risen to $2.25 billion, according to partner BHP Billiton. One reason for the increase is the need for measures to mitigate mercury, which was discovered in the reservoir during development drilling. Further design and fabrication requirements have delayed installation and offshore hook-up, with facilities now set to be completed in 2012. Kipper and Turrum hold combined recoverable reserves estimated at 1.62 bcf of gas and 140 MMbbl of oil and gas liquids.

New Zealand Oil & Gas (NZOG) is looking to drill the Kaupokonui oil prospect this year in the PEP 51311 permit in New Zealand’s offshore Taranaki basin, assuming a suitable rig becomes available. Kaupokonui has unrisked resources of over 200 MMbbl. In adjoining permit PML 38146, containing the producing Kupe Central field area, studies are under way that could lead to wells being drilled on one or more prospects, probably to coincide with second-stage development drilling in 2012/13.

Offshore Articles Archives

View Oil and Gas Articles on PennEnergy.com