North America

QatarEnergy has farmed into 40% of ExxonMobil Canada’s interest in license 1165A, 450 km (280 mi) east of St. John’s, Newfoundland and Labrador. The concession, in average water depths of 1,100 m (3,609 ft) of water, includes the Hampden prospect. ExxonMobil Canada recently contracted the drillship Stena Forth to drill an exploratory well during the second half of 2022.

***

Oil and gas production has started from the bp-operated Thunder Horse South Expansion Phase 2 project in Mississippi Canyon block 822 in the Gulf of Mexico. The initial two-well subsea tieback should boost throughput at the Thunder Horse platform to the northwest by 25,000 boe/d. Six more wells will likely be added in future via the two subsea drill centers.

***

Last month’s Lease Sale 257 drew high bids for 308 blocks in federal waters of the US GoM. Thirty-three companies submitted 317 bids totaling nearly $200 million. Blocks offered were in the western, central and eastern planning areas in water depths of 3-3,400 m (9-11,115 ft). ExxonMobil, bp, Chevron, Anadarko, Shell, DG Exploration, and Arena Exploration each submitted 10 or more applications.

Caribbean/South America

Barbados’ government has approved BHP’s request to conduct a 3D seismic survey over the Bimshire and Carlisle Bay blocks, 40-140 km (25-87 mi) southeast of the island in water depths of up to 2,000 m (6,562 ft). BHP aims to initiate operations shortly.

***

SBM Offshore is working on the FEED for Yellowtail, ExxonMobil’s next planned deepwater development in the Stabroek block offshore Guyana. Assuming FID and approvals for the project, SBM will build, install, and then operate the vessel during its first two years of service. The company will allocate its sixth newbuild hull under its Fast4Ward program, with standardized topsides, with the vessel designed to produce 250,000 b/d of oil and 450 MMcf/d of gas. In addition, SBM and McDermott are forming a special-purpose company, with a 70-30 ownership split, to execute the project’s turnkey phase.

Earlier, ExxonMobil confirmed another large oil discovery on the Stabroek block with the Cataback well, 6 km (3.7 mi) east of the Turbot field. This has pushed estimated recoverable resources across the block to around 10 Bboe.

***

Chevron has signed a 30-year production-sharing contract for shallow-water block 5 offshore Suriname. The company will operate in partnership with state-owned Staatsolie. Chevron will carry all costs during the six-year exploration phase.

APA Corp. now estimates resources from the deepwater Sapakara oil discovery off Suriname at 325-375 MMbbl, following a successful appraisal well on the structure’s eastern edge, which included a flow test with average rates of 4,800 b/d in the Campano-Maastrichtian reservoir. TotalEnergies is the operator.

***

Petrobras has a new oil discovery in the presalt Santos basin offshore Brazil. The Curação well was drilled in 1,905 m (6,250 ft) of water on the Aram block, 240 km (149 mi) offshore Santos. The company and partner CNODC planned to keep drilling to the planned depth to delineate the extent of the find, and to use the data to plan next-phase exploration in the area.

Yinson Production has two letters of intent to provide the FPSO and associated operations and maintenance for Petrobras’ Parque das Baleias project in the north Campos basin. The charter runs for 22.5 years, and the estimated overall value of the deal is over $5 billion. The vessel will have capacity to process 10,000 b/d of oil and 5 MMcf/d of gas from the newly unified Jubarte field. Plans also call for nine oil producer and eight water injection wells with subsea trees, connected to the FPSO via network of flexible pipelines and electro-hydraulic umbilicals.

***

Shell Brasil Petroleo has secured five exploration blocks in two areas of the Santos basin under the ANP’s 17th bid round. The company will operate four with a 100% interest, and a fifth – SM-1709 – in partnership with Ecopetrol.

West Africa

Tullow Oil has exercized its right to pre-empt Kosmos Energy’s planned acquisition of Occidental Petroleum’s producing interests offshore Ghana for $460 million. The deal would have given Kosmos a further 18% in the Jubilee field and 11% in the TEN field, both operated by Tullow.

***

BW Gabon’s Direction Generales des Hydrocarbures has provisionally awarded BW Energy operatorship of two blocks under the country’s 12th offshore licensing round. G12-13 and H12-13 are both adjacent to the company’s Dussafu license: the other partners are VAALCO Energy and Panoro Energy. Terms under the initial eight-year phase include 3D seismic acquisition and exploration drilling. BW Energy has also contracted Lamprell in the UAE to convert the drilling jackup Hibiscus Alpha to a production platform for the Dussafu license.

To the south off Namibia, BW Energy is seeking to develop the Kudu gas field, 130 km (81 mi) offshore in 170 m (558 ft) of water. It has agreed to purchase the semisubmersible drilling rig Leo from Aquadrill LLC for $14 million and plans a conversion to a floating production platform. However, final sanction will depend on securing finance for a planned gas-to-power project.

***

Eni has brought onstream the Cabaça North oil field in the eastern part of block 15/06 off Angola as a tieback to the FPSO Armada Olombendo. Next planned start-up in the western part of the concession is the Ndungo oil field development.

Northwest Europe

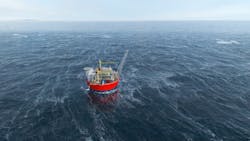

Repsol Norge has produced first oil from the re-developed Yme field in the southeastern Norwegian Sea. Statoil (Equinor) originally developed the field in the 1990s, but production ceased prematurely in 2001 due to low oil prices at the time. Repsol’s redevelopment, targeting 63 MMbbl recoverable, involved modifications and upgrades to the jackup Maersk Inspirer, and the installation of a new wellhead module on existing facilities in the field. Havila Sirius is responsible for operations of the platform under a bareboat charter arrangement.

Aker Solutions has a letter of intent from Equinor to perform the FEED for the 500-MMboe Wisting field development 310 km (193 mi) offshore in the Norwegian Barents Sea. The company also has an option to deliver the EPCI for the topsides of the Sevan-design circular FPSO, pending FID at the end of next year. The 20,000-metric ton (22,045-ton) topsides will comprise two large process and utility modules. Others working on FEED studies for the project include FMC Kongsberg Subsea, Technip Norge, NOV, Baker Hughes, Subsea 7, OneSubsea Processing, and IKM.

Two other operators have submitted plans for development and operation for Norwegian fields in the North Sea. ConocoPhillips’ Tommeliten A will involve installation of a two by six-slot subsea production system with 10 wells and an electrically heated flowline, connected to the Ekofisk complex. Aker BP’s plan for Frosk is a two-well tieback to the Alvheim FPSO via the Bøyla field subsea infrastructure.

***

Harbour Energy has secured a carbon-dioxide (CO2) appraisal and storage license for an area off the Lincolnshire coast in the southern UK North Sea. The company plans to re-use the depleted Rotliegend gas fields Victor and Viking, developed by Conoco in the 1970s-80s, for storage of CO2 transported via a newly built pipeline from Immingham to Theddlethorpe and the 120-km (74.6-mi) offshore LOGGS pipeline that used to export the field’s gas. Injection could begin in late 2026, reaching 11 MM metric tons/yr (12.1 MM tons) by 2030.

Mediterranean Sea

Construction is under way of a gas-handling complex in Sicily’s Gela area that will receive production from subsea wells at the Eni-operated offshore Argo and Cassiopea fields. The program has an estimated cost of over $816 million, with start-up slated for the first half of 2024.

***

Energean is supporting EDINA with the FEED for the Irena gas field development offshore Croatia, which could sustain the life of two platforms serving the depleting Izabela field. Off western Greece, Energean was aiming to clinch funding for the Epsilon gas development before year-end.

Caspian Sea

Lukoil expected to receive approval this month from Azerbaijan’s government to acquire a 25% interest from bp in the Shallow Water Absheron Peninsula exploration project in the Azerbaijani sector of the Caspian Sea. Water depths in the PSA area are up to 40 m (131 ft), with potential reservoirs at depths of 3,000-5,000 m (9,842-16,404 ft). There are plans to drill three prospective areas.

***

Mammoet has loaded out the new GDDP-A drilling platform for the Garagol Deniz West oil and gas development, 75 km (46.6 mi) offshore Turkmenistan in the Caspian Sea. Initially the company supported lead contractor ILK Insaat with the jacket, then returned for the topsides. This was jacked up in load cells then skidded from the site near Turkmenbashi to the transportation barge for delivery to the field. The new platform was due to start operations before year-end.

Middle East

ADNOC has awarded NPCC an EPC contract for the Dalma project in the offshore Ghasha sour gas concession, 190 km (118 mi) northwest of Abu Dhabi. The scope covers the wellhead towers, pipelines, and umbilicals serving the Hair Dalma, Satah, and Bu Haseeer fields. Dalma will produce around 340 MMcf/d of gas. In addition, ADNOC has contracted Technip Energies to update the FEED for the Ghasha concession where three artificial islands for extended reach wells have so far been completed.

East Africa

The Coral-Sul FLNG vessel has departed Samsung Heavy Industries’ shipyard in South Korea and is sailing for Mozambique, where it will be towed to the Area 4 offshore concession to serve the 450-bcm Coral South gas development, in 2,000 m (6,256 ft) of water. The 432-m (1,417-ft) long, 66-m (216-ft) wide vessel weighs around 220,000 t and can accommodate up to 350 personnel. Its gas liquefaction capacity is 3.4 MMt/yr: the facility is due to start operating in the second half of 2022.

Asia/Pacific

CNOOC has discovered a large oil field in the Laizhou Bay Sag region of southern Bohai Bay, offshore China. The Kenli-2 well, drilled in 15.7 m (51.5 ft) of water, encountered the main oil-bearing interval in the lower part of the Neogene Minghuazhen formation, flowing around 569 b/d of heavy oil during a test. The company estimates potential resources in Bohai’s shallow depression zone at around 100 MM t.

Bluewater Energy Services will supply the internal turret mooring system for the FPSO that SK Innovation plans to deploy at the Lufeng 12-3 oil field offshore China. The 70,000-b/d floater, due to be completed in 2023, will be moored in 240 m (787 ft) of water.

Australasia

Chevron has awarded two contracts for its Jansz-Io subsea gas compression project 200 km (124 mi) offshore Western Australia. Aker Solutions will design and manufacture around 70 km (43.5 mi) of dynamic subsea umbilicals, comprising three umbilicals taking power from the platform to the compressor and two powering the subsea pumps. Saipem’s Constellation vessel will perform installations for the project, starting in 2024.

Woodside Energy has entered an agreement to sell a 49% stake to Global Infrastructure Partners (GIP) in the Pluto Train 2 joint venture offshore/onshore northwestern Western Australia. Pluto is an LNG processing complex close to Karratha, which started operations in 2021. The new train 2 and modifications to train 1 will allow the facility to process gas from Woodside’s planned offshore Scarborough gas field development. In addition to its 49% share of the capex, GIP could fund a further $835 million of the construction costs.

About the Author

Jeremy Beckman

Editor, Europe

Jeremy Beckman has been Editor Europe, Offshore since 1992. Prior to joining Offshore he was a freelance journalist for eight years, working for a variety of electronics, computing and scientific journals in the UK. He regularly writes news columns on trends and events both in the NW Europe offshore region and globally. He also writes features on developments and technology in exploration and production.